A closer look at the current state of crypto taxation worldwide reveals a trend toward increased regulation and maturity, with many governments recognizing the potential benefits of blockchain technology in various sectors. As the blockchain and cryptocurrency industry continues to evolve and gain mainstream adoption, the regulatory landscape surrounding them is also evolving rapidly.

Cointelegraph Research has recently published its Crypto Taxation Database, which takes a closer look at approaches to crypto taxation on a country level and contains the following features:

- A comprehensive overview of crypto taxation by country — i.e., tax rates, tax laws and tax policies.

- A clear distinction between taxable and non-taxable events.

- Helpful information for investors, businesses and policymakers interested in understanding taxation requirements in different jurisdictions.

For example, in Europe, there has been an active promotion of the use of blockchain technology in finance, logistics and healthcare. The European Securities and Markets Authority (ESMA) has issued guidance on regulating initial coin offerings. The European Parliament has called for a comprehensive approach to regulating cryptocurrencies.

Explore the Crypto Taxation Database by Cointelegraph Research

In Asia, South Korea has announced plans to tax cryptocurrency exchanges and implement a 20% crypto earnings tax that was delayed from January 2023 until 2025. However, questions on how to regulate and tax cryptocurrency transactions arise, highlighting the need for a comprehensive approach on a global scale.

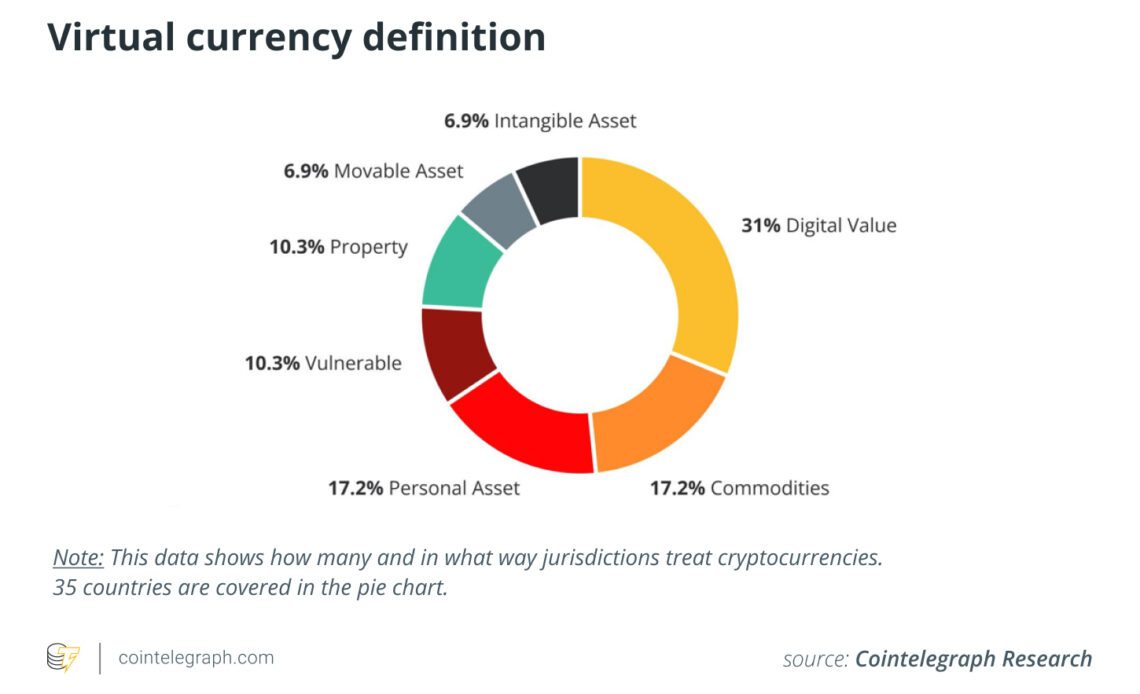

Tax treatment depends on the classification

The classification of a cryptocurrency as an asset, currency or property in various jurisdictions is of utmost importance for individuals to comply with tax laws and regulations.

When a country classifies a cryptocurrency as an asset, it is treated similarly to other types of assets, such as stocks, bonds or commodities. This means that gains and losses from the sale or trading of cryptocurrency are subject to capital gains tax.

When a country classifies cryptocurrency as a property, it is treated similarly to a car or a piece of jewelry. The Internal Revenue Service (IRS), for example, classifies cryptocurrency as property in the United States, meaning taxpayers must report capital gains or losses on their tax returns.

The tax rate on cryptocurrency gains in the U.S. varies depending on whether the gains are short-term (one year or less) or…

Click Here to Read the Full Original Article at Cointelegraph.com News…