The United States Federal Reserve Open Market Committee’s September decision on interest rates was entirely expected, with the FOMC holding rates at the current level of 5.25% to 5.5%. As also expected, the committee indicated there may be another rate hike coming this year, with Chairman Jerome Powell insisting — as usual — in his Sept. 20 press conference that the job of getting inflation back to the Fed’s 2% target is in “no way done.”

What was more of a surprise, however, is the fact that the Fed raised its long-term forecast for the Federal Funds Rate, which they now see as standing at 5.1% by the end of 2024 — up from June’s prediction of 4.6% — before falling to 3.9% at the end of 2025, and 2.9% at the end of 2026. These numbers are notably higher than previous forecasts and indicate a “higher for longer” scenario for U.S. interest rates that not too many market participants were expecting.

As such, we saw markets pull back slightly, with the S&P 500 trading down 0.80% shortly after the announcement, followed by the NASDAQ, which fell 1.28% — a big tumble for these headline indexes. Cryptocurrency markets also responded negatively, with Bitcoin (BTC) falling below $27,000 and Ether (ETH) falling nearly 2% to just more than $1,600 shortly after Powell wrapped up his press conference.

Related: How Bitcoin miners can survive a hostile market — and the 2024 halving

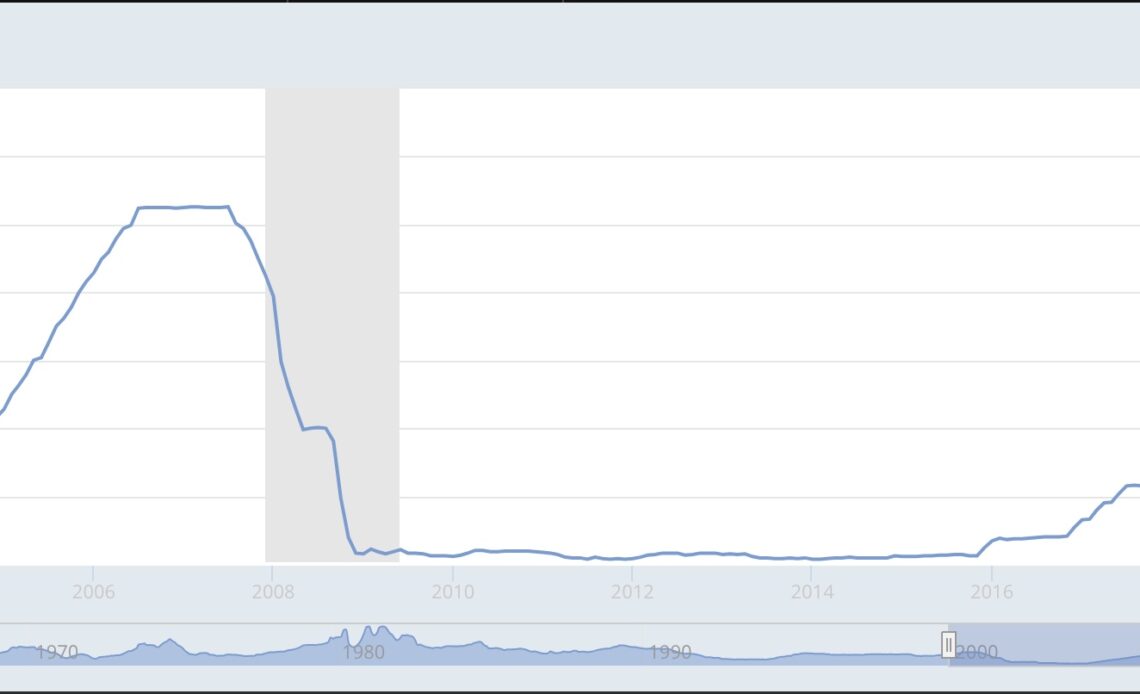

Ultimately, the data shows the U.S. economy is returning to a state we haven’t seen since before the financial crisis of 2008-09, one in which economic growth and inflation remain relatively consistent. A U.S. interest rate averaging around 4% over three years would be no surprise in this old world, nor would annual inflation greater than 2%.

The trouble is that investors have become addicted to central banks pumping fast, free money into our economies to battle concurrent crises. We are now in a mentality as investors where strong economic growth and stable inflation are interpreted as bad news — and crypto markets seem to feel the same way. This is particularly interesting considering Bitcoin was founded during the financial crisis in direct critique of the loose monetary policy decisions of the Federal Reserve, Bank of England, and others.

What now seems evident is that we can’t rely on central banks to provide our investment mandates….

Click Here to Read the Full Original Article at Cointelegraph.com News…