The metaverse is a futuristic iteration of the internet, featuring a digital economy and an immersive virtual environment alongside other interactive features. This relatively nascent space has gained so much traction in recent years that conservative estimates suggest that by 2024, its total valuation could top $800 billion. Meta (the parent body behind Facebook and Instagram), Google, Microsoft, Nvidia, Nike and others have made Fortune-100-sized metaverse splashes.

But with great valuations comes great scrutiny from increasingly tech-savvy financial regulators. Unlike traditional tech products, which often spend years putting growth over revenue, some metaverse projects push questionable monetization schemes on their users prior to launching a live experience. Metaverse real estate is a prime example of this practice, with platforms like Big Time games selling land in their metaverse before opening up access to the game.

Typically, the United States Securities and Exchange Commission doesn’t step in unless retail investors face predatory courting of their dollars without full disclosure of what they are investing in. The line for what classifies as a security is often blurry — but in the case of the metaverse, the practice of land sales should generally be considered a security under U.S. law.

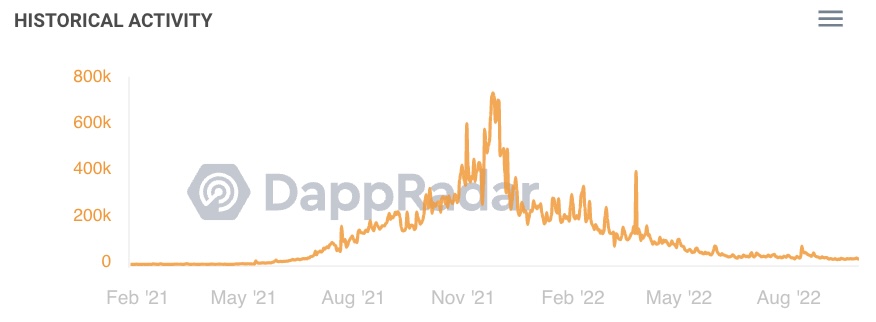

GameFi platforms like Axie Infinity demonstrate the speed at which metaverse projects can birth multi-billion-dollar economies. Their sheer scale necessitates internal controls and monetary policies similar to multinational banks or even small countries. They should be required to staff compliance officers who coordinate with government regulators and even conduct Know Your Customer for large transactions.

The metaverse is intrinsically linked with financialization. While no bodily harm can be inflicted in the metaverse (yet), a lot of financial harm has already been caused. The company behind the Bored Apes Yacht Club nonfungible tokens (NFTs) saw a hack this year after a community manager’s Discord was compromised. Hackers walked away with NFTs worth 200 Ether (ETH).

A swath of Wall Street banks was recently fined $1.8 billion for using “banned” messaging apps. Metaverse projects like Yuga Labs should face similar proactive fines for not implementing secure monetary and technical controls.

Related: Throw your Bored Apes in the trash

A key first step for any metaverse project will…

Click Here to Read the Full Original Article at Cointelegraph.com News…