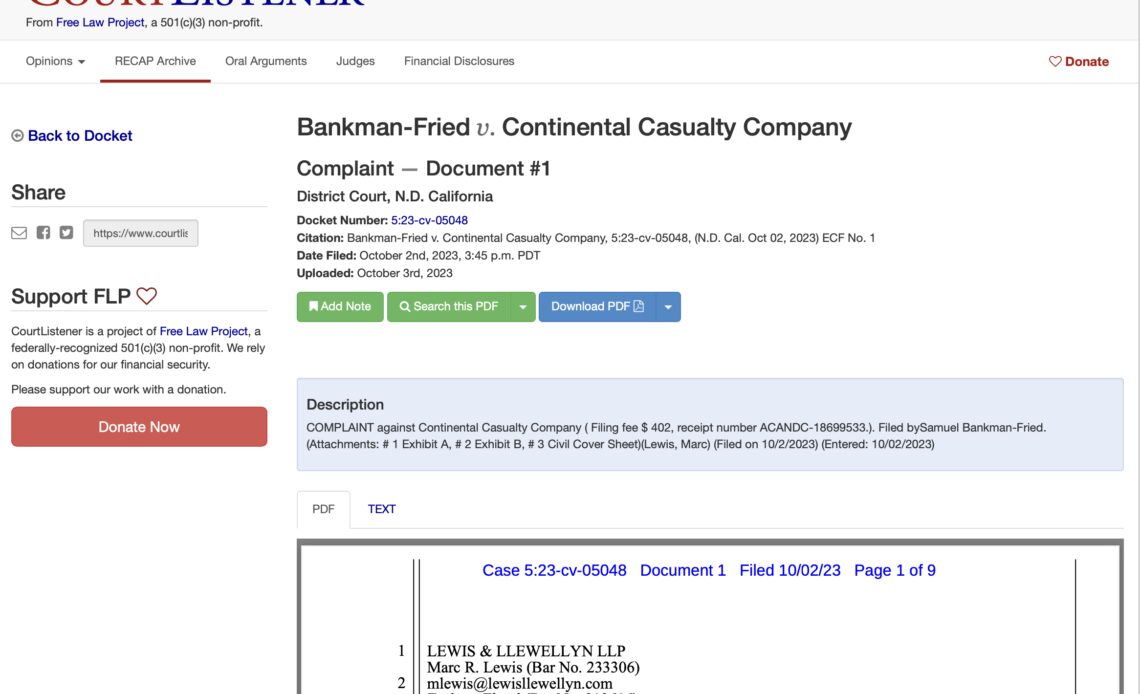

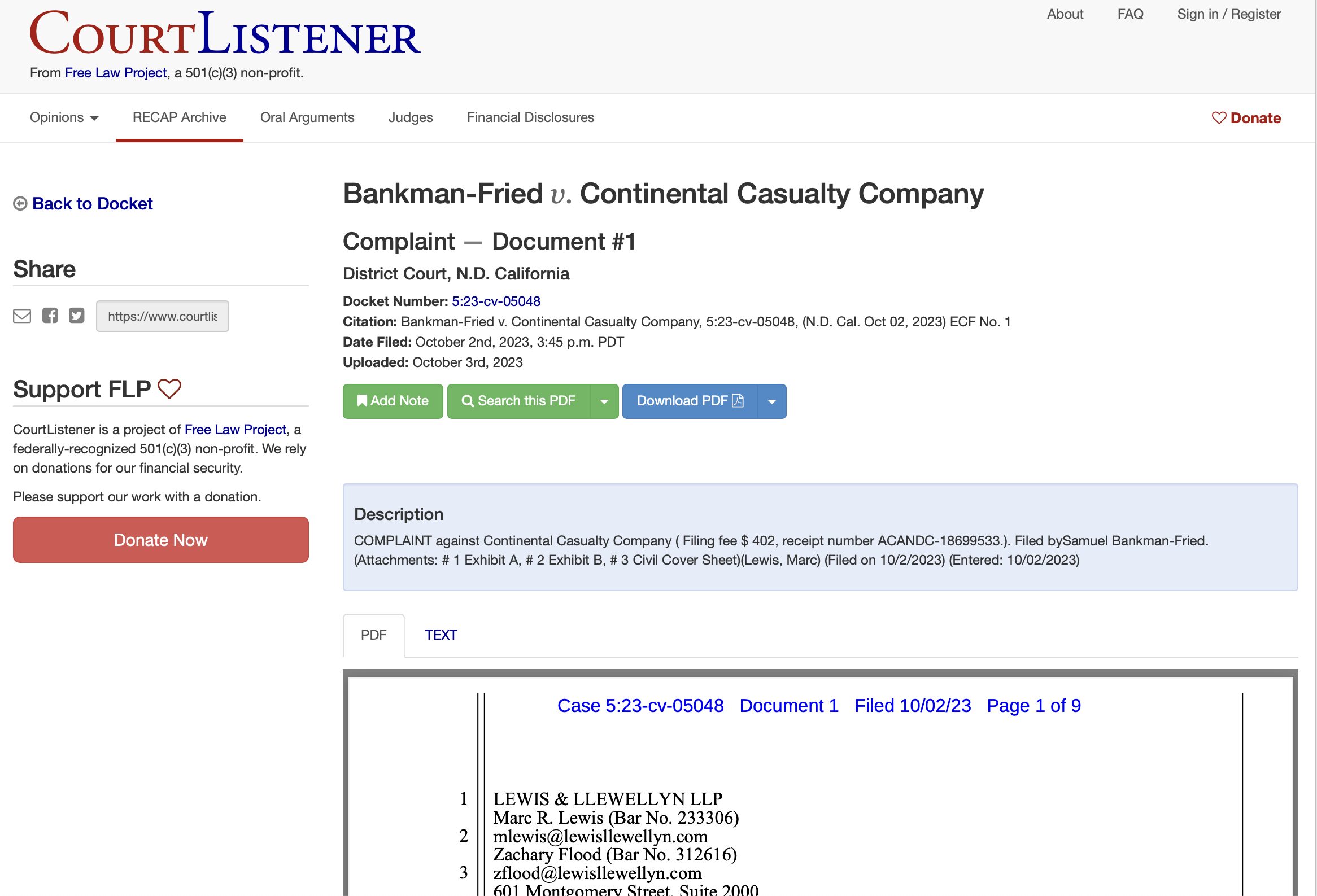

As the final preparations for the trial of Sam Bankman-Fried were underway in Manhattan, attorneys for the embattled former FTX CEO were filing a suit against the Continental Casualty insurance company in the District Court of Northern California. That company has allegedly provided Paper Bird and its subsidiary FTX Trading directors and officers (D&O) insurance. The suit was filed by Bankman-Fried as an individual.

The suit claimed that Continental Casualty is the provider of Paper Bird’s “second-layer excess policy in the D&O insurance tower.” D&O insurance protects the directors and officers of a company from personal losses in the event of a suit against them. Such coverage can be organized into a metaphorical tower of policies, where a policy on a given layer comes into force when the policy below it reaches its limit.

According to the suit, the primary layer of D&O coverage provided $10 million for Bankman-Fried’s defense from two insurers, and Continental Casualty’s policy was intended to provide $5 million. The policy mandated that payments be made on a current basis. It covered the cost of defense against criminal charges, even though there was an exclusion for “fraudulent, criminal, and similar acts.” There was no clawback provision in the policy.

Related: Sam Bankman-Fried is paying for legal defense using previously gifted funds from Alameda: Report

The suit noted that Paper Bird’s two primary D&O policy providers, Beazley and QBE, paid his defense costs according to the terms of the policy. Bankman-Fried is demanding that Continental Casualty pay his defense costs according to its contractual obligation, along with damages, including court costs.

The third layer of Paper Bird’s D&O tower, provided by Hiscox Syndicates, is the subject of court action as well. Hiscox has filed a Complaint for Interpleader against Paper Bird and a long list of insured persons, including Bankman-Fried. An interpleader action compels the parties in a legal procedure to litigate their claims among themselves.

According to that complaint, filed on Aug. 9 in the District Court of Northern California, the Hiscox policy comes into force after the $15 million in underlying coverage. The complaint stated that Hiscox expected claims to be made under its policy for $5 million in coverage, and the interpleading was necessary to ensure fair disbursement of policy funds.

Twenty…

Click Here to Read the Full Original Article at Cointelegraph.com News…