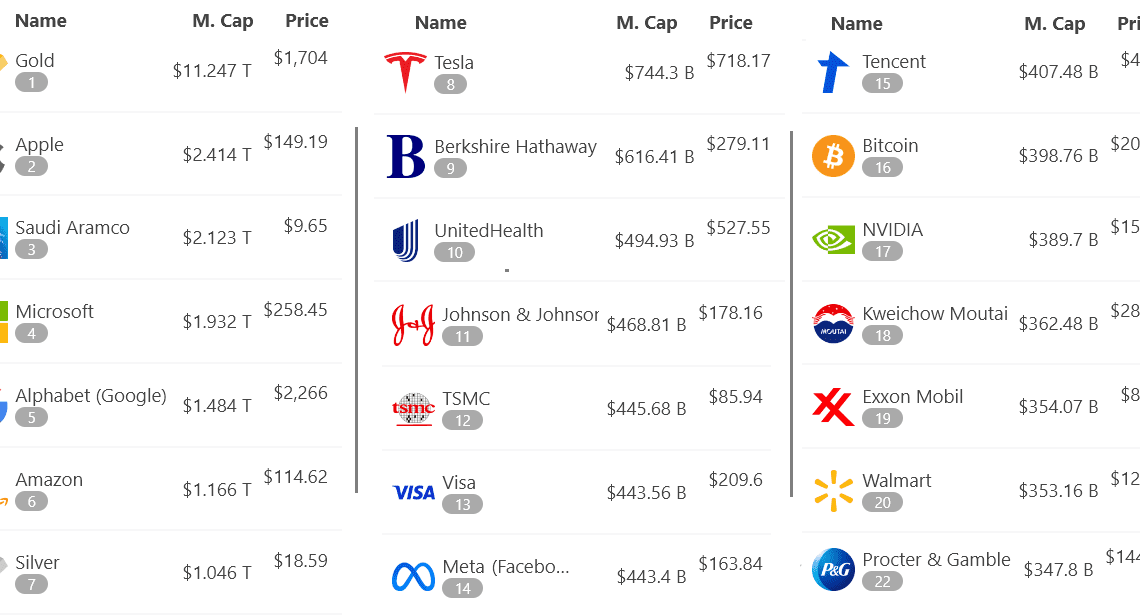

Bitcoin (BTC) price is down 56% year-to-date, but the correction was not strong enough to remove the digital asset from the list of top-20 global tradable assets. Bitcoin’s current $400 billion market capitalization stands higher than traditional companies like Exxon Mobil, Walmart and Procter & Gamble, but there’s always the question of whether a direct comparison between a commodity like Bitcoin and equities is valid.

Analysts and investors favoring stocks constantly remind crypto advocates that Exxon Mobil posted $25.79 billion in earnings over the past 12 months, as a justifying example of its valuation. But on the flip side, earnings don’t necessarily explain how Boeing booked $16.1 billion losses in two years, even as it holds an $87.1 billion market capitalization.

Measuring a commodity market value can be tricky. For example, in the case of silver, only 50% of precious metal is used in industrial applications. There are individuals and companies holding the asset for investment in the form of bars, coins, or jewelry and these are not “productive” revenue-generating assets.

Bitcoin’s value is vastly inferior to gold’s $11.2 trillion market capitalization, but what does “$400 billion” even mean, and how does it compare to broader asset classes such as global equities, real estate and debt markets?

Was the Bitcoin “digital gold” thesis wrong?

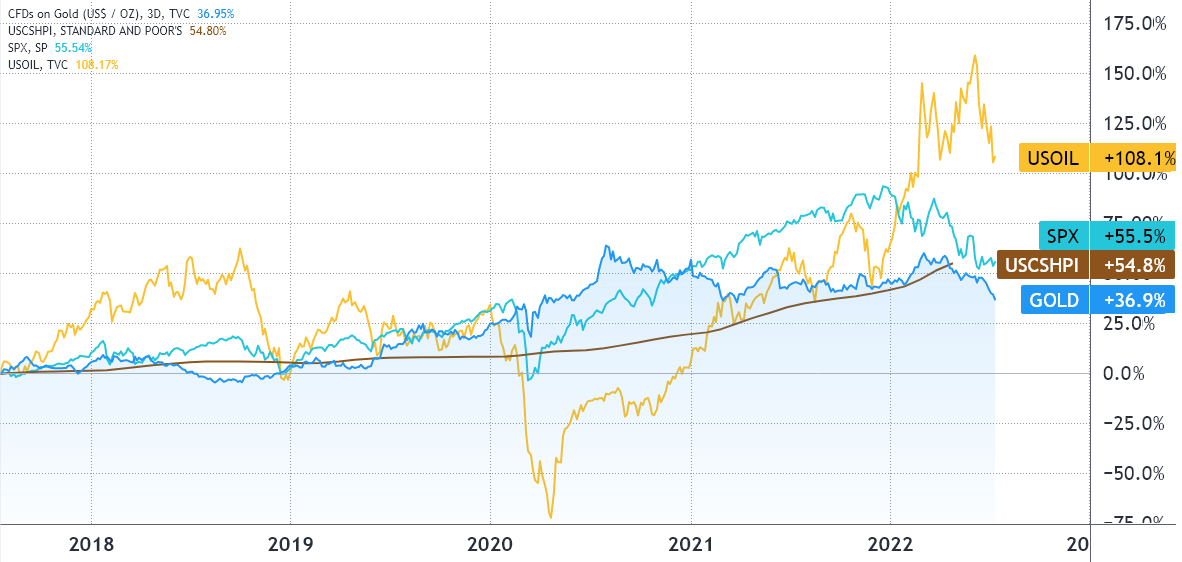

The first question one should ask is: has gold been a good store of value over the past five years? To find answers, traders have to compare its price against other trillion-dollar asset classes like global equities, oil and real estate. The overall goal for any store of value is to maintain the purchasing power, regardless of price fluctuations during the period.

From July 2017 until July 2022, gold has underperformed the remaining asset classes by 18% or higher. The precious metal broke above $2,000 in August 2020, but it could not keep up with the ever-growing prices of stocks, housing and energy. In comparison, the United States monetary base, bank deposits and cash, expanded by 48.5% in the same period.

One could argue that gold has failed to sustain its purchasing power over time, but it’s likely that more time is needed to evaluate how the precious metal will behave if the current global crisis accelerates or extends longer than expected. Meanwhile,…

Click Here to Read the Full Original Article at Cointelegraph.com News…