The approval of the first spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) on Jan. 10 was a significant milestone in the crypto market. However, the milestone led to even more significant volatility in Bitcoin’s price and on-chain activity.

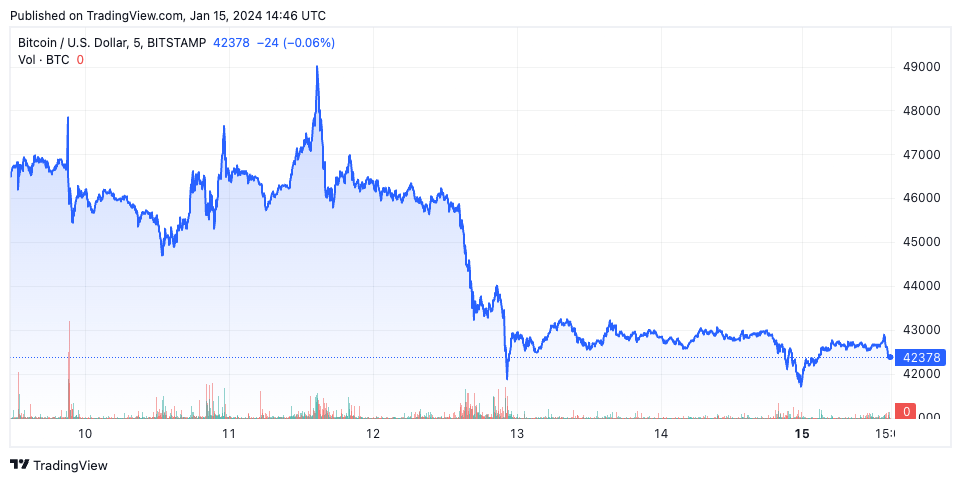

Initially, Bitcoin’s price showed a positive reaction to the news of the ETF approval, climbing to $46,608 on Jan. 10. By Jan. 11, the price declined to $46,393, and a more pronounced drop occurred on Jan. 12, when the price fell to $42,897. This downward trend continued over the following days, culminating in a price of $41,769 on Jan. 14.

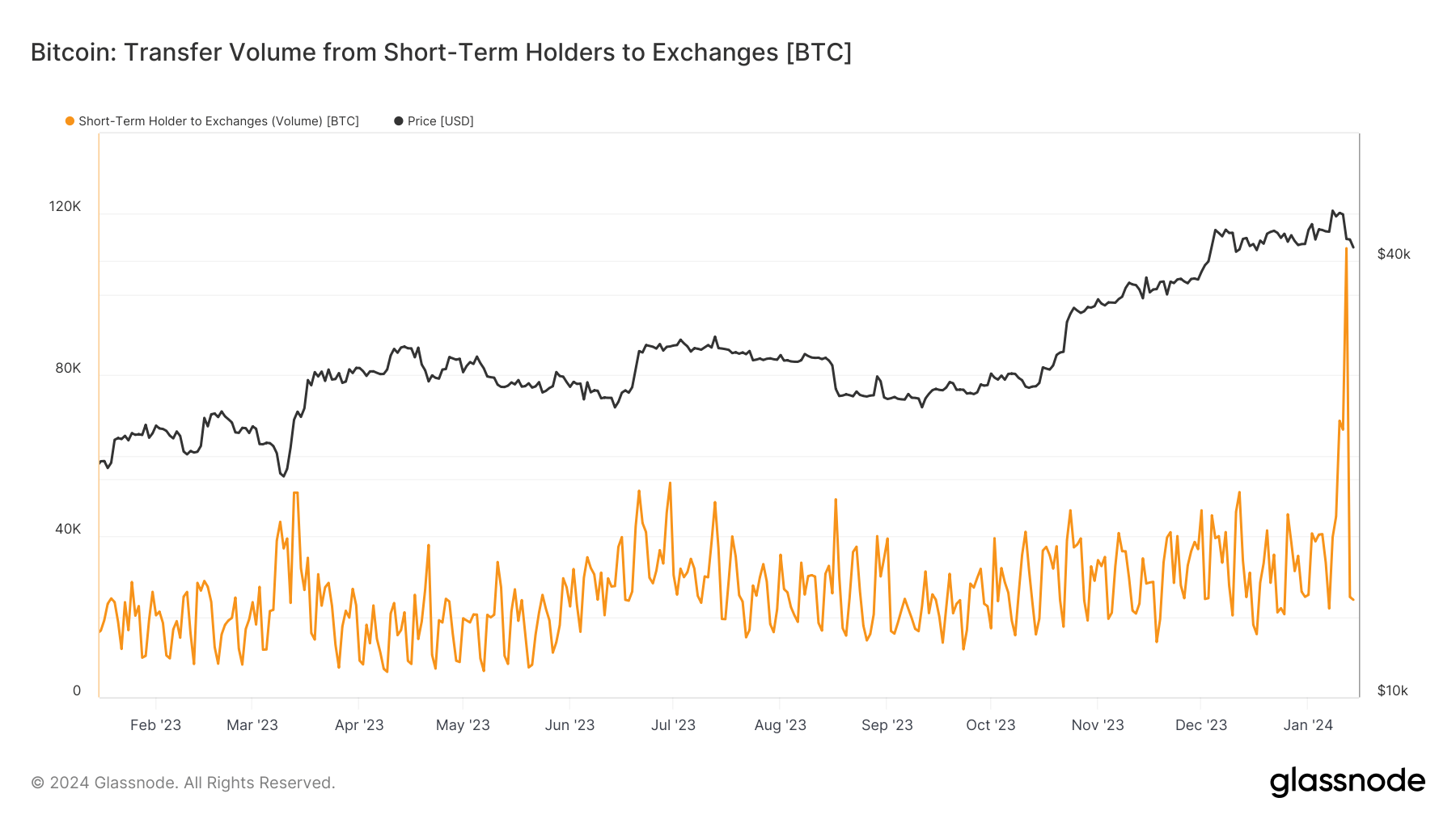

The activities of short-term holders, particularly their transactions to exchanges, show where most of the volatility came from. A significant increase in the volume of Bitcoin sent to exchanges was observed, particularly on Jan. 12, when short-term holders transferred 111,476 BTC to exchanges, marking the highest level since May 19, 2021. This spike indicates a considerable sell-off by addresses that have held their BTC for less than 155 days.

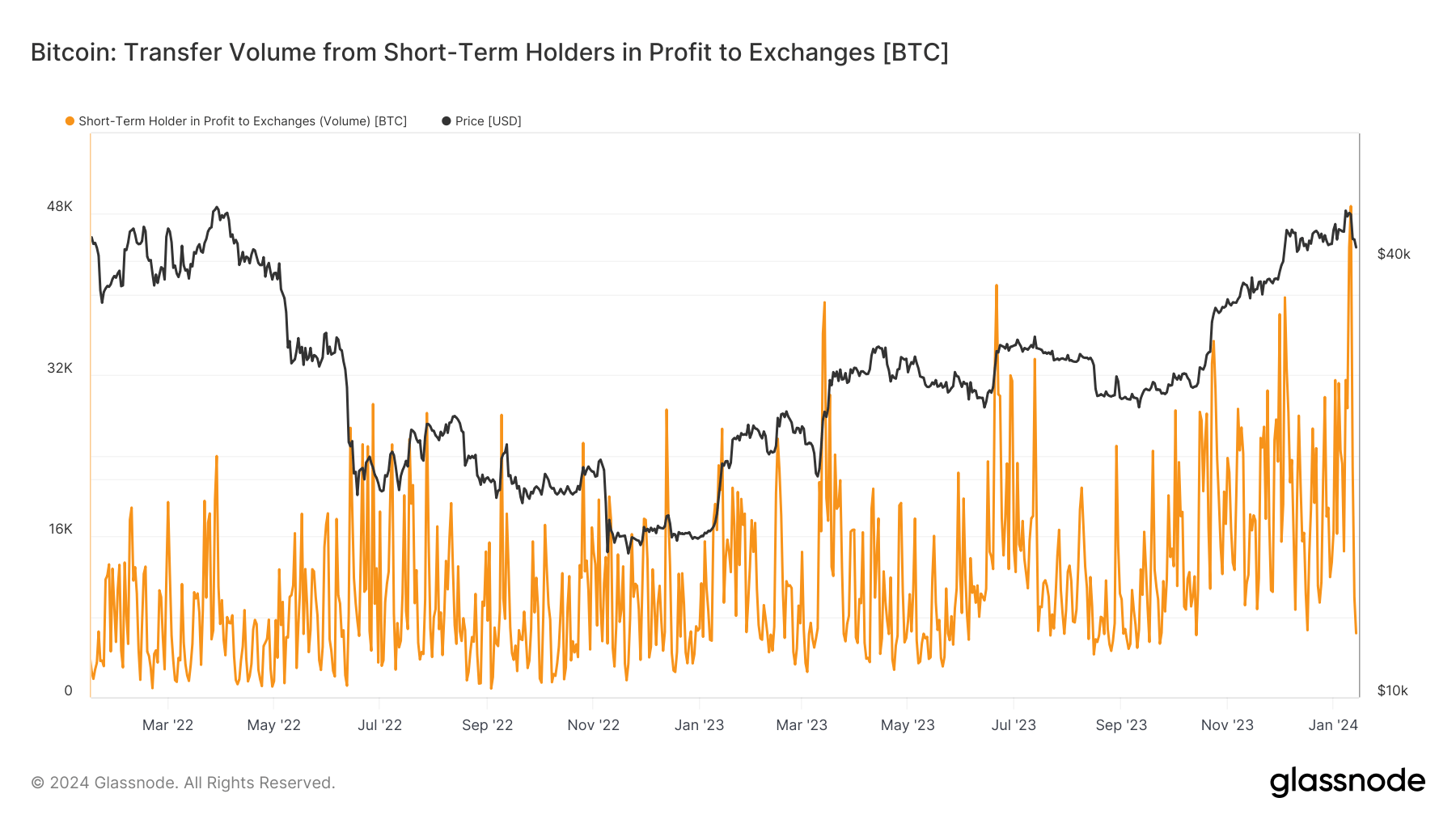

Further analysis of short-term holders’ positions in profit and loss shows the extent of profit-taking during the volatility. On Jan. 11, the volume of Bitcoin held by short-term holders in profit sent to exchanges reached its peak.

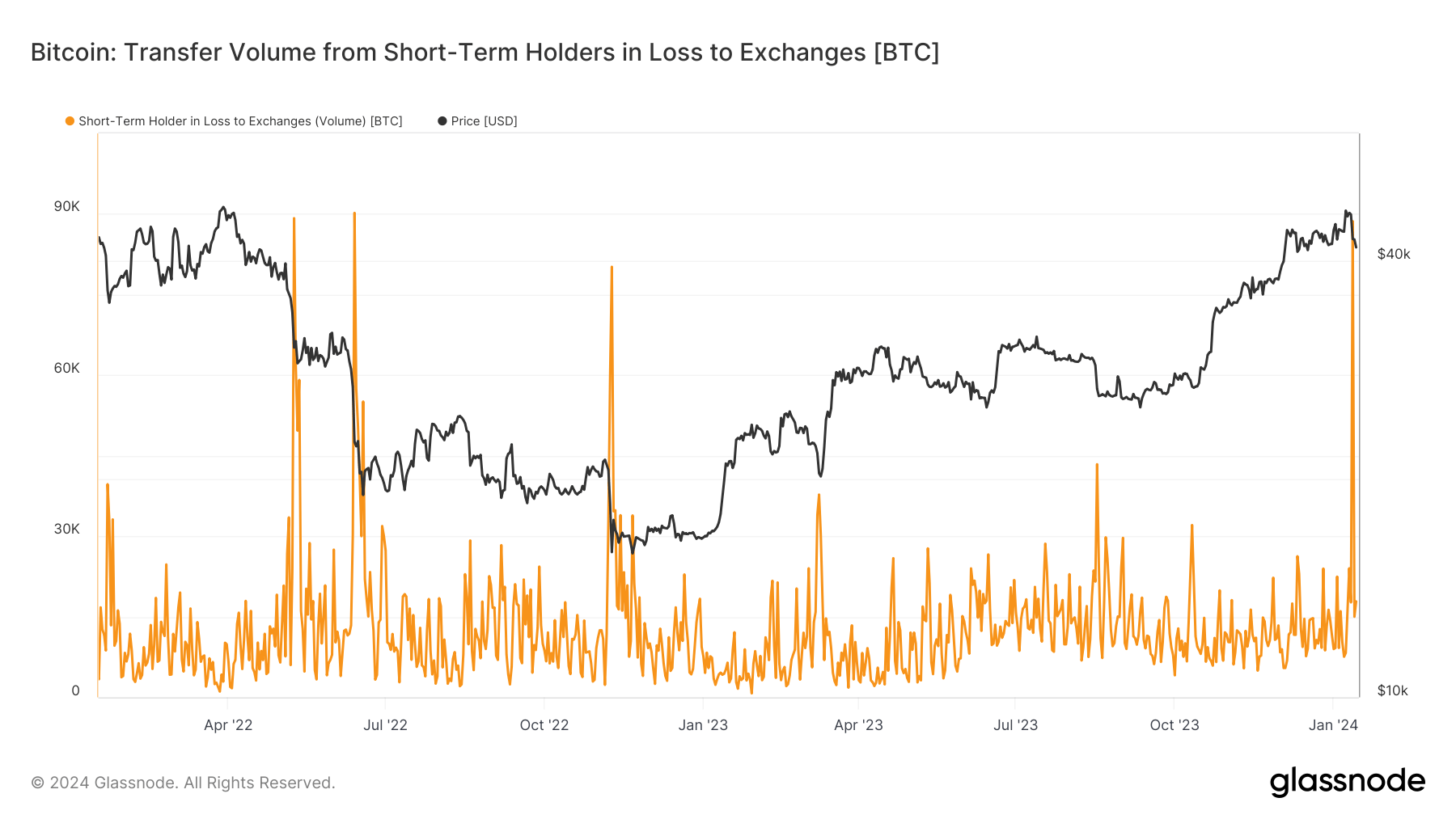

Conversely, the following day saw a peak in Bitcoin held by short-term holders in loss being transferred to exchanges. These movements suggest a quick shift in market sentiment — from taking profits to cutting losses — as the price started to fall.

The Market Value to Realized Value (MVRV) ratio helps us understand the profitability of these short-term holdings. MVRV compares the market value (the price at which BTC last moved) with the realized value (when BTC was last bought).

Typically, a high MVRV ratio suggests that holders are in profit and may be inclined to sell, while a lower MVRV indicates minimal profit or losses. During this period, the MVRV ratio saw a downward trend, reflecting a decrease…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…