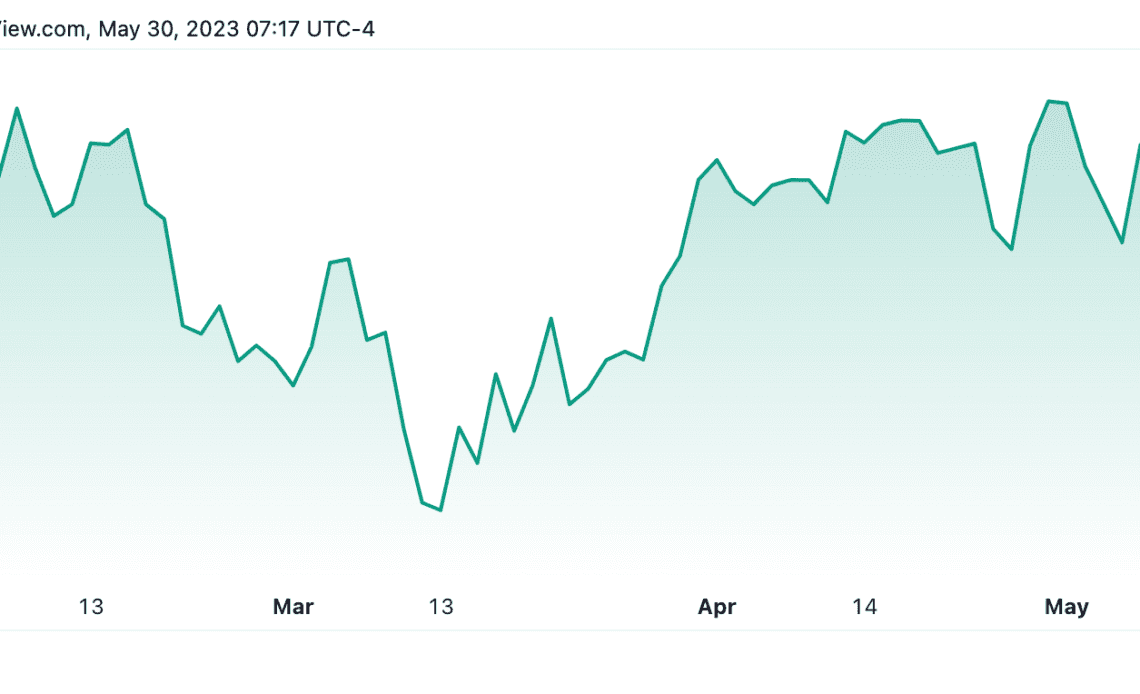

The S&P 500 index, a key barometer of U.S. equities, stood at 4,151 points at the closing bell on May 29, showing a year-to-date (YTD) percentage growth of 9.15%, standing at odds with the growing inflation and potential recession.

In parallel, the crypto market, as measured by its total market capitalization, witnessed substantial oscillations, ending the month at a commanding $1.16 trillion. Despite periodic downturns, the overall YTD growth rate for the crypto market stands at an impressive 45.3%.

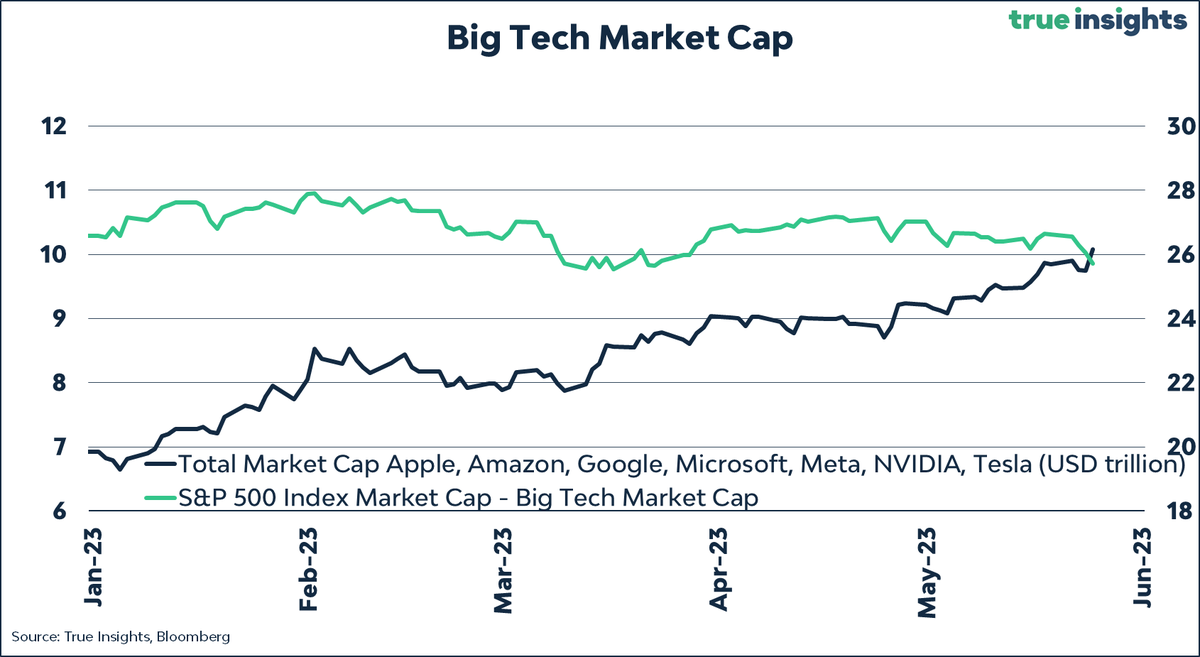

However, the S&P 500’s performance doesn’t illustrate actual market conditions. A closer look reveals the disproportionate influence of tech behemoths Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla — which form a significant portion of the index’s total market cap — on the index’s overall performance.

The combined market capitalization of these stocks has increased by $3.16 trillion, representing a 46% YTD growth rate.

When these companies are removed from the YTD performance calculation, the S&P 500 paints a different picture, with the YTD percentage growth dropping to just 3% and indicating a highly skewed dependency on these entities for its robust performance.

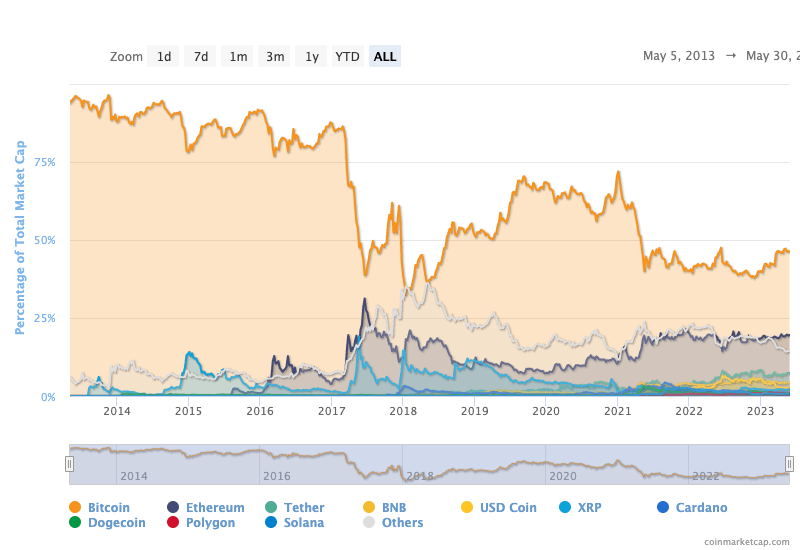

However, the crypto market is also dominated by a significant player: Bitcoin. As of May 23, 2023, Bitcoin alone accounted for $542.7 billion of the total crypto market cap. Its sheer size and influence often overshadow the performance of other cryptocurrencies in the market.

In fact, Bitcoin’s dominance stands at approximately 46% of the entire crypto market cap, reflecting its standing as the original and most widely adopted cryptocurrency. The figure significantly shapes the crypto market’s dynamics, illustrating Bitcoin’s resilience and growing popularity.

When we exclude Bitcoin’s market cap from the total, the remaining crypto market cap comes to $617.3 billion, indicating a lower YTD growth rate of 29.1% for the rest of the market and highlighting the significant impact Bitcoin has on the overall crypto market growth.

Comparing…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…