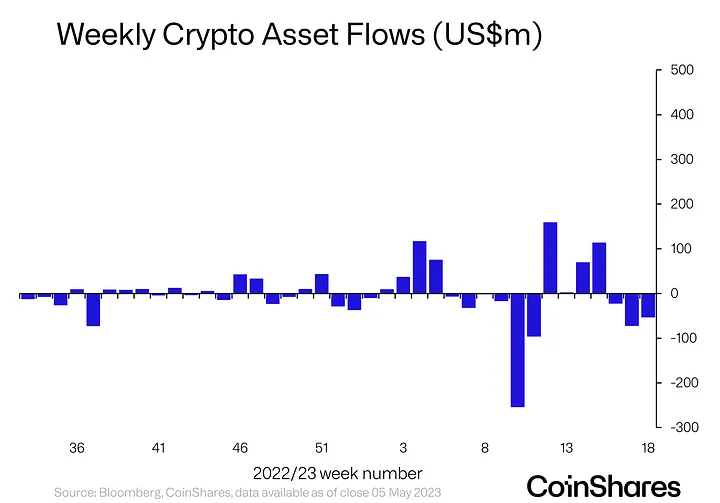

Digital assets manager CoinShares says institutional investors have a negative sentiment about the market as crypto suffers major outflows for the third week in a row.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional investors sold off $54 million in crypto holdings last week, with most of the outflows stemming from outside the US.

“Digital asset investment products saw outflows totaling US $54million last week, representing the 3rd consecutive week of negative sentiment for the asset class…

Regionally, the majority of outflows were from Germany and Canada with US $27million and US $20million respectively.”

King crypto Bitcoin (BTC) took the brunt of the outflows, totaling $32 million, according to CoinShares.

“Bitcoin saw US $32 million of outflows last week. While sentiment in the US turned markedly positive, with inflows of US $ 18 million and the largest weekly outflows from short-Bitcoin on record of US $ 23million.”

Altcoin investment was “unusually low,” according to CoinShares. Leading smart contract platform and altcoin Ethereum (ETH) suffered outflows of $2.3 million, bringing its year-to-date outflows to $26 million. Multi-asset investment products took in $0.1 million of inflows. Solana (SOL) was the only stand-alone altcoin with inflows.

“Solana was the only other altcoin to see any activity with inflows of US$3.4m, the second largest over the last 12 months.”

Coinshares reports that blockchain equities also suffered weak sentiment last week and had outflows of $7.3 million.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Alina Spiridonova/Natalia Siiatovskaia/Fotomay

Click Here to Read the Full Original Article at The Daily Hodl…