It has been widely accepted that Bitcoin ETF applications have been the main driver for Bitcoin’s return to the April 2022 level at above $40k. The thesis is simple: with a new layer of institutional legitimacy, the capital pool for Bitcoin inflow would deepen.

From hedge funds and commodity trading advisors (CTAs) to mutual and retirement funds, institutional investors have easy access to diversify their portfolios. And they would do so because Bitcoin is an anti-depreciating asset.

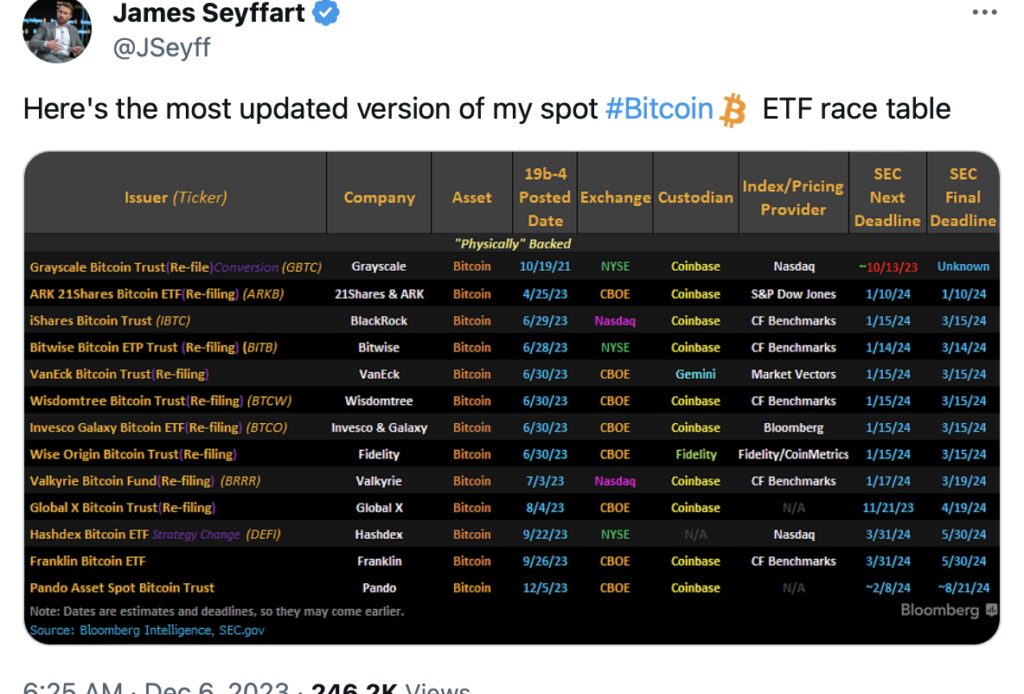

Not only against forever-depreciating fiat currencies but against not-so-capped gold. In contrast, Bitcoin is not only limited to 21 million but its digital nature is secured by the world’s most powerful computing network. So far, 13 applicants have maneuvered to serve as institutional Bitcoin gateways.

According to Matthew Sigel, VanEck’s Head of Digital Asset Research, SEC approvals will likely bring “more than $2.4 billion” in H1 2024 to boost Bitcoin price. Following the SEC’s court battle loss against Grayscale Investment for its Bitcoin trust-ETF conversion, the Bitcoin ETF approvals are now perceived as near-certainty.

Most recently, SEC Chair Gary Gensler met with Grayscale representatives alongside seven other Bitcoin ETF applicants. Later, in a CNBC interview, Gensler confirmed that the path to Bitcoin ETFs is a matter of sorting out technicalities.

“We had in the past denied a number of these applications, but the courts here in the District of Columbia weighed in on that. And so we’re taking a new look at this based upon those court rulings.”

The most telling indicator in that direction is that BlackRock, the world’s largest asset manager, has integrated Wall Street-friendly rules. In that framework, banks could participate as authorized participants (APs) in Bitcoin ETF exposure. This is also notable given that Gary Gensler himself is a former Goldman Sachs banker.

Considering this likely horizon, what would the Bitcoin ETF landscape look like?

The Role and Concerns of Custodians in Bitcoin ETFs

Of 13 Bitcoin ETF applicants, Coinbase is the BTC custodian for 10. This dominance is not surprising. BlackRock partnered with Coinbase in August 2022 to link BlackRock’s Aladdin system with Coinbase Prime for institutional investors.

Furthermore, Coinbase has established a cozy relationship with government agencies, from ICE and DHS to Secret Service, to provide blockchain analytics software. At the same time, the largest US crypto…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…