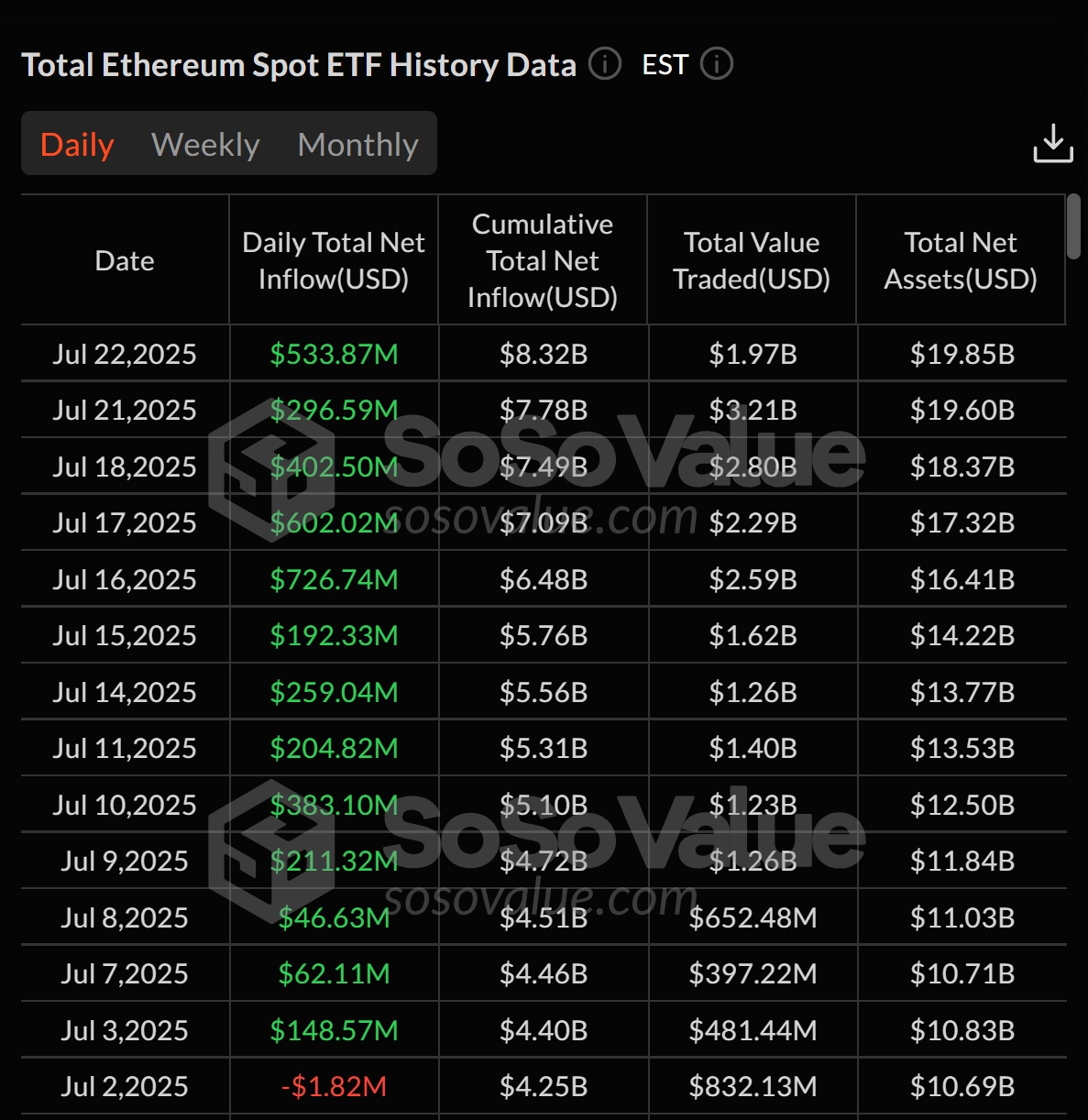

Spot Ether exchange-traded funds (ETFs) continued their bullish momentum on Tuesday, recording a net inflow of $533.87 million and extending their streak to 13 consecutive trading days of inflows, according to data from SoSoValue.

BlackRock’s iShares Ethereum Trust (ETHA) led the surge with $426.22 million in daily net inflow. The fund now holds over $10 billion in assets, commanding the largest share of the Ether (ETH) ETF market. Fidelity’s FETH followed with $35 million in inflows.

“Spot Ether ETF inflows have been driven by falling BTC dominance and growing institutional appetite for ETH exposure. As liquidity deepens and macro conditions hold, this demand trend is likely to endure,” Vincent Liu, chief investment officer at Kronos Research, told Cointelegraph.

The cumulative net inflow across all Ether ETFs has now surpassed $8.32 billion, up from $4.25 billion at the beginning of the streak on July 2. The total net assets locked in these products have reached $19.85 billion, representing 4.44% of Ethereum’s market cap.

Related: The rise of ETFs challenges Bitcoin’s self-custody roots

Spot Ether ETFs pull in $4 billion over 13-day inflow streak

The total net inflows during the 13-day streak from July 3–22 amount to over $4 billion. The streak also includes record-breaking activity on July 16, when Ethereum ETFs registered a $726.74 million daily inflow, the largest since their debut. July 17 followed with $602.02 million, the second-largest yet.

“ETP Investors remain significantly underweight Ethereum vs. Bitcoin: Although ETH’s market cap is about 19% the size of BTC, Ethereum ETPs have amassed less than 12% of the assets of Bitcoin ETPs,” Matt Hougan, chief investment officer at Bitwise, wrote in a Tuesday post on X.

He said the trend of companies holding ETH on their balance sheets is likely to accelerate. He estimated that between exchange-traded products (ETPs) and these companies,…

Click Here to Read the Full Original Article at Cointelegraph.com News…