For over 14 years, central banks worldwide have seen blockchain technology deliver highly secure, immutable, verifiable and transparent financial ecosystems, starting with the Bitcoin network. Central bank digital currencies (CBDCs) stood out as one of the ways for fiat currency to harness a part of what cryptocurrencies achieve today.

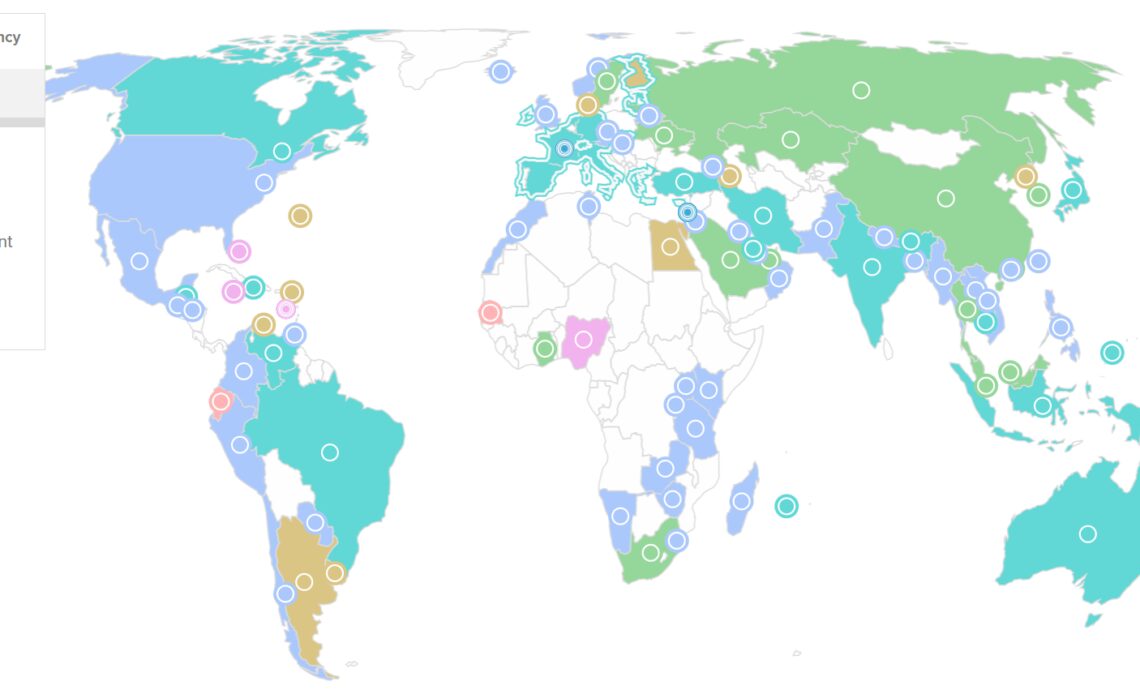

To not only keep up with rising inflation and cut down on operational costs but also to counter money laundering and related concerns, 98 of 195 countries — representing over 95% of global GDP — have either launched or are researching and developing their own versions of CBDC.

With CBDCs joining the race to dominate the future of finance, the relevance of the stablecoin ecosystem — cryptocurrencies backed 1:1 with fiat, such as the United States dollar — comes into question.

As the managing director of crypto exchange Bitget, Gracy Chen got a front-row seat to the global disruption of cryptocurrencies. In an interview with Cointelegraph, Chen shared her thoughts on the future of stablecoins as CBDCs make their entry into the mainstream.

Cointelegraph: How relevant will stablecoins be (in retail and wholesale markets) once CBDCs are circulating?

Gracy Chen: According to the definition of the Bank for International Settlements (BIS), CBDCs can be divided into two categories according to users and purposes:

Wholesale CBDC: It is mainly issued to commercial banks and other large financial institutions for large-value payment settlement.

The wholesale CBDC with improved liquidation efficiency through blockchain technology is under a relatively mature regulatory system and can be supervised more easily with large amounts of funds. But, it also has disadvantages such as limited case uses (only suitable for participants like large companies).

Recent: Regulators face public ire after FTX collapse, experts call for coordination

Retail CBDC: It is mainly issued to individuals and companies and is widely used in small retail transactions as a cash supplement. This kind of CBDC helps enhance social welfare and improve payment convenience along with rich use cases. Nonetheless, supervision of it is difficult and intricate. Meanwhile, the high demand for transactions per second poses a challenge to the computing power of blockchain technology.

Overall, retail and wholesale CBDCs are complementary to each other. The central banks of various countries have different needs for…

Click Here to Read the Full Original Article at Cointelegraph.com News…