An anonymous Ethereum investor has lost more than $2 million trading Ether (ETH) since Sep. 9, 2022, on-chain data shows.

Buying Ethereum high, selling low

Spotted by on-chain monitoring resource Lookonchain, the “stupid money” trader spent $12.5 million in stablecoins to buy 7,135 ETH after it rallied 10% to $1,790 in September 2022. But a subsequent correction forced the trader to sell the entire stash for $10.51 million.

As a result, the trader lost nearly $1.75 million. Interestingly, waiting and selling at today’s price would have resulted in a smaller loss of $1.14 million.

1/ Please don’t blindly follow the trend to buy $ETH after the price rises for a period of time, and don’t panic sell after the price drops.

A stupid money who loses more than 2M $USDC in half a year will tell you how dangerous this behavior is.

— Lookonchain (@lookonchain) February 22, 2023

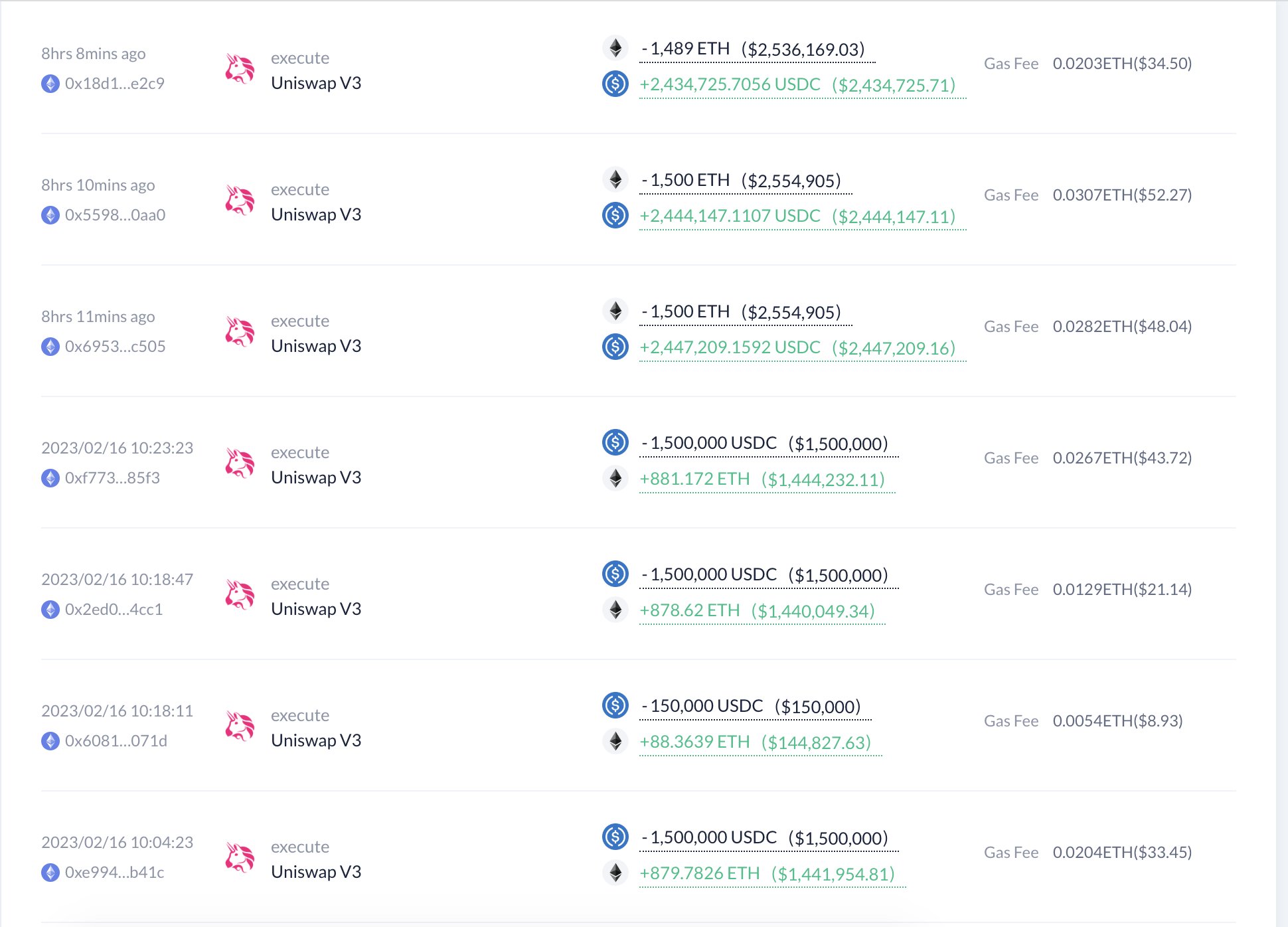

The investor’s trades reemerged in February as ETH price had risen by approximately 10%. Data shows that $7.65 million in ETH was acquired on Feb. 16, only to sell it eight hours later as ETH price dropped, resulting in a loss of another $324,000.

3 Ethereum investment lessons to learn

Traders can use such examples to learn from others’ mistakes and reduce their investment risks with proven strategies. Let’s take a look at some of the most basic tools that can help reduce losses.

Don’t rely on just one fundamental

The investor first traded stablecoins for ETH on Sep. 12, just three days before long-awaited transition from proof-of-work (PoW) to proof-of-stake (PoS) via the Merge upgrade.

The Merge, however, turned out to be a “sell-the-news” event. Thus, going extremely bullish on Ether based on one strong fundamental was a poor decision.

Moreover, going all in while relying on one indicator, particularly a widely-anticipated news event, is often…

Click Here to Read the Full Original Article at Cointelegraph.com News…