While advances in blockchain technology and tokenization often grab the headlines, there is a more mundane concept that nevertheless may end up being the single most important piece of future financial industry (and commercial) infrastructure – the digital wallet.

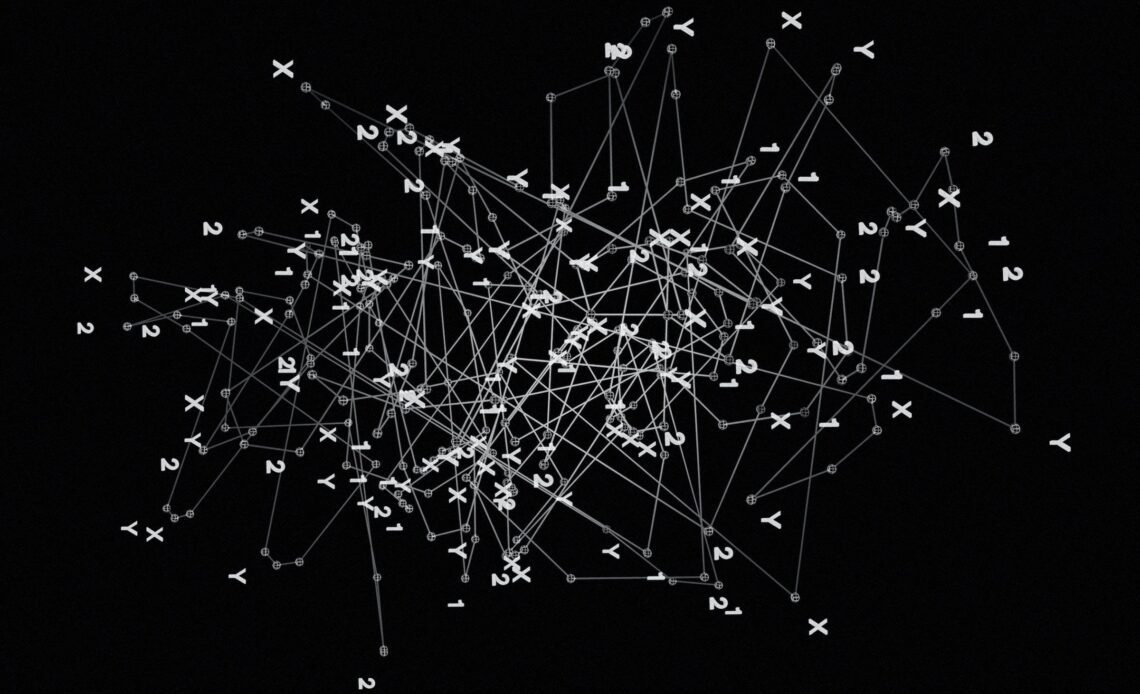

A cryptographically protected, blockchain-based digital wallet is a piece of software that points to an address on the internet where tokenized assets can be stored. There is no identifying information on these wallets other than a long string of letters and numbers. The wallet itself contains a digital key that is required to unlock and access the holdings in the user’s wallet, and such keys are only shared when a wallet owner authorizes a transaction.

Today, individuals, many small and medium enterprises as well as institutions operate across a fragmented set of financial accounts that each require separate types of paper-based documentation (often stored in electronic form). For individuals, this includes checking and savings accounts that deal with the entity’s cash; brokerage and investment accounts that deal with retirement, education, healthcare and more; liability accounts that deal with mortgages, loans, lines of credit or credit cards; and a significant number of accounts that relate to the individual’s assets, valuables and collectibles including special documents such as titles, contracts and insurance policies.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Navigating this plethora of accounts is rarely enjoyable or easy. Within each of these account categories, a single entity may have multiple service providers or multiple accounts within a service provider. Account owners must remember their usernames and passwords, authorize their devices and oftentimes manually input account numbers and balances to create aggregated views of their holdings across institutions.

Tokenization of the assets in these different types of accounts would allow multiple types of instruments to sit side-by-side in a digital wallet and enable every user to see the entirety of their wealth in one location. Cash could become spread across a set of central bank digital currencies (CBDCs),…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…