Global NFT sales in October clocked in at more than $850 million over roughly 3 million total transactions. I looked into NFT wash trades last month and that research got me to look at the numbers more closely.

The trigger points for me to say that transactions are becoming more fake are as follows:

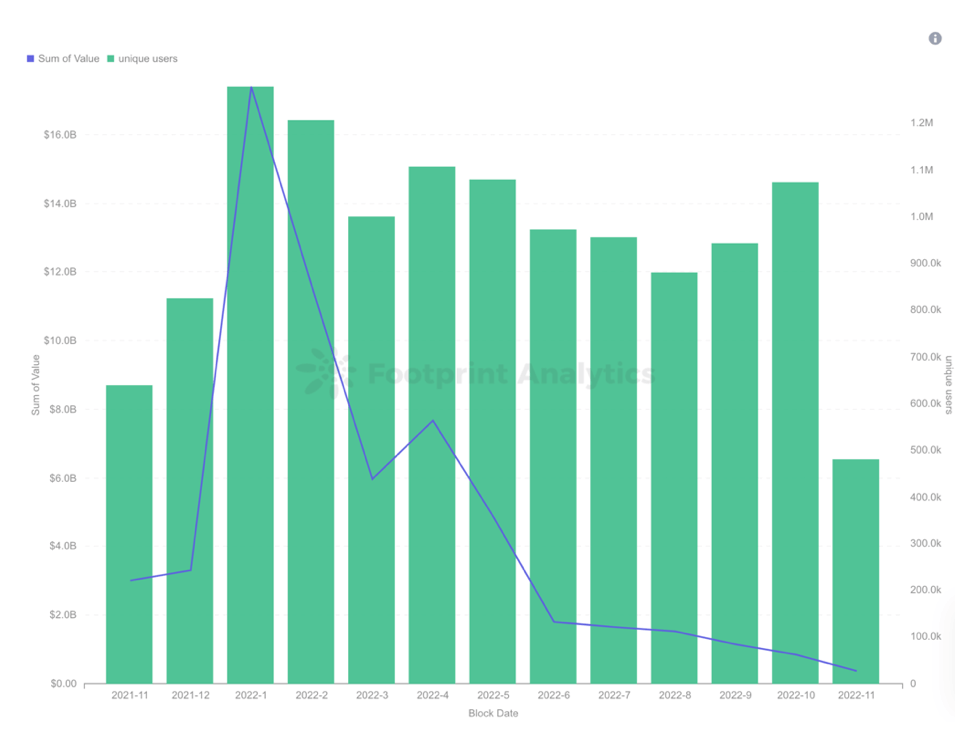

- Despite bad market conditions, we continue to see a high number of unique buyers and sellers. In October, we had over 1 million unique buyers and sellers. Both buyers and sellers have increased compared to September.

- The number of unique buyers and sellers seems to be inconsistent with the growth of sales value and transactions. Around 1 million users contributed more than 4 million sales value in May versus less than 250,000 in October. To me, it seems unlikely to have a growing market demand with less sales value traded.

To look into this further, I spoke with two centralized exchanges that operate NFT marketplaces. The exchanges said that around 80% of new buyers are keeping NFTs in their wallets, rather than selling them. With the market so unfavorable, holding these assets seems to be the sensible move.

So where are all these unique buyers and sellers coming from? I had a word with Footprint Analytics and brought up my points. I realized that the statistics I am looking at are way too big. It involved multiple chains and it is hard to track everything. We agreed to work on only Ethereum-based marketplaces as an example to dive deep into since it is the most popular.

Here are the findings:

According to Footprint Analytics’ filters, wash trading makes up nearly half of all NFT trading volume.

Footprint Analytics – ETH NFT Market Overview (With Wash Trading Filtered)

Traders seeking to artificially inflate the price of collections or earn marketplace trading rewards generated $389 million in wash trades out of October’s total of $758 million in NFT trading volume —…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…