Grayscale Bitcoin Trust (GBTC), a cryptocurrency fund that currently holds 3.12% of the total Bitcoin (BTC) supply, or over 640,000 BTC, is trading at a record discount compared to the value of its underlying assets.

Institutional interest in Grayscale dries up

On Sep. 23, the $12.55 billion closed-end trust was trading at a 35.18% discount, according to the latest data.

To investors, GBTC has long served as a great alternative to gain exposure in the Bitcoin market despite its 2% annual management fee. This is primarily because GBTC is easier to hold for institutional investors because it can be managed via a brokerage account.

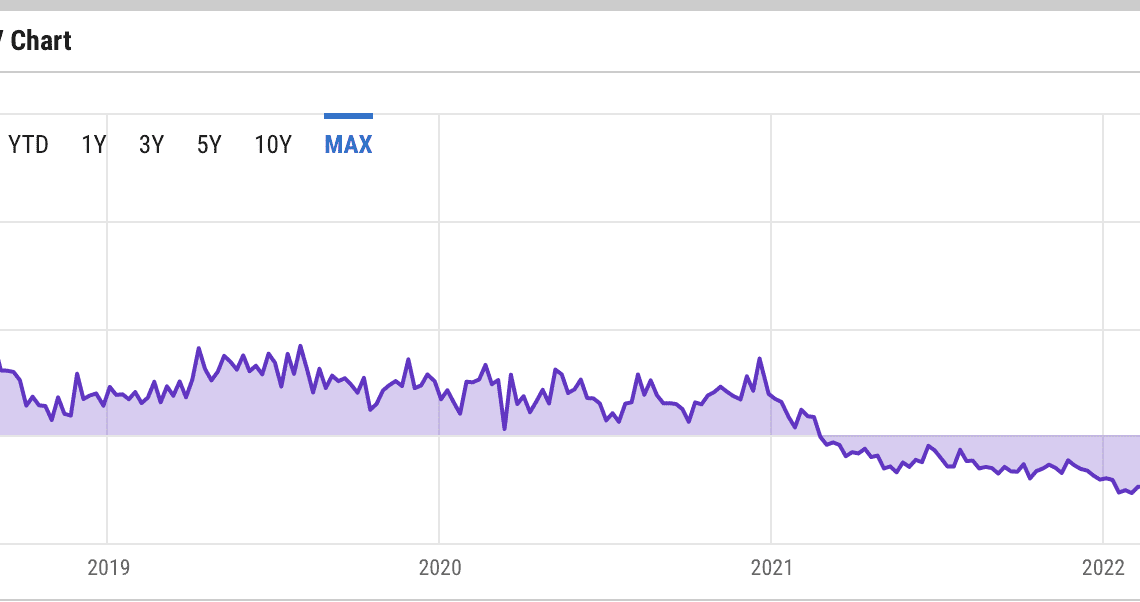

For most of its existence, GBTC traded at a hefty premium to spot Bitcoin prices. But It started trading at a discount after the debut of the first North American Bitcoin exchange-traded fund (ETF) in Canada in February 2021.

Unlike an ETF, the Grayscale Bitcoin Trust does not have a redemption mechanism. In other words, GBTC shares cannot be destroyed or created based on fluctuating demand, which explains its heavily discounted prices compared to spot Bitcoin.

Grayscale’s efforts to convert its trust into ETF failed after the Securities and Exchange Commission’s (SEC) rejection in June. In theory, SEC’s approval could have reset GBTC’s discount from current levels to zero, churning out profits for those who purchased the shares at cheaper rates.

Grayscale sued the SEC over its ETF application rejection. But realistically, it could take years for the court to give a verdict, meaning investors would remain stuck with their discounted GBTC shares, whose value have fallen by more than 80% from their November 2021 peak of around $55.

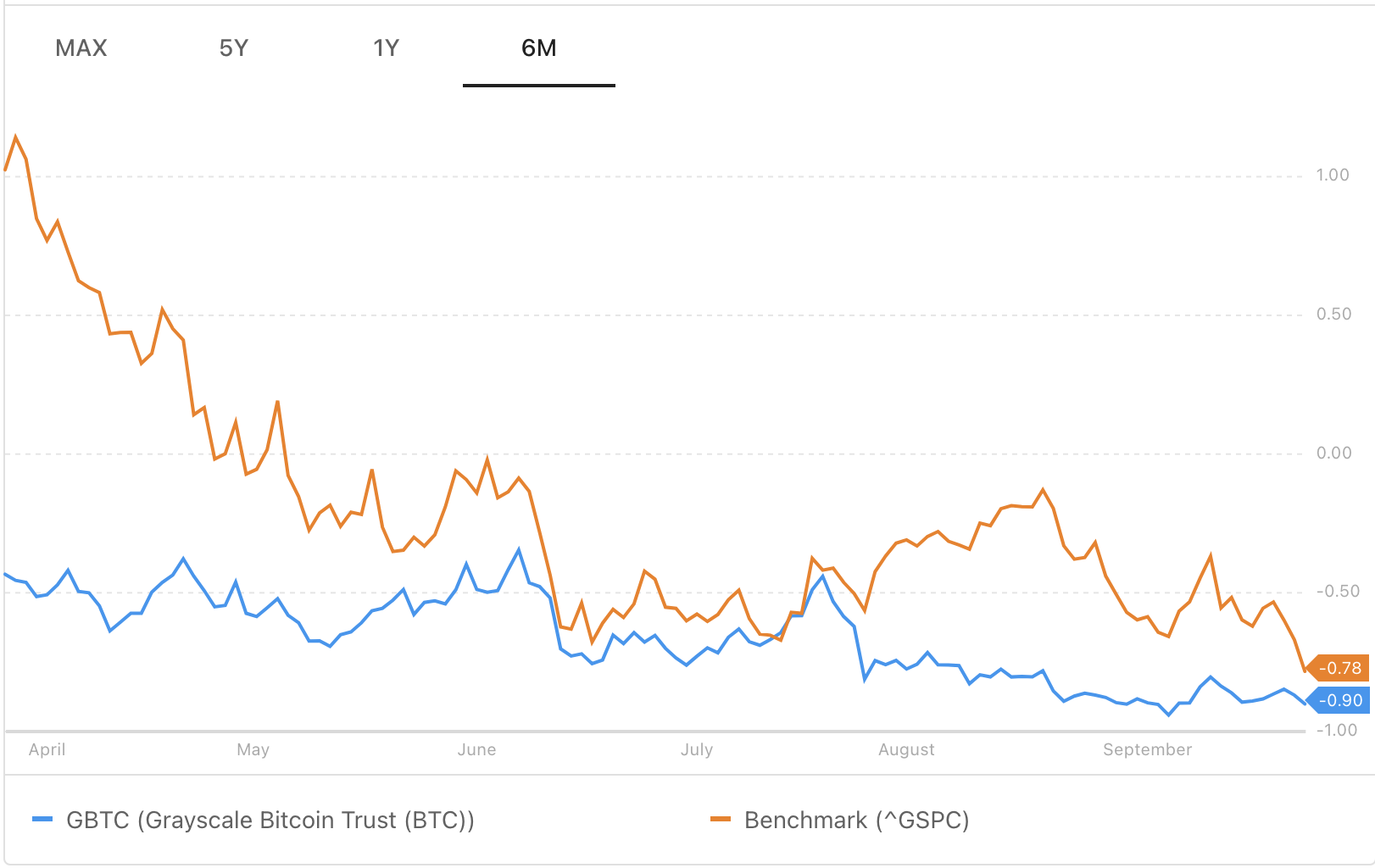

Also, GBTC’s 12-month adjusted Sharpe Ratio has dropped to -0.78, which shows that the anticipated return from the share is relatively low compared to its significantly high volatility.

Simply put, institutional interest in Grayscale Bitcoin Trust is drying up.

A warning for spot Bitcoin price?

Grayscale is the world’s largest passive Bitcoin investment vehicle by assets under management. But it doesn’t necessarily enjoy a strong influence on the spot BTC market after the emergence of rival ETF vehicles.

For instance, crypto investment funds have attracted a combined total of almost $414 million in 2022, according to the CoinShares’ weekly report. In…

Click Here to Read the Full Original Article at Cointelegraph.com News…