The price of Bitcoin has been on a tear in recent weeks, surging over 30% and breaching the $50,000 mark. At the time of writing, Bitcoin was trading at $52,377, up 1.3% and 8.8% in the daily and weekly timeframes, data from Coingecko shows.

This bullish momentum has ignited fresh optimism among investors, with many wondering if the world’s leading cryptocurrency is poised for another assault on its all-time high of $69,000.

Analysts point to several key technical factors that could propel Bitcoin towards new heights in the coming months. Here are three of the most prominent:

Halving Frenzy

April 2024 marks the next Bitcoin halving, a highly anticipated event that occurs roughly every four years. During this event, the block reward for miners, currently 6.25 BTC, is slashed in half, effectively reducing the rate at which new Bitcoins enter circulation. This engineered scarcity has historically triggered significant price rallies, and analysts predict a similar outcome this time around.

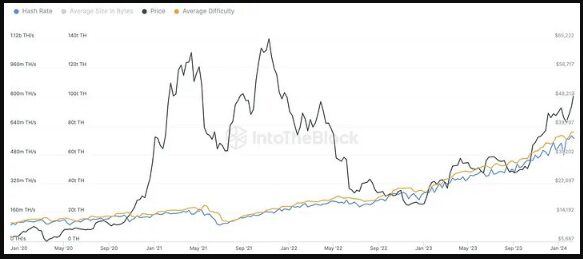

Source: IntoTheBlock

IntoTheBlock, a quantitative crypto analysis firm, estimates a surge to a new all-time high just one month after the halving. They reason that miners, better prepared for the halving’s impact this time, will hold onto their rewards, limiting selling pressure and potentially boosting the price. Additionally, the halving reduces Bitcoin’s inflation rate from 1.7% to 0.85%, further enhancing its store-of-value appeal.

We give Bitcoin 85% odds of hitting all-time high in the next 6 months. Curious what’s behind this prediction? read our latest newsletter

https://t.co/acx2Fbi1Dw

— IntoTheBlock (@intotheblock) February 17, 2024

The CEO of Sound Planning Group and an investment adviser representative, David Stryzewski, gave an explanation of his belief that the price of bitcoin is about to experience a significant upswing on the Schwab Network on Thursday.

He clarified that the triggers for the rising price momentum for bitcoin are the impending halves of the cryptocurrency and the recently introduced spot exchange-traded funds (ETFs) that the U.S. Securities and Exchange Commission (SEC) approved last month.

Macroeconomic Tailwinds

The Federal Reserve’s dovish monetary policy stance, aimed at combating deflationary pressures, is another factor buoying Bitcoin’s prospects. The anticipation of interest rate cuts and increased liquidity injections into the financial system could benefit Bitcoin alongside other…

Click Here to Read the Full Original Article at NewsBTC…