In the dynamic landscape of decentralized finance (DeFi), risk management is the bedrock upon which sustainable lending protocols are built.

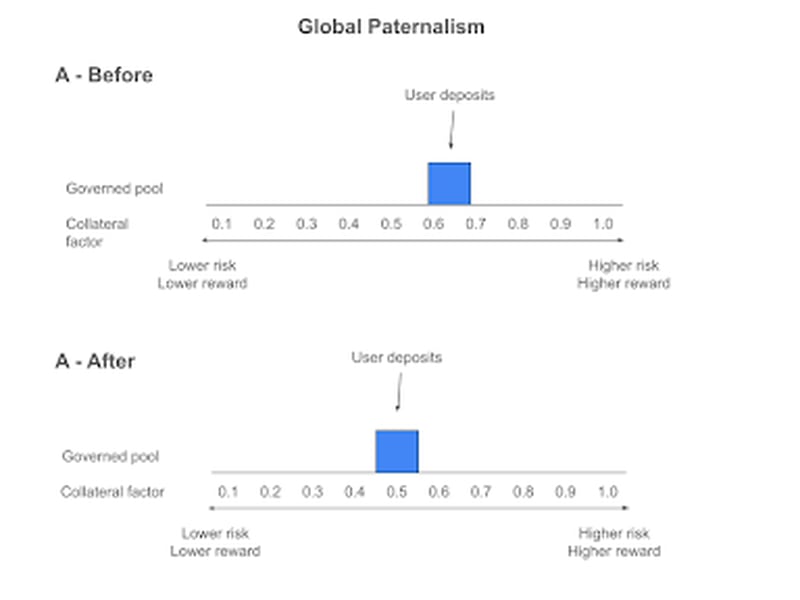

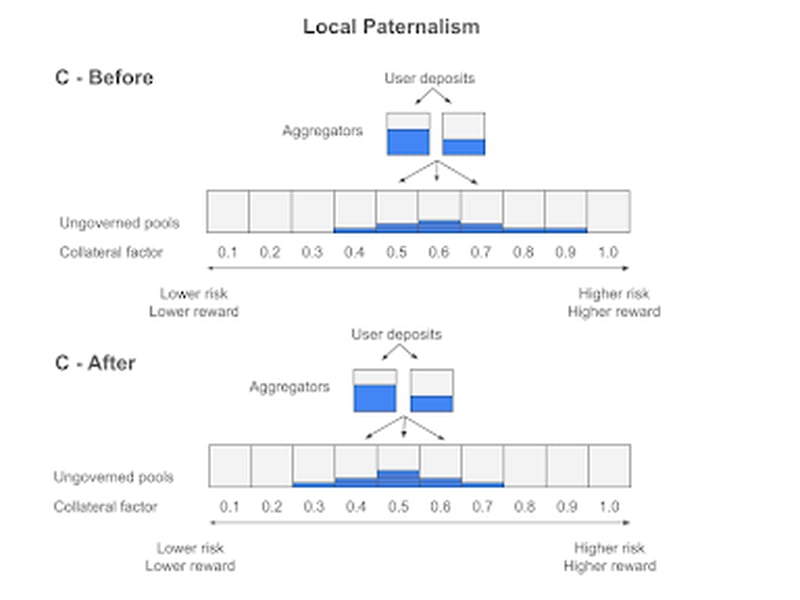

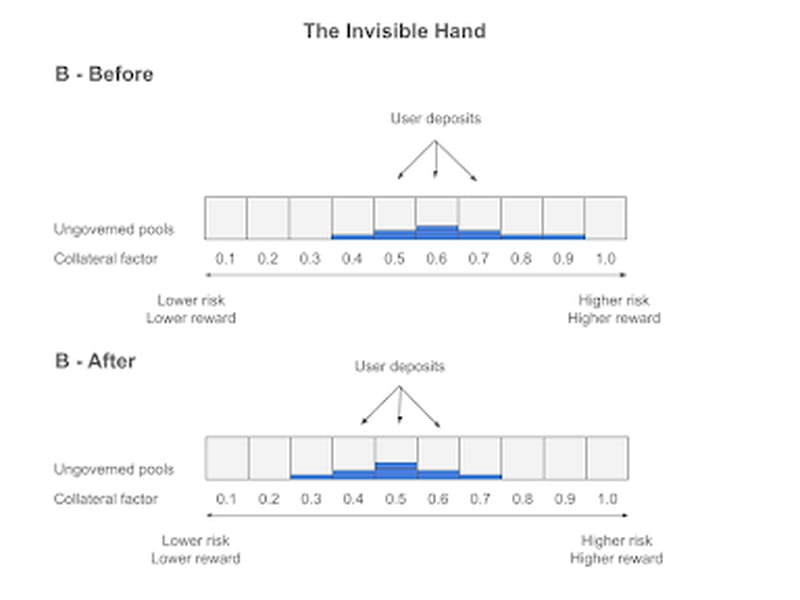

The challenge lies in finding the delicate balance between paternalistic management of risk (i.e. thresholds for borrowing are determined by DAO governors and risk managers) and allowing the invisible hand of the free market to determine risk tolerance.

Michael Bentley is CEO of Euler Labs.

As the space grows, it’s crucial that we properly understand the trade-offs inherent in different risk management models.

Euler v1 serves as a thought-provoking illustration of the perpetual debate between immutable code and governed code. While Euler v1 adopted a paternalistic protocol design, with code governed by a decentralized autonomous organization (DAOs) that could adapt to economic shifts or bug discoveries, it faced a critical turning point in early 2023: a $200 million exploit.

See also: Hacker Behind $200M Euler Attack Apologizes, Returns Funds

Despite rigorous auditing, insurance and a substantial bug bounty instituted at launch, a seemingly minor bug emerged, leading to a code fix followed by an additional audit and DAO vote in the months leading to the attack. However, this fix inadvertently exposed a larger attack vector, culminating in the exploit last year.

Although we ultimately took actions that would lead to one of the largest recoveries the crypto space has ever seen, the question still arises: is paternalism in DeFi inherently bad?

I still think, as I always have, that paternalism is all about trade-offs and personal risk tolerances. Ultimately, users must weigh the perceived risks themselves and decide what is right for them.

The complexity of risk in lending protocols

Imagine a lending protocol where borrowers use USDC as collateral to secure loans in ETH. Determining the optimal loan-to-value (LTV) ratio for this transaction becomes a formidable task. The ideal LTV constantly shifts, influenced by factors like asset volatility, liquidity, market arbitrage and more. In the fast-paced world of DeFi, calculating the perfect LTV at any given moment is impractical.

Lending protocol design therefore necessitates heuristics and pragmatic choices. This leads to three broad classifications of risk management models.

Global paternalism via DAO…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…