Solana (SOL) has garnered significant attention in the cryptocurrency market, surpassing its peers with an impressive 79% upward trend over the past 30 days. As its price continues to soar, inquiries have arisen regarding the reaction of the Solana ecosystem to this surge.

About this subject, the Jarvis Labs team has offered intriguing insights into the ongoing SOL bull run and the condition of its ecosystem, addressing the factors influencing its growth.

Is The Solana Ecosystem Lagging Behind?

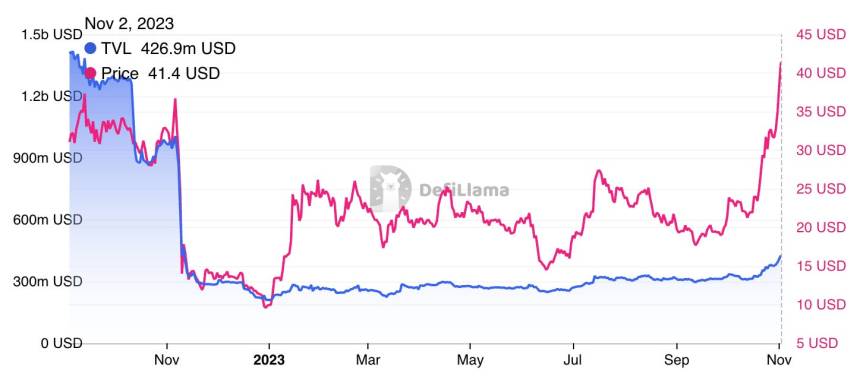

Despite SOL’s price surge, the Total Value Locked (TVL) on Solana has only doubled during this period, failing to match the fourfold increase in SOL’s token price. This disparity raises concerns about the growth and development of Solana’s ecosystem in 2023. A closer examination of the ecosystem reveals a significant lag compared to the rapid appreciation of SOL’s price.

The Jarvis Labs team highlights that a new wave of projects injects liquidity into Solana’s ecosystem, offering hope for its growth. Notably, these projects have been launched within the past year, leading to a diverse ecosystem rather than a concentration of similar offerings.

Among the top gainers in TVL, seven projects emerged recently, contributing to Solana’s expanding landscape.

Several projects have caught attention within Solana’s ecosystem, showcasing their potential to drive growth. Jito, a liquid staking provider, offers maximum extractable value (MEV) rewards alongside staking yields.

Marginfi, another noteworthy project, offers liquid staking tokens (LST) based on Jito’s platform, as well as a lending service emphasizing risk management. Additionally, decentralized exchanges like Phoenix and Jupiter have excelled in their respective niches.

Surprisingly, many successful projects within Solana’s ecosystem have yet to launch their tokens. This absence of tokens, according to Jarvis Labs, has contributed to “the lag in Solana’s TVL” despite the soaring token price.

Sustainable Token Design

The hesitance to introduce tokens stems from past experiences, where projects tied to now bankrupt crypto exchange FTX and its trading arm Alameda Research suffered significant losses, leaving a cautious sentiment among Solana developers, according to Jarvis Labs’s analysis.

The Jarvis Labs team believes that while tokens have the potential to be valuable assets, the cautionary tale of FTX-related…

Click Here to Read the Full Original Article at NewsBTC…