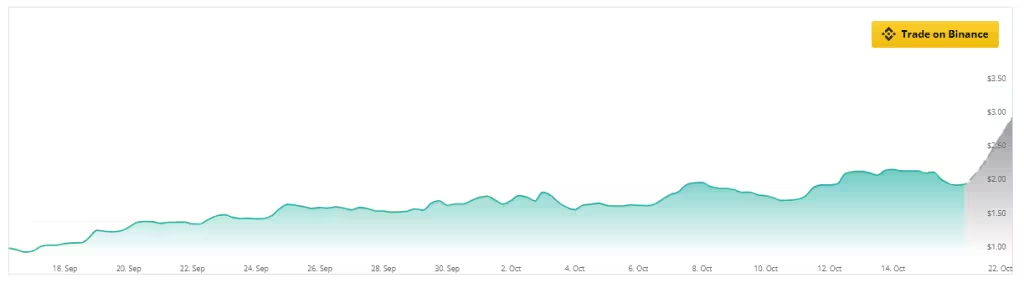

SUI has lately attracted a lot of interest and peaked in its development. It finished the week at its all-time high price of $2.30 and ranked higher than top altcoins such as Polkadot (DOT), therefore ranking itself among the top 15 cryptocurrencies. Among those who support SUI, this achievement has inspired hope since they believe it will become a major competitor in the market.

Related Reading

DeFi noted SUI’s price surge and $1 billion Total Value Locked (TVL). The coin ranks higher than Avalanche (AVAX) and Polygon (MATIC). Investors are noting SUI’s growing position in the DeFi market, with SUI projections showing a continuous positive trend and a whopping 240% increase over the next three months,

$SUI passes $DOT. Congrats to those that listened to me. pic.twitter.com/FtU5vk8f8M

— MartyParty (@martypartymusic) October 13, 2024

At the time of writing, SUI was trading at $2.04, down 4.3% in the last 24 hours, but sustained an 8.7% in the last seven days, data from Coingecko shows.

Valuation Inquiries Arise

The rapid rise of SUI has evoked excitement among many but it has also raised doubts. In fact, some analysts are questioning whether there is a justification in the prevailing market capitalization of the token to its real fundamentals.

The rising value has sparked a debate because people are trying to measure SUI’s market capitalization in order to come up with underlying problems. Such an occurrence is not unusual for coins and even tokens on the rapid expansion corner; however, it also tends to instill some doubts into potential buyers.

Insider selling is another worry. Significant transactions from a foundation wallet during the token’s recent rise have raised questions about its price sustainability. Divesting during a price spike may indicate insider insecurity, making investors doubt long-term prospects.

SUI market cap currently at $5.6 billion. Chart: TradingView.com

Comparison Of Fully Diluted Valuation

The complexity of SUI’s current condition is exacerbated by its Fully Diluted Valuation. The FDV of SUI is $1.2 billion, far lower than Solana’s $4.7 billion. Several market experts claim that Solana could be mispriced because the fully diluted valuation of Solana is less than one-third that of Ethereum. This has led some to conclude that SUI…

Click Here to Read the Full Original Article at NewsBTC…