The on-chain analytics firm Santiment has revealed how Shiba Inu (SHIB) and Cardano (ADA) are among the altcoins seeing high whale activity recently.

Shiba Inu & Cardano Have Seen High Interest From Whales Recently

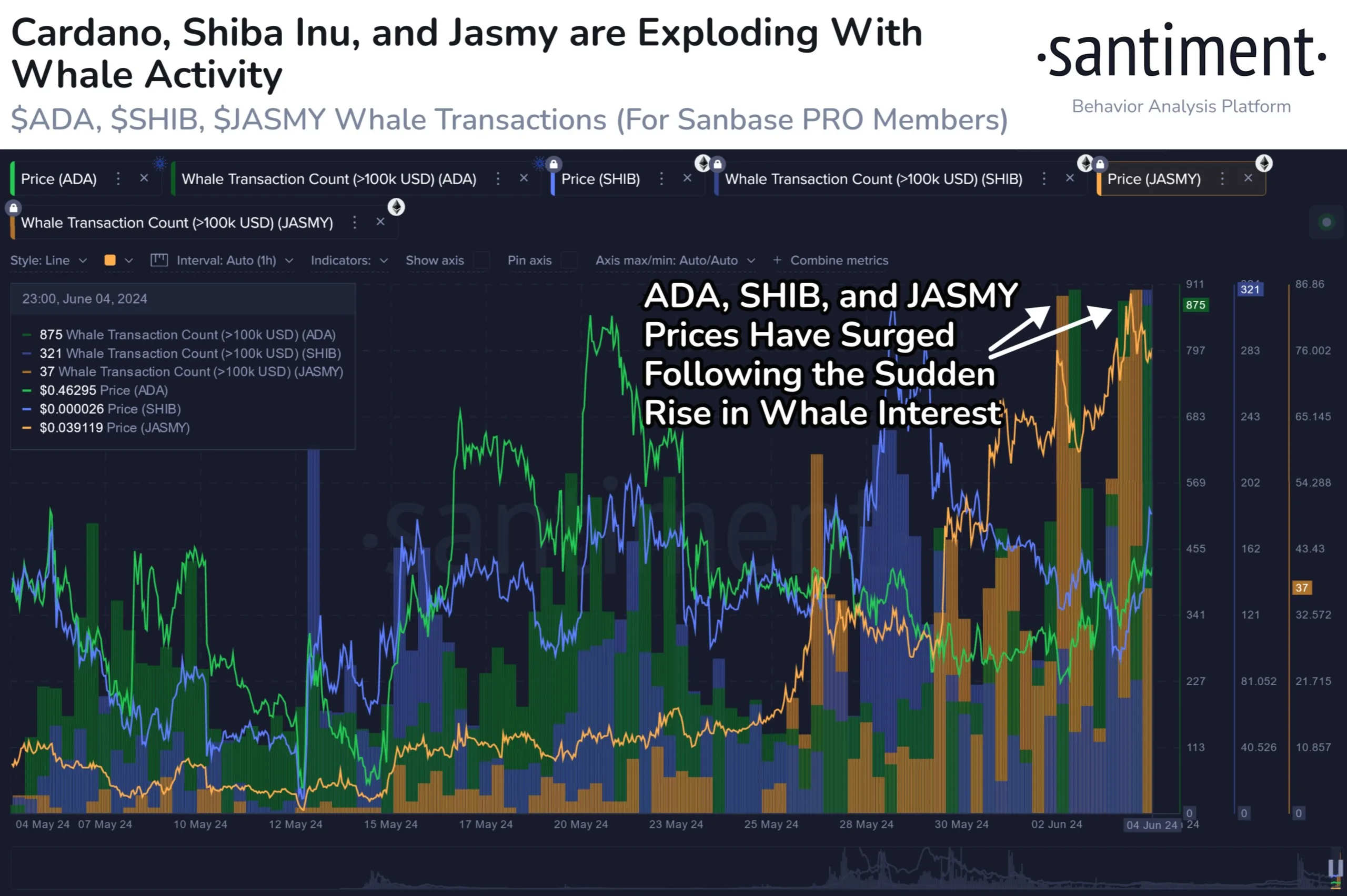

In a new post on X, Santiment has talked about how some altcoins have been seeing a high Whale Transaction Count recently. The “Whale Transaction Count” here refers to an indicator that keeps track of the number of transactions happening on any cryptocurrency network that are valued at $100,000 or more.

Generally, only the whale entities are capable of moving such a large amount of capital with single transfers, so transactions of this scale are associated to movements related to them.

Related Reading

When the value of the indicator is high, it means the whales are making a large number of moves on the network right now. Such a trend could imply these humongous investors have an active interest in trading the coin.

On the other hand, the metric being low could imply the big money investors may not be paying much attention to the asset currently as they aren’t making too many transactions.

Now, here is a chart that shows the trend in the Whale Transaction Count for three altcoins: Shiba Inu, Cardano, and JasmyCoin (JASMY).

As displayed in the above graph, all three of Shiba Inu, Cardano, and JasmyCoin have seen the metric spike for them recently. Naturally, this means that the whales are actively trading these assets right now.

As for what this could mean for the prices of these cryptocurrencies, a high whale transaction count can be a predictor for volatility. The indicator doesn’t contain any information about whether the transfers are tending towards buying or selling moves, though, so it can usually be hard to say about where exactly such volatility could take the asset.

Since the transfers have started, however, all three of these coins have seen some level of price appreciation, hinting that the whale activity so far may have been leaning towards accumulation after all.

The analytics firm also appears to believe that buying could be the goal behind these transactions. “The amount of $100K+ transactions on each of these networks have all more than doubled this week compared to usual 2024 averages, signaling accumulation,” notes Santiment.

Related Reading

Whatever the case be, if the high value of…

Click Here to Read the Full Original Article at NewsBTC…