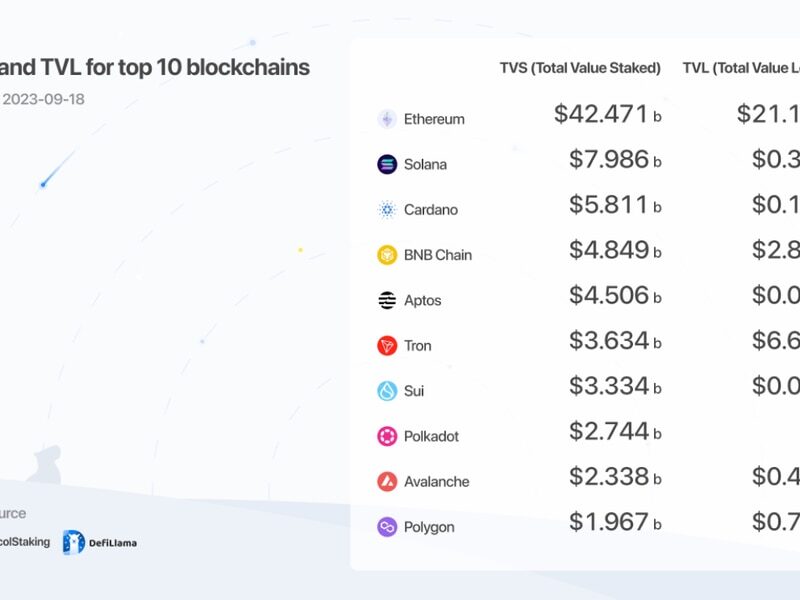

Interest in staking has shown a strong resilience to the bear market. A considerable amount of value remains staked on top blockchains, in many cases surpassing the actual total value locked (TVL) living on-chain.

This article is part of CoinDesk’s “Staking Week.” JK is the founder of ApybaraIO, the maker of ProtocolStaking.info.

However, things are not looking so good otherwise for staking. Public perception of staking has become one of the biggest casualties of the current bear market. Many of the crypto lending firms and exchanges that went under in the past year frequently marketed their service offerings as “staking.” In most cases, they were not.

As a result, staking has been categorized as a high-risk activity and discouraged by regulators. In some cases, regulatory actions have been taken leading to some crypto platforms shutting down any staking service offerings. Are these actions against staking justified?

See also: Crypto Lenders Caused Crypto Contagion Last Year | Opinion

Will the real stakers please stand up

It’s important to first draw a line between staking and “staking.” Staking involves locking tokens directly on the blockchain with operators/validators. Stakers do not give up ownership of their tokens through this process. Operators/validators are expected to secure and perform work on the blockchain with the stake delegated to them.

Liquidity pool (LP) token locking and lending are the biggest offenders of liberally using “staking” when describing their services. These imposter “staking” services are harder to analyze in comparison to on-chain staking, which can be fully observed and monitored because it’s on a blockchain.

The risks for on-chain staking are relatively clear cut and should be assessed independently from these other services that may entail higher and, at times, obscure risks.

Realistic risks of staking

There are four major risks associated with staking.

1. Slashing and penalties: Slashings occur when a validator attests to two different histories of the chain and penalties occur when a validator is offline for a prolonged period of time. In combination, they deter malicious validators from attacking blockchains. The amount at risk is not de minimis. For example, the most recent slashing on Ethereum resulted in a loss of 1 ETH (roughly a…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…