Last week marked a noteworthy surge for Solana in inflows, leading the pack in altcoin investment interests and outshining Bitcoin. Solana’s recent performance particularly placed it in the spotlight as it amassed roughly $24 million, the altcoin registered its largest inflow since March 2022, according to a recent report from Coinshares.

A Closer Look: Dissecting The Solana Inflow Surge

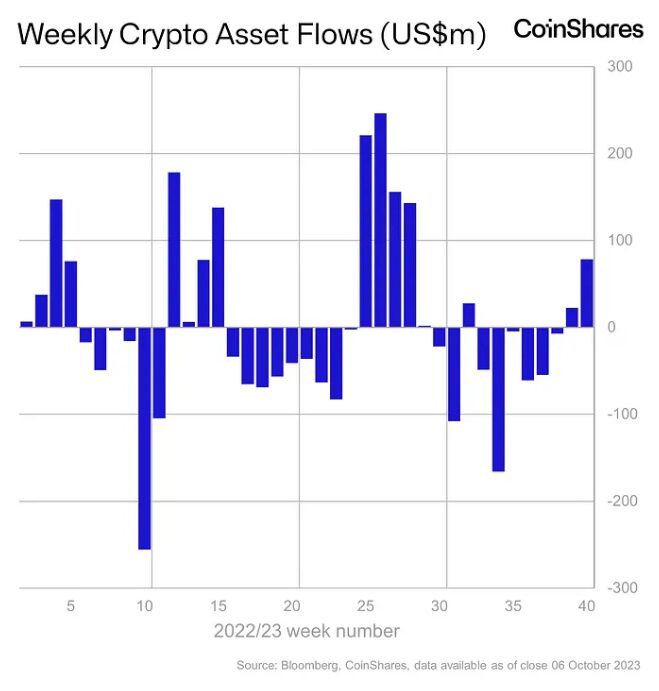

Diving into the numbers, the broader digital-asset investment domain observed net inflows for the second consecutive week, accumulating a significant $78 million, showcasing a bullish sentiment reminiscent of July’s performance.

While Bitcoin, the quintessential crypto giant, continued to dominate, Solana grabbed headlines. As highlighted by James Butterfill, Head of Research, Solana’s re-emergence as a sought-after altcoin signifies its growing appeal among digital investors, especially in light of recent Ethereum futures ETF product launches.

According to the report, with a noteworthy track record for 2023, Solana funds reported inflows for 28 weeks, with a mere four weeks registering outflows.

Always a major player, Bitcoin recorded inflows of $43 million. The report disclosed that a certain subset of investors, potentially riding on Bitcoin’s recent price momentum, initiated positions in short-bitcoin products, leading to an inflow of $1.2 million within the week.

Diverging Investment Patterns: Europe Leads While ETH ETFs Underwhelm

Geographically, Europe continued its digital asset supremacy, accounting for 90% of the total inflows. On the contrary, the combined inflows from the US and Canada totaled a mere $9 million. According to Butterfill, this noticeable regional disparity in investment sentiments underscores evolving market dynamics and investor preferences.

Adding to the digital fervor, trading volumes for exchange-traded products surged by 37%, settling at $1.13 billion for the week. Trusted exchanges dealing with Bitcoin also witnessed a 16% jump in trading volume.

However, it wasn’t all sunshine and rainbows. The recent US launch of six Ethereum futures ETFs raked below $10 million. While seemingly substantial, Butterfill termed the response as showcasing a “tepid appetite,” particularly when juxtaposed against the $1 billion amassed by Bitcoin futures ETFs in their inaugural week back in 2021.

However, Butterfill attributed this difference more to the…

Click Here to Read the Full Original Article at NewsBTC…