The insurance industry has a long history of providing vital support for major leaps in innovation. It’s no coincidence that the modern insurance industry and the industrial revolution arose in parallel. Indeed, it has been convincingly argued that the invention of fire and property insurance — in response to the Great Fire of London — lubricated the gears of capital investment that powered the industrial revolution and is likely the reason why it started in London. Through that first and each subsequent technological revolution, insurance has offered innovators and investors a safety net and served as an outside, objective validator of risk — thereby acting as a source of both the encouragement and the security needed to confidently test and break barriers.

Today, we are in the midst of a new digital financial revolution, and the case for this new technology is clear and compelling. The recent White House executive order on “Ensuring Responsible Development of Digital Assets” further underscored this and was a watershed moment for the industry, elevating the discussion around the importance of the technology to the national stage and acknowledging its importance to the United States strategy, interests and global competitiveness.

The lack of crypto insurance

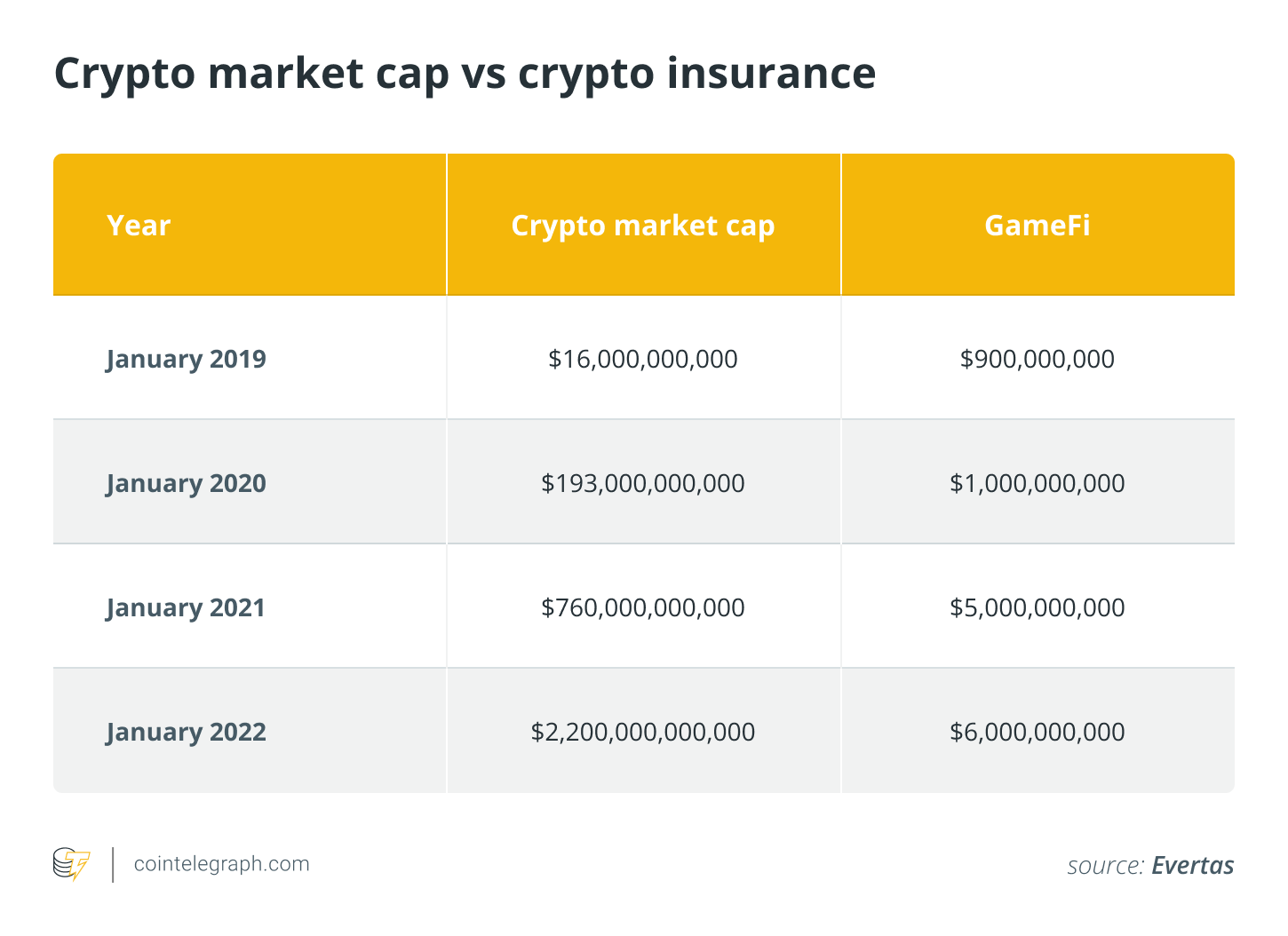

Yet, considering current crypto insurance capacity is estimated to be about $6 billion — a drop in the bucket for an asset class with a roughly $2-trillion market capitalization — it’s clear that the insurance industry is failing to keep up and play its vital role.

This striking lack of insurance protection for digital assets was specifically referenced in December’s House Financial Services Committee hearings on the state of the market. Should this state of affairs persist, it does so at the risk of impeding future growth and adoption.

Why have traditional insurers avoided entering this space despite the obvious need and opportunity?

Click Here to Read the Full Original Article at Cointelegraph.com News…