Solana’s native token, SOL (SOL), surged by 35% between Oct. 5 and Oct. 11, reaching its highest level since December 2021 at $222. This movement has led traders to speculate whether the all-time high of $260 is within reach, especially after Bitcoin (BTC) crossed $84,500, driven by steady institutional inflows and anticipated regulatory clarity in the United States.

SOL has outperformed the broader altcoin market, which saw a 33% increase over the same six-day period ending Oct. 11. Investors’ optimism regarding SOL is partly fueled by the expansion in Solana’s smart contract activity, as evidenced by the total value locked (TVL).

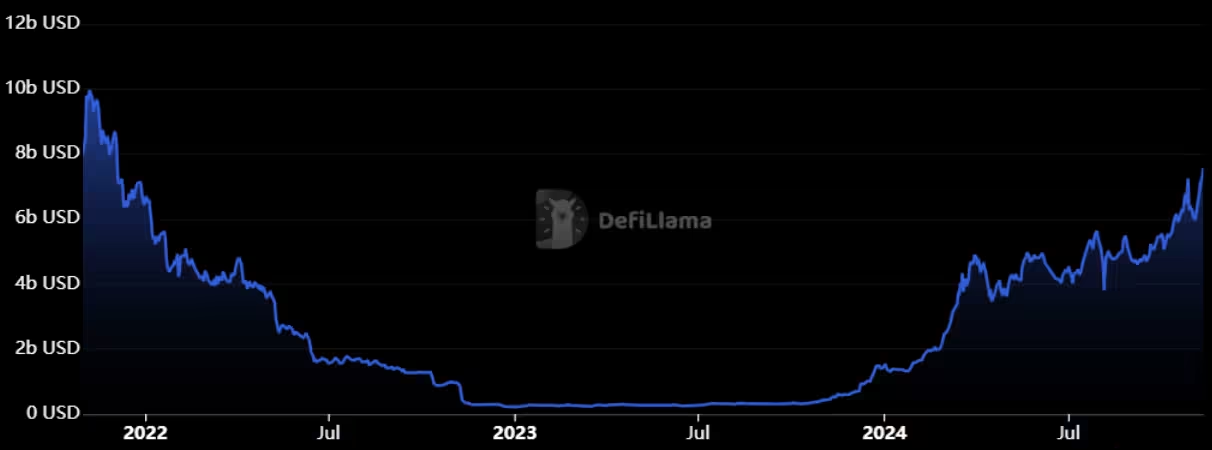

Solana total value locked in USD. Source: DefiLlama

The TVL on Solana escalated to $7.6 billion by Oct. 10, marking the highest since December 2021. Key decentralized applications (DApps) like Jito, Raydium, Drift, and Binance’s liquid staking significantly contributed to a 36% growth in deposits.

Solana’s activity increase is not limited to memecoin trading

There is some valid criticism regarding Solana’s heavy dependence on memecoins, including Dogwifhat (WIF), Bonk (BONK), and Popcat (POPCAT), all of which have surpassed the $1.5 billion market capitalization threshold. Decentralized token launch platforms like Pump.fun have been the main drivers behind the increase in Solana decentralized exchanges (DEX) volumes.

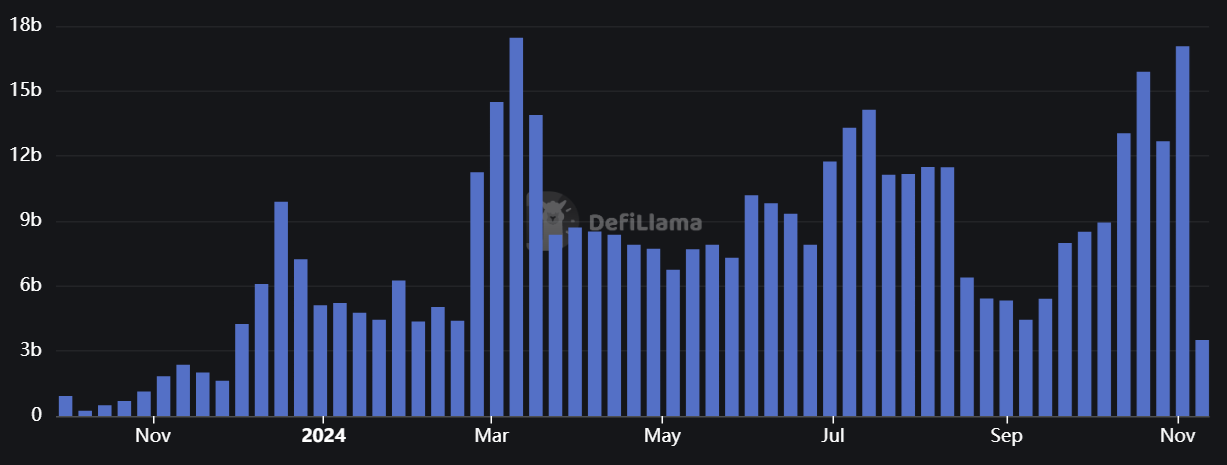

Solana weekly DEX volumes, USD. Source: DefiLlama

Weekly DEX volumes on Solana surged to $17.1 billion in the week ending Nov. 2, a figure not seen since March 2024, and corresponding to a 26% market share, surpassing even the leading DApp-focused blockchain, Ethereum. Solana also managed to capture $88.2 million in monthly fees, which is vital for addressing network security concerns.

By comparison, the Ethereum network, with a TVL over 7 times higher than Solana, earned $131.6 million in monthly fees. Similarly, Tron, another blockchain emphasizing base layer scalability, collected $49.1 million in fees over 30 days. These figures do not include broader ecosystem revenues, which include notable contributions like $100.2 million from Jito and $83 million from Raydium.

Evaluating platforms solely by TVL and fees might be misleading since not all DApps need high volumes to be significant. However, they are crucial for adoption and attracting new users, setting the stage for sustainable growth and increased demand for SOL accumulation and utilization.

For example, Magic Eden, Solana’s leading non-fungible token…

Click Here to Read the Full Original Article at Cointelegraph.com News…