Amid arguably the coldest winter in Bitcoin’s history, its price has fallen by more than 70% from its Nov. 10, 2021, all-time high of $69,044.77, while its market cap is down to $318.943 billion from the yearly high of $902.04 billion — a 64.64% decline.

Let’s take a look at some metrics that can provide more insight into the current Bitcoin bear market:

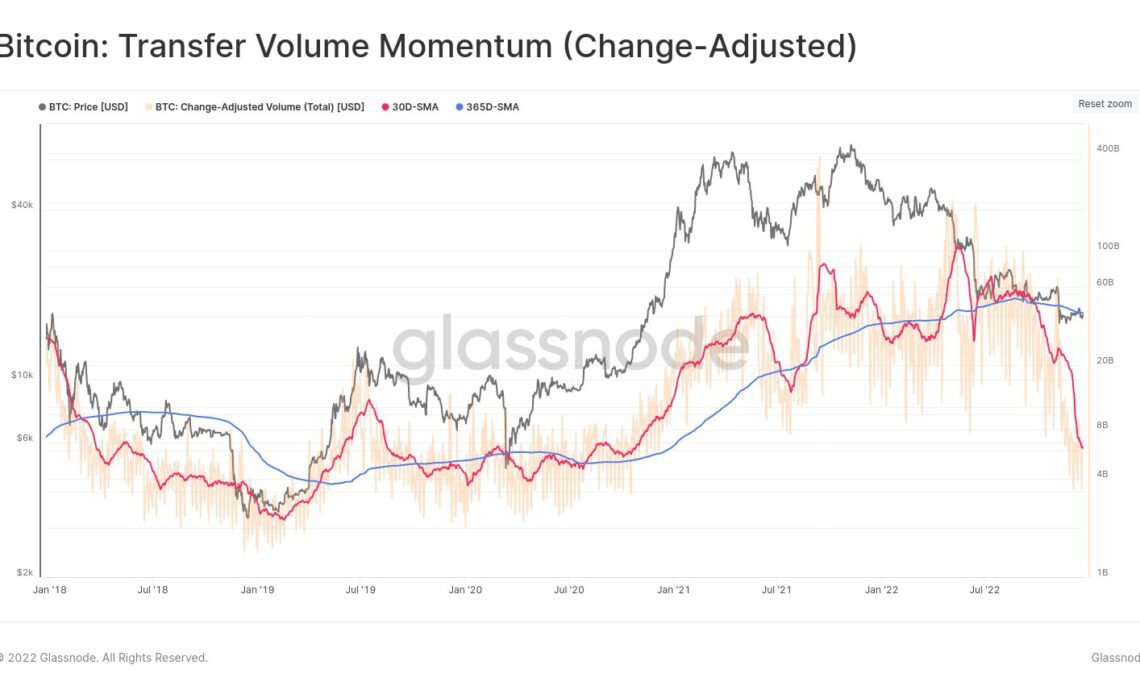

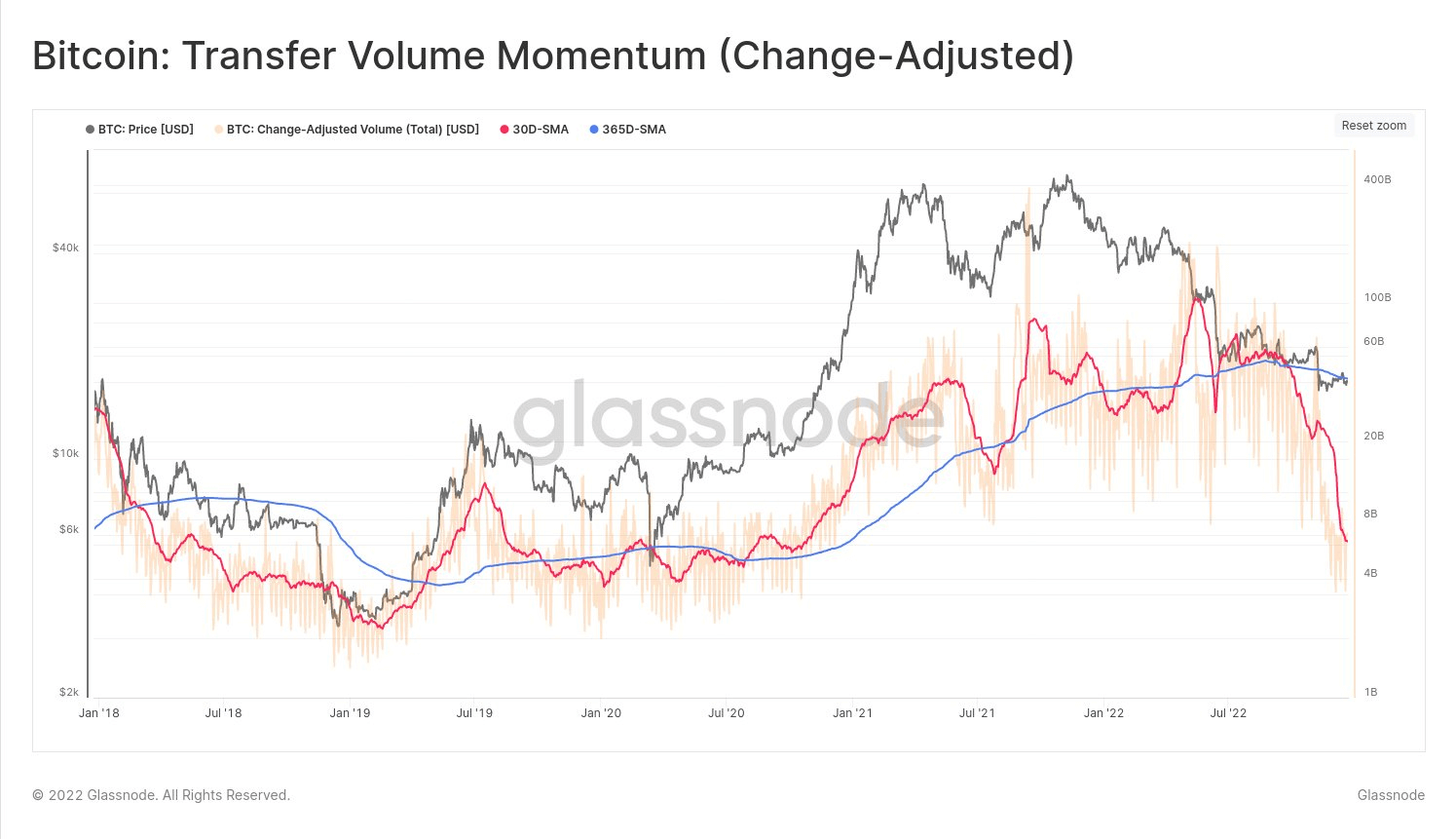

Transfer Volume Momentum

Before June, the 30-day Moving average (DMA) (red line) transfer volume in BTC reached new highs, but after the Luna-Terra crash, it rapidly declined and now stands at new lows.

Transfer volume on the Bitcoin network provides an indication of the current level of network activity and the value that is being transferred in BTC and USD. This metric compares the monthly average (red line) transfer volume against the yearly average (blue line) to underline relative shifts in dominant sentiment and help identify when the tides are turning for network activity.

It is typical for the 30DMA to be below the 365 DMA during bear markets and vice versa during bull markets. Currently, the 30 DMA has fallen below the 365 DMA, indicative of declining network fundamentals and declining network utilization, according to data analyzed by CryptoSlate.

This indicates that momentum has evaporated in terms of chain transfer, which is concerning. It is also the largest discrepancy between the 30 DMA and the 365 DMA in over the last five years.

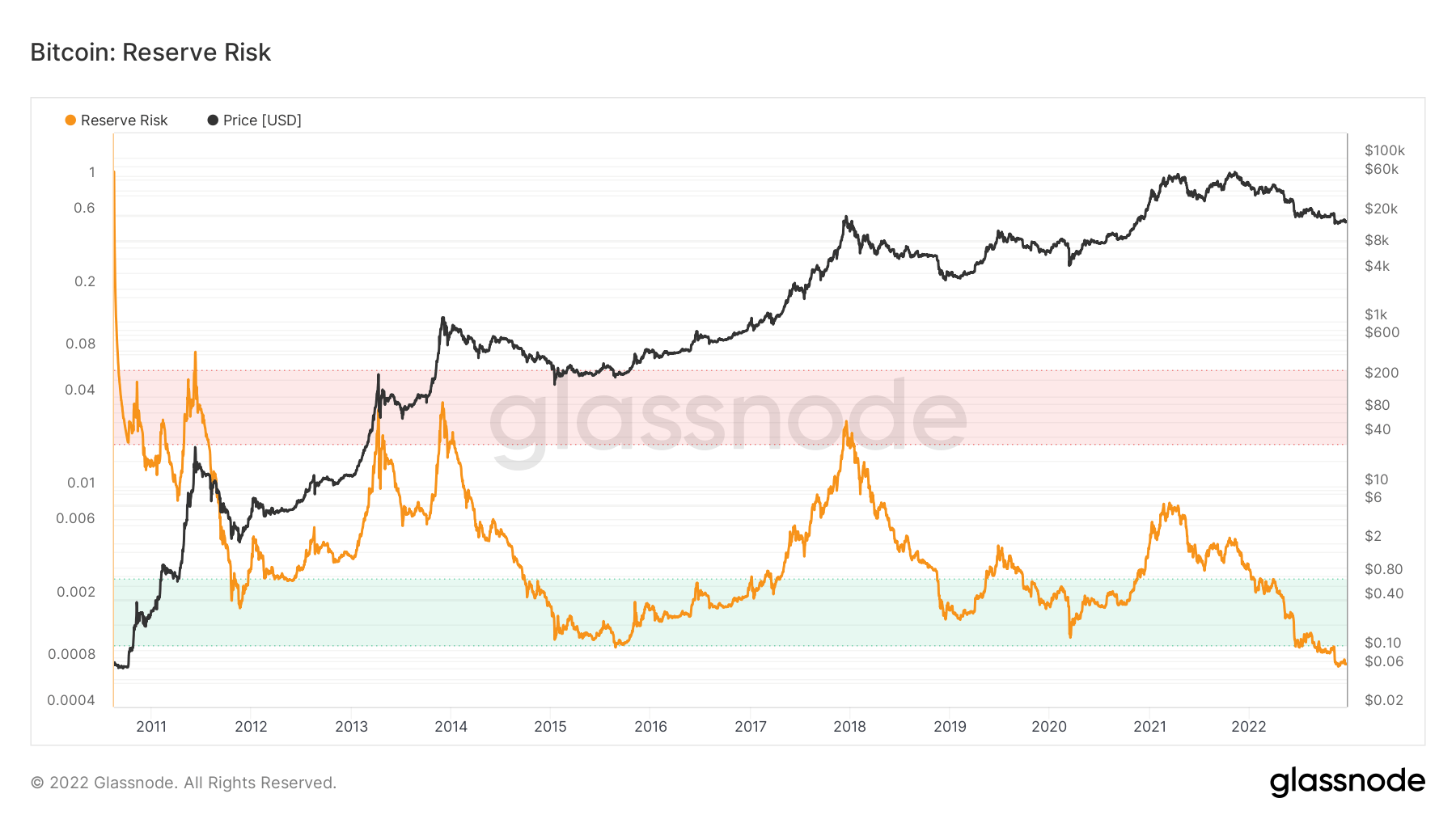

Bitcoin Reserve Risk

CryptoSlate’s on-chain analysis shows the Bitcoin Reserve Risk indicator has declined to an all-time low.

The Bitcoin Reserve indicator gauges the confidence level of long-term holders relative to the current bitcoin price. Reserve Risk is the ratio between the current price (incentive to sell) and HODL Bank. The HODL Bank metric represents the cumulative opportunity cost of holding the asset.

When Bitcoin prices reach record highs, Reserve Risk (the red zone) tends to be higher, reflecting a decrease in investor confidence.

Alternatively, a lower Bitcoin price and higher confidence mean lower Reserve Risk (the green zone) or an improved risk/reward ratio.

However, at current times, BTC reserve risk has fallen out of the green box for the first time in its history, showing a lack of confidence among investors.

Nevertheless, low Reserve Risk can signal relative undervaluation, which can be a lengthy and prolonged…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…