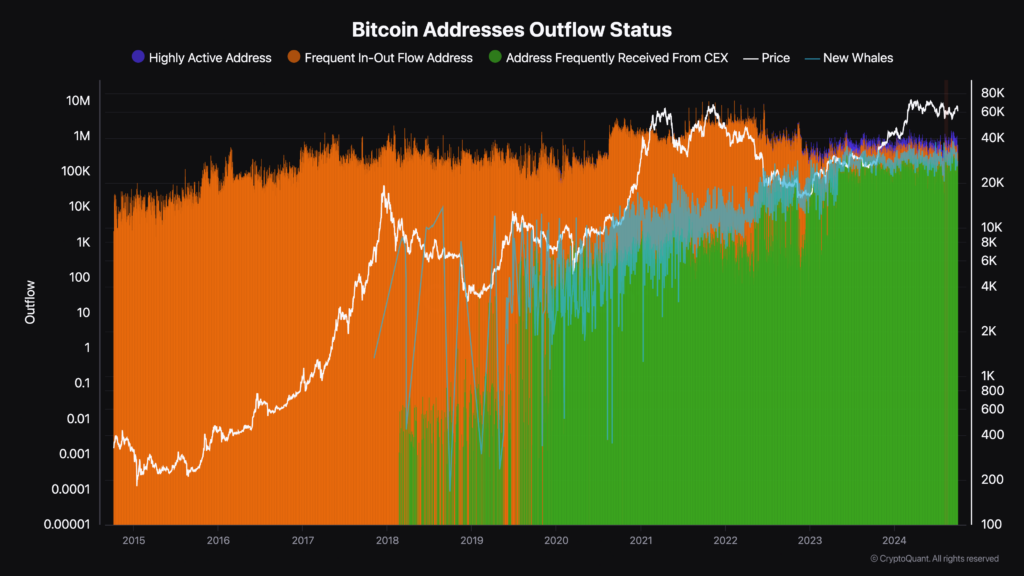

Analysis of Bitcoin address outflow patterns indicates a correlation between address activity types and Bitcoin’s price movements from 2014 to 2024. Per CryptoQuant data, shifts in outflow trends among different address categories reflect underlying market trends and participant behaviors.

From 2014 to 2017, frequent in-out flow addresses dominated Bitcoin’s outflow landscape. This period coincided with low Bitcoin prices relative to today, suggesting that high transactional activity among these addresses did not significantly impact market valuation. The dominance of frequent in-out flows mirrors a market primarily driven by smaller transactions and individual users engaging in regular transfers.

Around 2018, a notable shift occurred as addresses frequently receiving from centralized exchanges began to grow rapidly. This growth came with an increase in Bitcoin held by or moving through exchange addresses due to heightened trading activity and increased user adoption of exchanges.

The timing aligns with an upward trend in Bitcoin’s price, indicating a connection between exchange activity and market valuation. The prominence of exchange-related addresses may echo investors moving assets onto exchanges in anticipation of market movements or increased speculative trading.

The number of new whale addresses identified by new or existing large Bitcoin holders spiked at the beginning of 2020. The spike coincided with increased Bitcoin price growth and volatility, implying accumulation regardless of the price.

The influx of new whales during these periods suggests that institutional investors or high-net-worth individuals were entering the market, potentially driving prices upward through substantial purchases.

Bitcoin address activity from 2021 onward

As Bitcoin’s price declined throughout 2022, frequent in-out flow addresses remained dominant. However, their influence weakened after mid-2022, coinciding with a marked increase in addresses frequently receiving from centralized exchanges. This shift suggests that more Bitcoin was moving through or held by exchange addresses during the recovery period, indicating increased trading activity or investor repositioning in response to market conditions.

New whale activity continued to increase during the second half of 2022 and into 2023, indicating persistent purchases by large holders during price lows. This growth reflects strategic market repositioning…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…