Bitcoin is the non-sovereign reserve currency of the digital world, and from an investment management perspective, it can uniquely and inexpensively diversify well-balanced portfolios to improve total risk-adjusted returns. However, while there have been many ways to gain exposure to crypto’s apex asset, there has long been one glaring hole, the holy grail of access if you will: a U.S. spot bitcoin ETF.

Brian Rudick is a senior strategist for GSR. Matt Kunke is a research analyst for GSR. This post is part of Consensus Magazine’s Trading Week, sponsored by CME.

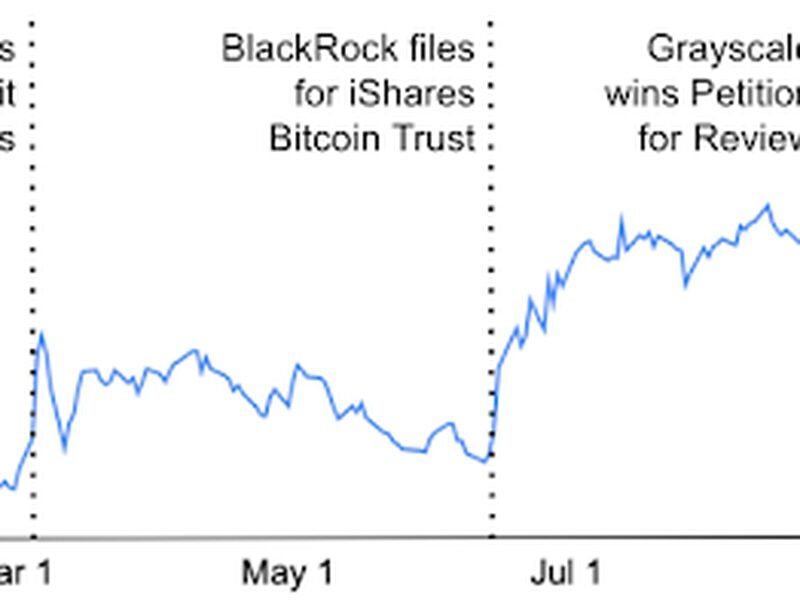

The road to a US spot bitcoin ETF has been long and arduous, with the SEC rejecting all 33 applications across more than a dozen filers since the Winklevoss twins first sought approval over a decade ago. However, from BlackRock, with its $9 trillion in AUM and impeccable application track record, entering the fray in June, to Grayscale’s resounding court victory over the SEC vacating its previous application denial to the recent approvals of a levered bitcoin futures ETF and Ethereum futures ETFs, it appears as if we are closer than ever before.

Indeed, noted industry analysts now peg the chance of approval by early January to be 90%; Grayscale’s discount to net-asset value (NAV) has narrowed from 45% at the beginning of the year to 13% indicating a higher market-implied probability of approval/conversion, and bitcoin is up a resounding 110% year-to-date due at least in part to spot ETF hopes.

So what’s the big deal?

A U.S. spot bitcoin ETF is a massive opportunity because of the sheer size of the U.S. capital markets. In fact, SIFMA estimates that the U.S. accounts for a full 40% of total global fixed income assets and equity market cap. Moreover, ETFs in the U.S. represent a greater percentage of total assets than in other jurisdictions, coming in at 7% of equity and fixed income assets versus 4% in Europe and 2% in Asia-Pacific.

All in, that amounts to a $7.0 trillion U.S. ETF market, which is multiples the size of Europe’s $1.5 trillion market and Asia-Pacific’s $1.0 trillion market. Looked at another way, assets managed by broker dealers, banks, and RIAs in the U.S. total nearly $50 trillion, so it would take just a tiny percentage of managed and brokerage assets migrating into a spot bitcoin ETF to move the needle….

Click Here to Read the Full Original Article at Cryptocurrencies Feed…