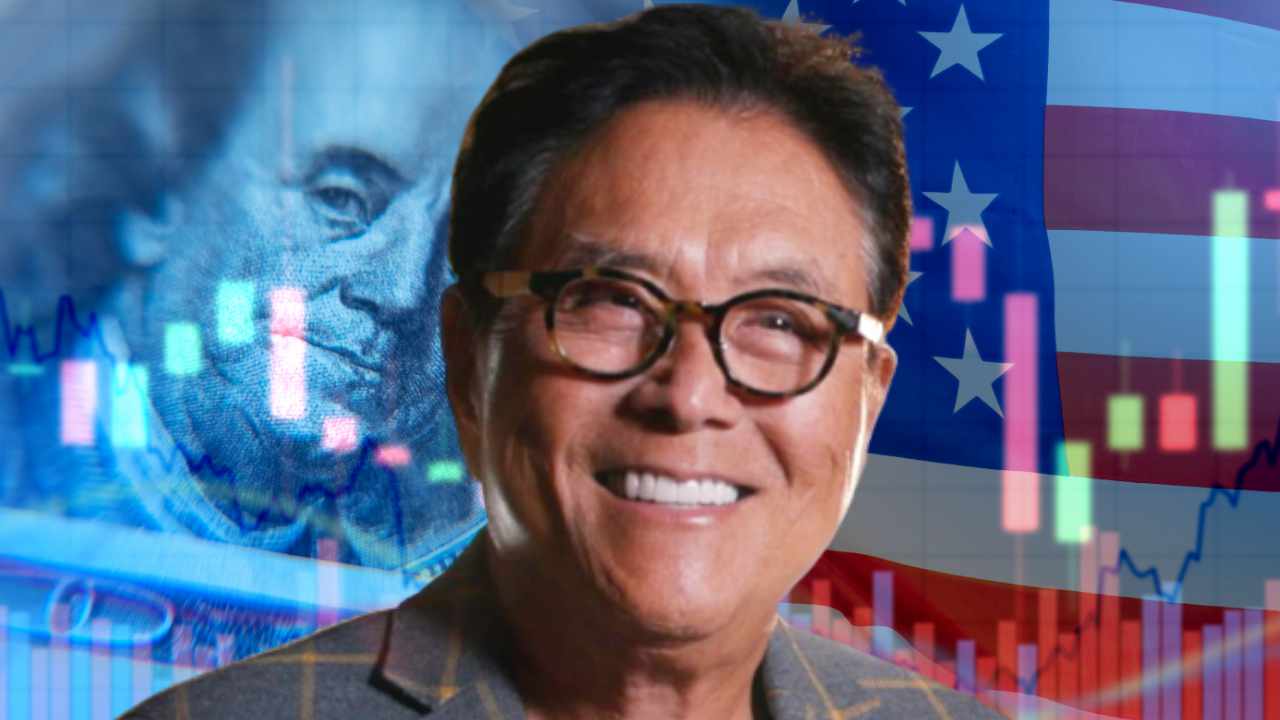

Rumors of expanding war, massive inflation destroying people’s purchasing power, and widespread volatility in the world of fiat currencies shaped the news this past week, with similarly dynamic developments in the world of cryptocurrency. Rich Dad Poor Dad author Robert Kiyosaki says the “end is here” for fake money. This and more just below in the latest Bitcoin.com News Week in Review.

While the US Dollar Tramples the Euro, Pound and Yen, Russia’s Ruble Skyrockets Against the Greenback

While the U.S. dollar has soared in value against a basket of worldwide fiat currencies, Russia’s ruble climbed 4.5% against the greenback last week. During the first week of September, Russia told the press China would pay for natural gas with rubles and yuan. Moreover, Switzerland’s imports of Russian gold reached a high not seen since April 2020.

Report: Gap Between Ethiopian Currency’s Official and Parallel Market Exchange Rate Grows to New Record

The Ethiopian birr currency’s parallel exchange rate against the U.S. dollar recently dropped to a low of 92 birr per dollar, a report has said. The report added that following this latest plunge, the gap between the birr’s official and parallel market exchange rates has widened to a record high.

Robert Kiyosaki Says End of Fake Money Is Here — Shares 3 Lessons to Help Investors Amid Market Crashes

After predicting the biggest crash in world history, Robert Kiyosaki, the famous author of the best-selling book Rich Dad Poor Dad, says the “end is here” for fake money. He reiterated three lessons that will help investors “do well in market crashes.”

South Korea Seeks to Freeze 3,313 Bitcoin Allegedly Linked to Luna Founder Do Kwon

South Korean prosecutors are seeking to freeze 3,313 bitcoins at two cryptocurrency exchanges allegedly tied to luna founder Do Kwon. The coins were moved soon after a South Korean court issued an arrest warrant for the Terraform Labs co-founder.

Do you think the end is nigh for currencies like the USD? Let us know in the comments section below.

Click Here to Read the Full Original Article at Bitcoin News…