Crypto analytics firm Santiment says that on-chain data is now hinting at renewed bull runs for Bitcoin (BTC) and Ethereum (ETH).

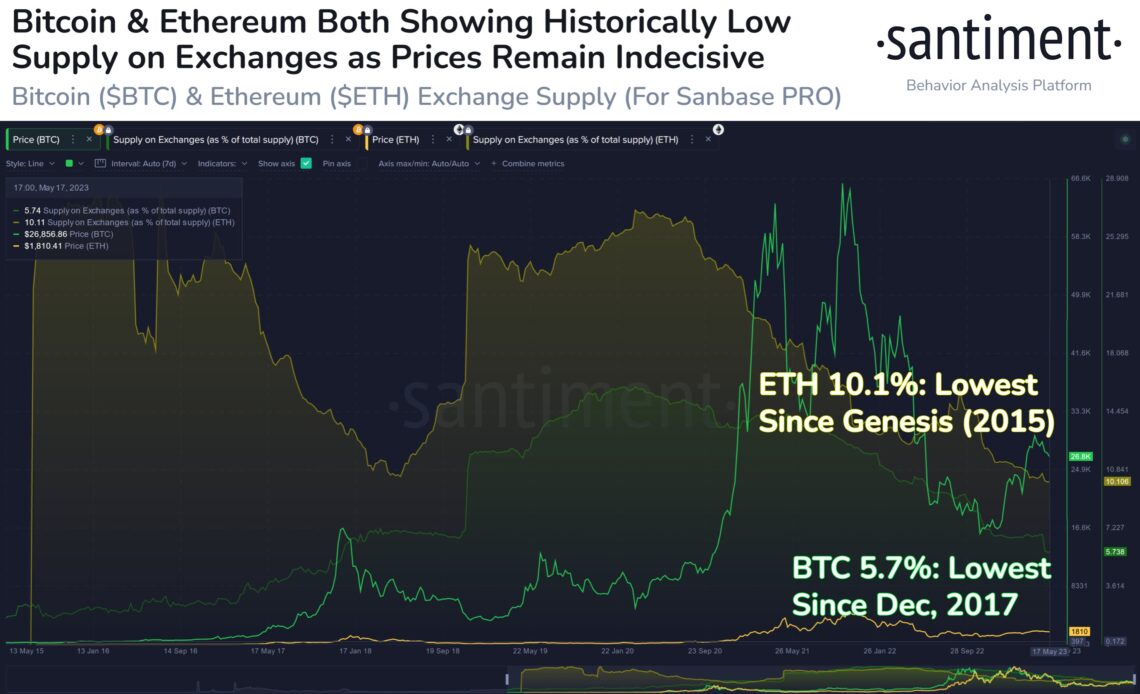

The market intelligence firm says that both of the top two crypto assets by market cap are seeing more and more of their supplies being moved out of digital asset exchange platforms and into self-custody wallets.

According to the firm’s data, both the crypto king and the leading smart contract platform are seeing historically low supply on exchanges.

“Bitcoin and Ethereum both continue to quietly see more and more of their existing supplies move into self custody. Though not a perfect indicator, declining coins on exchanges generally hint at future bull runs, given enough time playing out.”

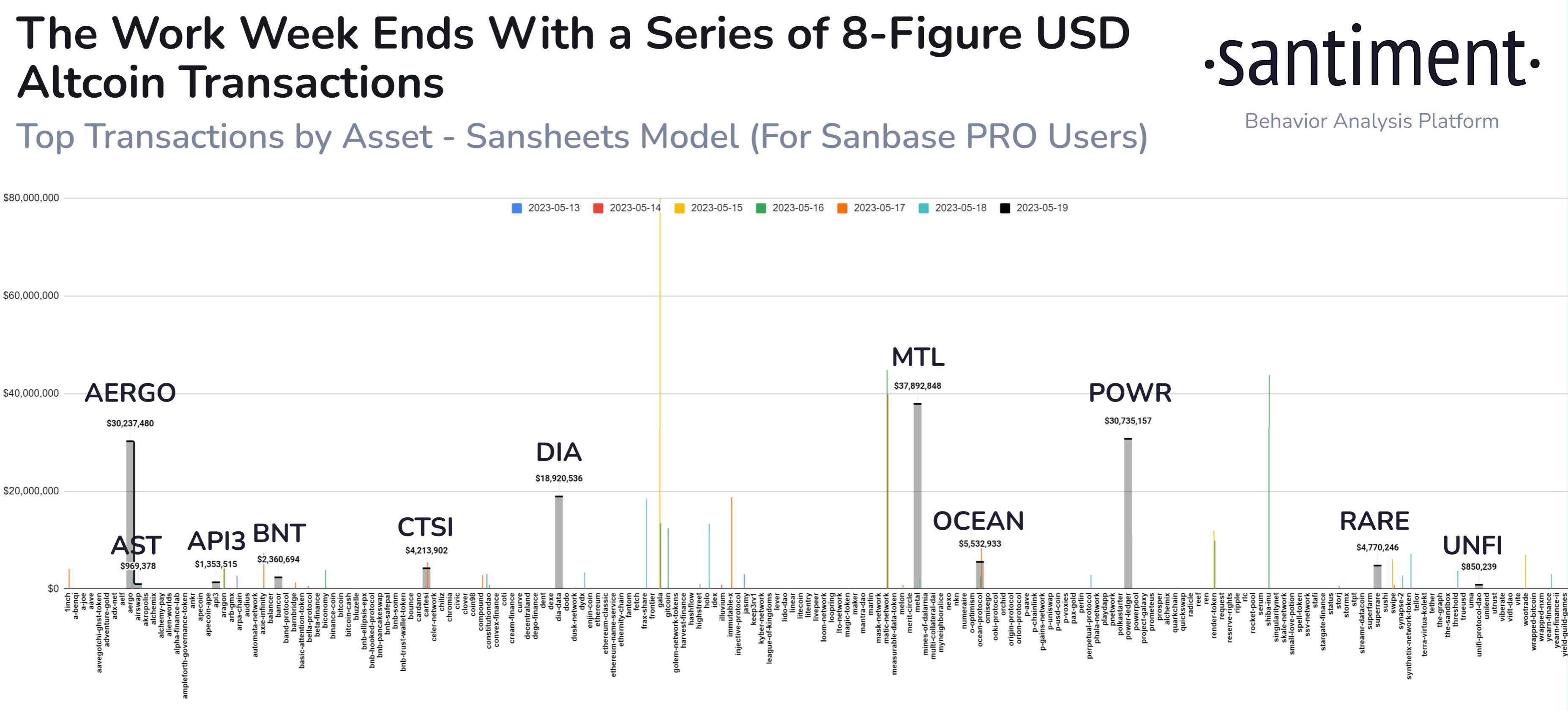

Santiment also has its attention on low and mid-cap altcoins, such as payments proceessing token Metal (MTL) and peer-to-peer energy protocol Power Ledger (POWR). The firm says the altcoins saw heavy whale and shark activity last week, which could mean that they are now worth paying attention to.

Previously, Glassnode, another crypto insights firm, examined numerous metrics to conclude that BTC is well into its bear market recovery phase.

Bitcoin is trading for $26,628 at time of writing, while Ethereum is worth $1,802.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Space…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…