The great handover of crypto infrastructure from crypto natives to traditional finance is happening, but it is not driven by ideology, a newfound desire to “bank the unbanked,” or to promote an alternative financial system. Instead, it’s a function of both push and pull forces.

This post is part of Consensus Magazine’s Trading Week, presented by CME.

On one side, traditional institutions are pushing into crypto because they see a business opportunity and are jockeying for a share of this promising asset class. On the other, institutional investors are pulling them in because they lost trust in crypto native intermediaries.

Not only are institutions here, but they’re starting to eat the crypto-natives’ lunches.

Future futures

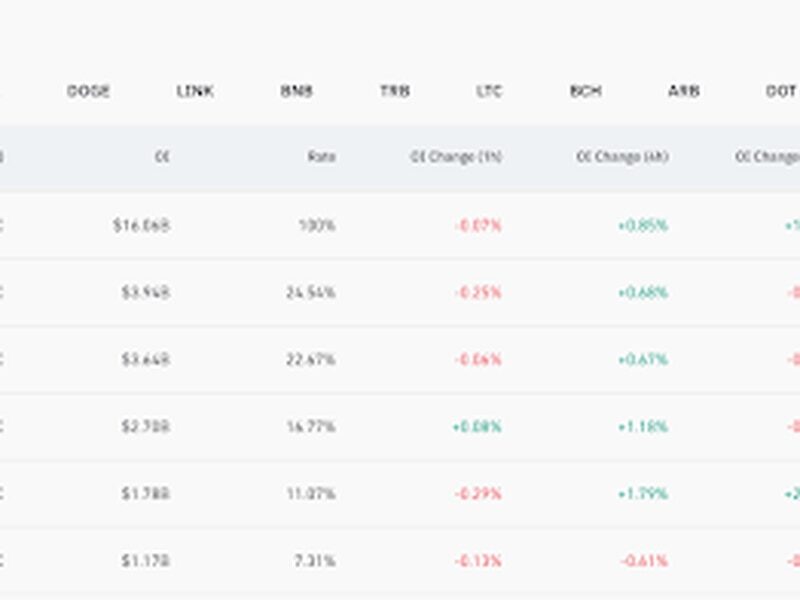

At the end of October, we saw headlines about CME was “on the cusp of replacing Binance as the top futures exchange.” This should come as no surprise (see table below). Binance (and its geographic entities) is opaque and lightly regulated. Imagine an investor or institution looking to short a crypto asset – say, for hedging purposes. Many will have a strong preference for expressing this view (shorting) with a traditional financial institution with a diversified balance sheet.

For some, carrying a large position in crypto with a crypto-only institution would be akin to buying CDS on Lehman from Bear Stearns, to make an extreme analogy. Operationally, the onboarding practices at large institutions are easily understood by their peers and have been fashioned over decades of securities law amendments (e.g. credit, KYC, and AML checks).

Stablecoins

For centralized stablecoins, instant settlement and de-risking are no longer unique selling propositions. The market has moved on. Transparent and attested backing, openness around banking capabilities (rails and custody), liquidity and yield are now the most important elements.

It’s different for DeFi stablecoins, as it should be, as protocols try to carve out their own niches and look for competitive advantages. Even in the post-Terra world, DeFi continues to experiment with new constructs. Many of the first generation of stablecoin protocols, such as FRAX, were exploring ways to improve capital efficiency. But the latest batch is focused on passing through yield to users – in effect, importing…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…