Hester Peirce, one of five commissioners with the United States Securities and Exchange Commission (SEC) and an outspoken proponent of crypto, has urged lawmakers and regulators for clarity on digital assets.

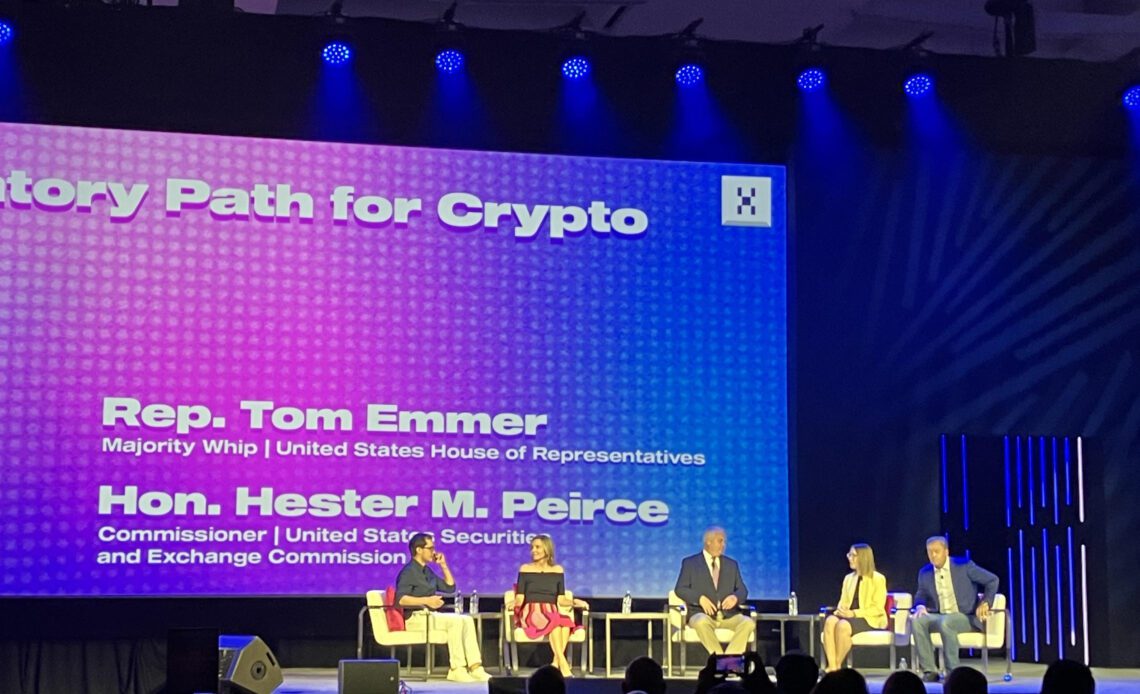

Speaking to Cointelegraph at the Permissionless II conference in Austin, Texas on Sept. 11, Peirce said she wouldn’t have expected the SEC to be “this far behind” in finding a solution for a regulatory framework on cryptocurrencies when she joined the commission in 2018. She pointed to countries like Switzerland and Singapore as seemingly ahead of the curve on crypto regulations globally but said they largely couldn’t be compared to the situation in the United States.

“I haven’t seen a lot of changes for the better,” said Peirce. “You do have a lot of people who know quite a bit about crypto at the agency, whether that’s in FinHub or throughout the divisions. You have people who are actually quite knowledgeable, and I think that that has changed in the time that I’ve been there.”

The SEC, under the leadership of Chair Gary Gensler, has taken a lot of criticism from industry leaders, regulators and lawmakers, often being accused of a “regulation by enforcement” approach to digital assets. At the time of publication, the commission was embroiled in civil actions against crypto firms Coinbase, Binance and Ripple and had not approved a spot Bitcoin (BTC) exchange-traded fund (ETF) for listing in U.S. markets. In August, Grayscale Investments won an appeal against the SEC’s rejection of its spot ETF application, which may lead to a review.

Related: Stoner Cats NFTs are ‘fan crowdfunding,’ not securities — SEC’s Peirce, Uyeda

Peirce said she could not comment on any particular court case involving the SEC but urged institutions involved in the crypto industry to communicate with the commission on how to move forward. She hinted that the agency could have a “change of heart” over crypto-related policy:

“Don’t give up on the United States. This too shall pass, the confusion shall pass. The United States is a good place to build things, and I want it to stay that way. But come forward with very concrete ideas, […] be thinking of concrete ways that you need clarity.”

At the time of publication, lawyers with the SEC were meeting with their counterparts at Binance.US in a Washington D.C….

Click Here to Read the Full Original Article at Cointelegraph.com News…