Siacoin (SC), the native token of the decentralized cloud storage platform Sia, has been on a tear in recent months, defying expectations and leaving investors wondering if the rocket ride can continue. After reaching a low of $0.0025 in mid-September 2023, the price skyrocketed a staggering 360% to peak at $0.0130 by January 24, 2024. While a 30% correction followed, wiping out those gains, the story didn’t end there. Siacoin defied bearish predictions, embarking on a new upward trajectory culminating in a new high of $0.0175 on February 21st, marking over 100% increase from its January low.

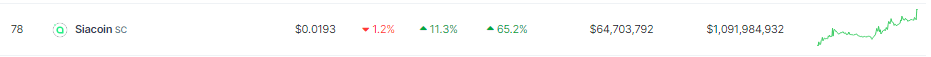

SC price up in the daily and weekly timeframes. Source: Coingecko

Unpacking The Surge: Technical Advancements, Community Optimism

So, what’s fueling Siacoin’s unexpected rise? Several factors contribute to the narrative. Firstly, the February 2024 update unveiled significant advancements in the Sia network, focusing on stability, performance, and user experience. These include the implementation of RHP4 for the upcoming Utreexo hardfork, aiming to boost efficiency and scalability.

Additionally, new features like metadata addition and improved upload processes enhance data management and user interaction. The Siacoin community, excited about these technical developments, saw them as a sign of progress and fueled further investment.

SCUSD trading at $0.0147 on the daily chart: TradingView.com

However, it’s important to acknowledge the broader market context. Siacoin’s price rise coincided with a bullish trend in the cryptocurrency market, with many digital assets experiencing significant gains. This suggests that investor sentiment played a significant role in the token’s upward trajectory.

Meanwhile, there has been a significant rise in short liquidations as a result of the SC token boom. The volume of shorts liquidations increased to above $40k on Wednesday, the highest amount in a month, according to data provided by CoinGlass.

Source: Coinglass

Charting The Course: Bullish Breakout Or Bearish Divergence?

Technical analysis paints a somewhat complex picture. While the price broke out of a long-lasting consolidation zone, potentially signaling the start of a larger bull cycle, a bearish divergence emerges when comparing the current rise with the daily Relative Strength Index (RSI). This discrepancy indicates that the price action might not have enough momentum to sustain itself in the short term.

SC price action in the...

Click Here to Read the Full Original Article at NewsBTC…