Bitcoin (BTC) is predicted to drop more than 70% to the $8,000 value area, according to comments by Guggenheim Chief Investment Officer Scott Minerd. This is not the first time he has made a bearish call, and he has, in the past, made bullish calls as well. However, Minerd’s more recent calls have occurred just before major reversals.

Scott Minerd BTC price calls:

– $600k at $60k → went to $30k.

– $10k at $30k → price to $65k.

– $8k at $30k (again) → TBD. pic.twitter.com/NWjrRdegFM— mhonkasalo (@mhonkasalo) May 23, 2022

It should be noted that Mr. Minerd, if inferred from previous comments, is a Bitcoin bull and has a long forecast for the biggest digital asset in the six-figure range. However, if traders and investors used his comments as a sentiment indicator for a market low, then other confirmatory data must be used.

Long term oscillators values support a bullish reversal

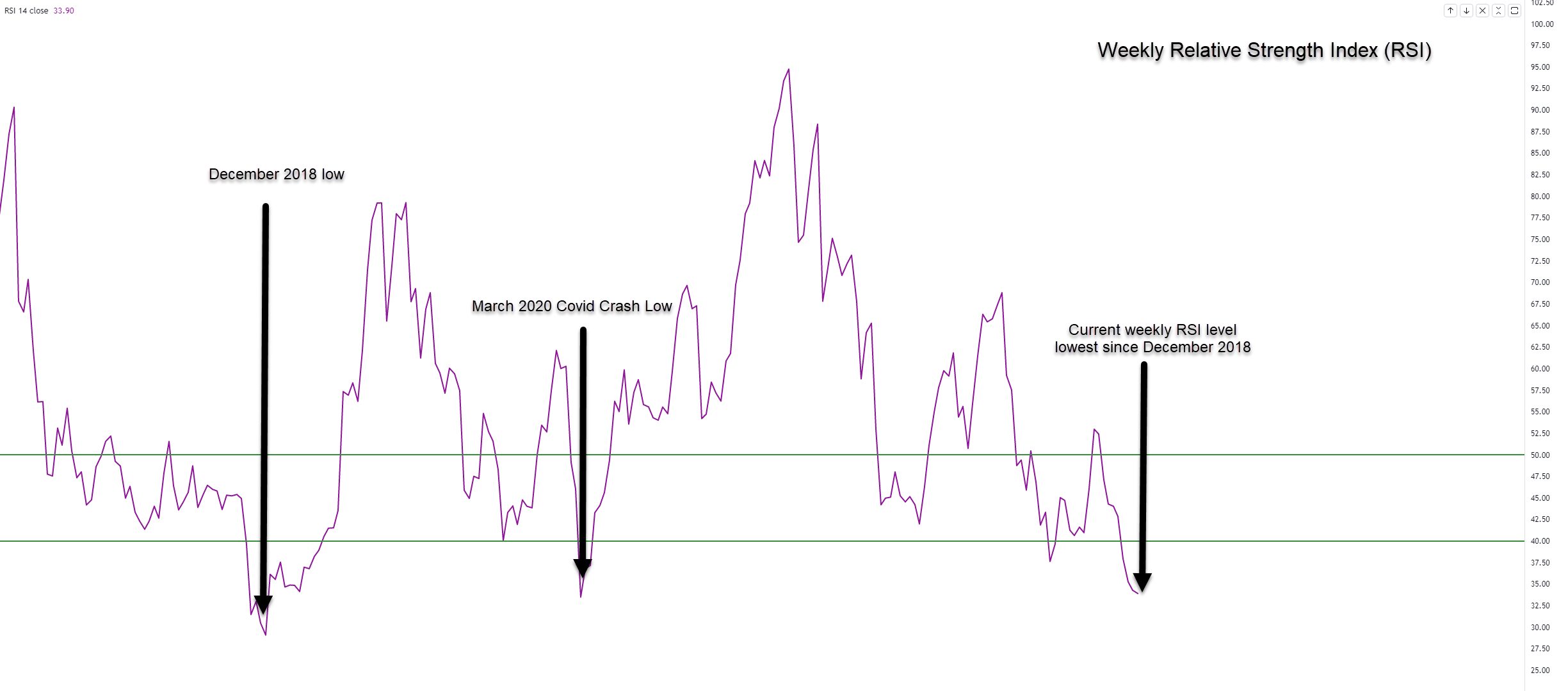

The weekly and monthly RSI (relative strength index) and composite index show extremes have been met. These extremes do not predict or guarantee a reversal. Still, they warn bears that further downside movement’s momentum is likely to be severely limited or eliminated.

The weekly RSI remains in bull market conditions, despite it moving below both the oversold levels of 50 and 40 – until it hits 30, the bull market RSI settings remain. Currently, at 33, this weekly RSI level is the lowest since the week of December 10, 2018, and just below the March 2020 Covid crash low of 33.48.

Likewise, the weekly composite index reading for Bitcoin is at an extreme. It is currently at the lowest level it traded at since the week of February 8, 2018. The current level that the weekly composite index is at has historically been a strong indicator that a swing low is likely to develop.

The black vertical lines identify the most recent historical lows in Bitcoin’s…

Click Here to Read the Full Original Article at Cointelegraph.com News…