After the failure of Silicon Valley Bank (SVB), a great deal of Americans are starting to realize the dangers of fractional-reserve banking. Reports show that SVB suffered a significant bank run after customers attempted to withdraw $42 billion from the bank on Thursday. The following is a look at what fractional-reserve banking is and why the practice can lead to economic instability.

The History and Dangers of Fractional-Reserve Banking in the United States

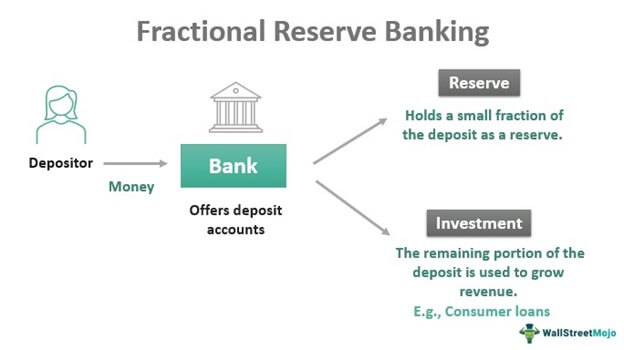

For decades, people have warned about the dangers of fractional-reserve banking, and the recent ordeal of Silicon Valley Bank (SVB) has brought renewed attention to the issue. Essentially, fractional-reserve banking is a system of bank management that only holds a fraction of bank deposits, with the remaining funds invested or loaned out to borrowers. Fractional-reserve banking (FRB) operates in nearly every country worldwide, and in the U.S., it became widely prominent during the 19th century. Prior to this time, banks operated with full reserves, meaning they held 100% of their depositors’ funds in reserve.

However, there is considerable debate on whether fractional lending occurs these days, with some assuming that invested funds and loans are simply printed out of thin air. The argument stems from a Bank of England paper called “Money Creation in the Modern Economy.” It is often used to dispel myths associated with modern banking. Economist Robert Murphy discusses these alleged myths in chapter 12 of his book, “Understanding Money Mechanics.”

The FRB practice spread significantly after the passage of the National Banking Act in 1863, which created America’s banking charter system. In the early 1900s, the fractional-reserve method started to show cracks with the occasional bank failures and financial crises. These became more prominent after World War I, and bank runs, highlighted in the popular movie “It’s a Wonderful Life,” became commonplace at the time. To fix the situation, a cabal of bankers dubbed “The Money Trust” or “House of Morgan” worked with U.S. bureaucrats to create the Federal Reserve System.

After further troubles with fractional reserves, the Great Depression set in, and U.S. President Franklin D. Roosevelt initiated the Banking Act of 1933 to restore trust in the system. The Federal Deposit Insurance Corporation (FDIC) was also…

Click Here to Read the Full Original Article at Bitcoin News…