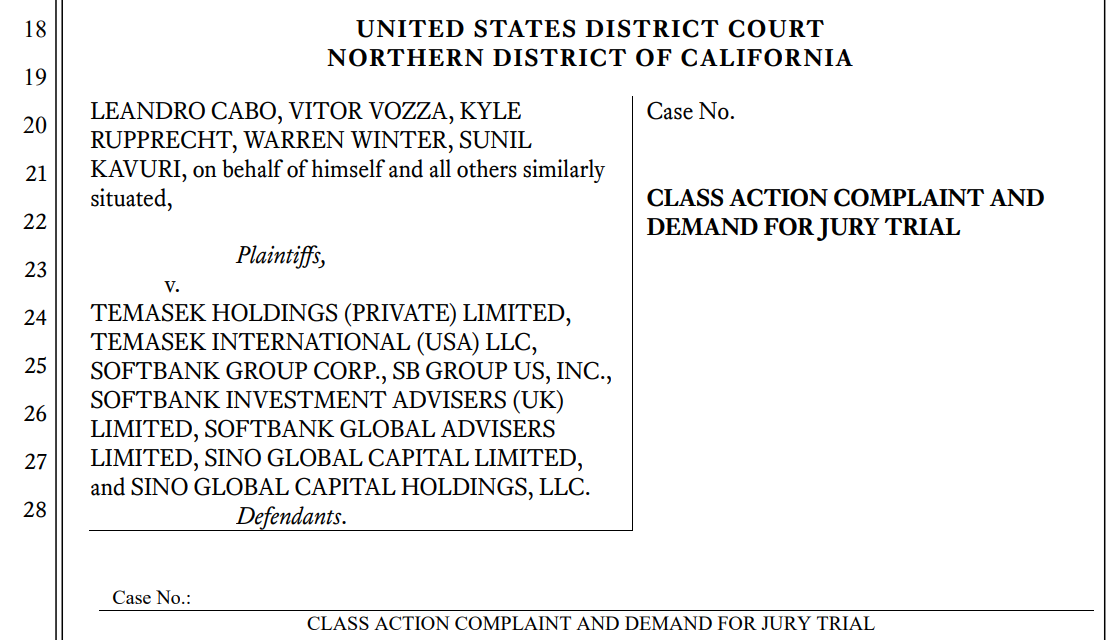

A total of 18 leading venture capital investment firms including the likes of Temasek, Sequoia Capital, Sino Global and Softbank have been named as defendants in a class action lawsuit filed in Miami for their links to now-bankrupt crypto exchange FTX.

The lawsuit filed on Aug.7 alleged that these investment firms were responsible for ‘aiding and abetting’ FTX fraud. The suit claimed that the defendants in the case used their “power, influence and deep pockets to launch FTX’s house of cards to its multibillion-dollar scale”.

The lawsuit noted that the FTX cryptocurrency exchange violated several securities laws and stole customers’ funds while the defendant VC firms especially the likes of Temasek offered an illusive picture of the exchange claiming they have done their due diligence. Thus, these VC firms directly “perpetrated, conspired to perpetrate, and/or aided and abetted the FTX Group’s multi-billion-dollar frauds for their own financial and professional gain.”

While talking about the role of VC firms in aiding and abating FTX fraud, the plaintiffs cited the example of Temasek and its statement regarding the financial conditions of FTX. Temasek has claimed that they conducted an 8-month-long extensive review of FTX’s finances, audits and regulatory checks and found no red flags. The suit read:

“The Multinational VC Defendants also made numerous deceptive and misleading statements of their own about FTX’s business, finances, operations, and prospects for the purpose of inducing customers to invest, trade, and/or deposit assets with FTX. “

The suit further alleged that these VC firms vouched for the safety and stability of the FTX and advertised FTX’s purported attempts to become properly regulated.

Temasek was one of the early investors in the FTX crypto exchange with a $275 million investment, but, after the collapse of the crypto exchange in November. The investment firm wrote off its entire investment in the exchange later and later even slashed compensation for the executives who were responsible for the FTX investment.

Related: Prosecutors will still consider Sam Bankman-Fried’s alleged campaign finance scheme at trial

Temasek being a state-backed investment firm also put the Singaporean government in a hot seat over its failure to curb such investment,

FTX collapse created a crypto contagion and cast a shadow of doubt on the entire crypto ecosystem leading…

Click Here to Read the Full Original Article at Cointelegraph.com News…