Bitcoin’s perpetual futures funding rate represents the cost traders incur to maintain long or short positions in the perpetual swaps market, with fees shifting between buyers and sellers based on market conditions.

Positive funding rates suggest that long positions dominate, reflecting bullish sentiment, while negative rates indicate bearish sentiment as short positions dominate.

Changes in funding rates provide insight into trader positioning and market risk. Spikes in funding rates often precede corrections, signaling heightened speculation and overleveraging. Conversely, negative or neutral funding rates during consolidations can signal potential entry points for strategic investors.

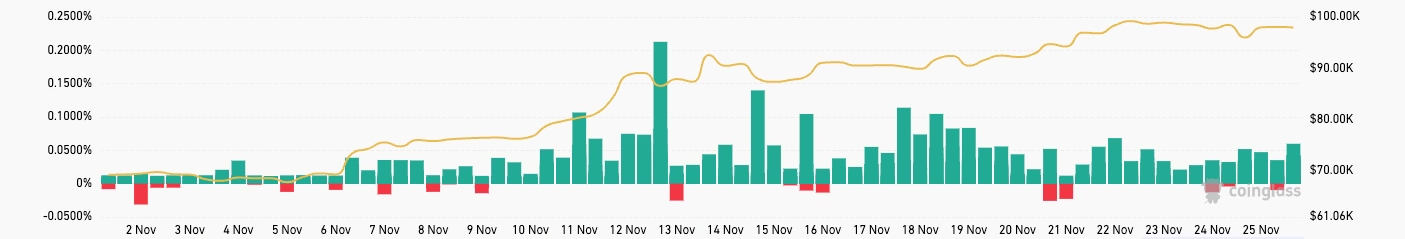

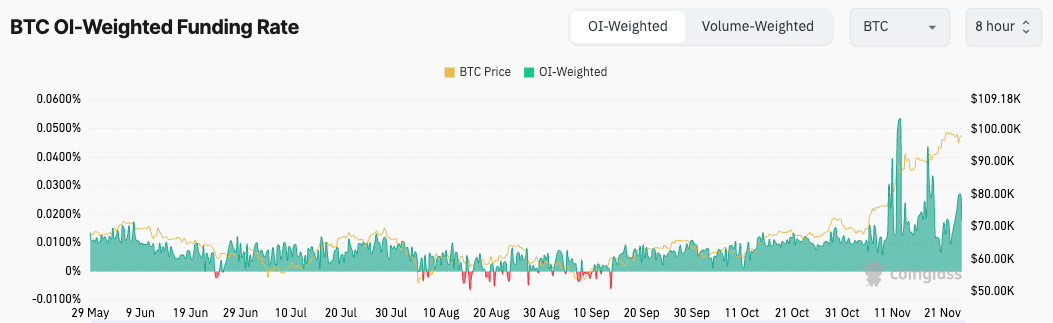

Bitcoin’s current funding rate tracks the strong rally we’ve seen in November. Since the beginning of the month, both volume-weighted and open interest (OI)-weighted funding rates have remained consistently positive, reaching the highest levels in over a year. This sustained positivity shows the dominance of long positions, with traders paying a premium to maintain these positions.

The market sentiment has been decisively bullish, as evidenced by traders’ willingness to incur higher funding costs in anticipation of continued price increases. The heightened funding rates show that leveraged long positions have contributed to the rally.

The volume-weighted funding rate showed greater volatility than the OI-weighted rate, suggesting that trading volumes had a pronounced impact during these rapid price increases. This volatility reflects speculative activity, with traders aggressively opening positions to capitalize on Bitcoin’s momentum.

However, earlier in the year, the situation was markedly different. From late June to mid-September, the market saw multiple instances of negative funding rates, particularly in the volume-weighted metric. This reflected bearish sentiment as Bitcoin’s price struggled to break out of a range-bound phase.

During these months, traders heavily favored short positions, a cautious outlook that aligned with subdued price action. The shift to consistently positive funding rates in late Q3 marked a turning point, signaling a broader transition to bullish sentiment as Bitcoin’s price recovered.

The volume-weighted funding rate demonstrated greater…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…