On-chain data shows the total number of sharks and whales on the XRP network has seen a sharp increase recently, a sign that could be bullish for the asset’s price.

XRP Sharks & Whales Have Witnessed Their Count Go Up Recently

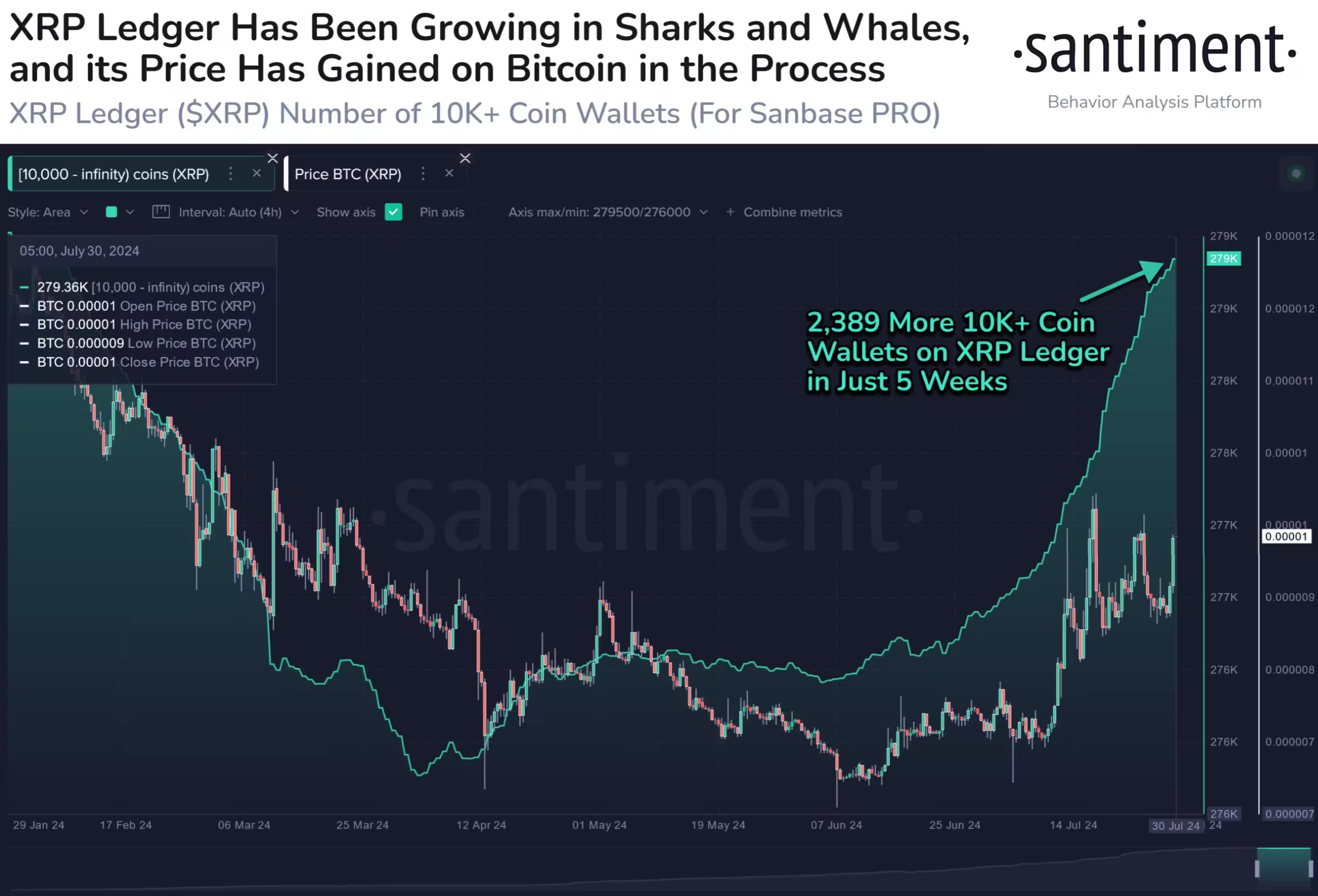

According to data from the on-chain analytics firm Santiment, the shark and whale wallets have registered a notable jump over the past five weeks. The indicator of relevance here is the “Supply Distribution,” which tells us about the number of addresses that currently belong to a given wallet group.

Related Reading

The addresses are put into these cohorts based on the number of coins that they are carrying in their balance right now. Investors who own between 1 and 10 XRP, for example, fall inside the 1 to 10 coins group.

In the context of the current discussion, the 10,000+ coins group is of interest. The cutoff for this cohort converts to around $6,500 at the current exchange rate. This amount in itself isn’t high, but the upper range of the group stretches to infinity, so it should also include heavyweight investors like sharks and whales.

The sharks and whales are considered key investors in the market, so their behavior can be to keep an eye on, as it may end up affecting the cryptocurrency’s price. Naturally, the whales are the more influential of the two, due to their larger size.

Now, here is a chart that shows the trend in the XRP Supply Distribution for the 10,000+ coins cohort over the past few months:

As displayed in the above graph, the XRP Supply Distribution for this wallet group has observed a rapid increase recently. More specifically, around 2,390 addresses of this size have popped up on the network in just the past five weeks.

This would suggest that entities like the sharks and whales have been busy accumulating the cryptocurrency. Following the latest increase, the indicator’s value has reached the 279,400 mark, which is the highest that it has been in about six months.

From the chart, it’s visible that the indicator’s value had been observing a downtrend earlier in the year, alongside which, the asset’s price had also been riding bearish momentum. The indicator reached a bottom in April, which is around when the asset’s drawdown also slowed down.

And since the recent uptrend in the Supply Distribution of the sharks and whales has appeared, the XRP price has also felt the…

Click Here to Read the Full Original Article at NewsBTC…