According to Dan Tapiero, Managing Partner at 10T Holdings, the Bitcoin and crypto market is on the verge of a major transformation, with the world’s most valuable coin likely to soar to over $200,000 by May 2024. Citing data by Raoul Paul, the CEO of Real Vision, Tapiero suggests that traditional money managers must take notice and prepare for a paradigm shift in the financial landscape.

Bitcoin Could Rally To Over $200,000 In 2024 On Rising Liquidity

Tapiero bases this bullish forecast on the expected BTC liquidity surge in the coming months. Market participants hope the stringent Securities and Exchange Commission (SEC) will approve the first batch of Bitcoin ETFs in the next few trading weeks.

The Bitcoin ETF, set to be issued by some mainstream players in traditional finance, including BlackRock, will provide regulated vehicles through which institutional investors can get exposure to the coin. Based on Tapiero’s analysis, as more and more institutions adopt Bitcoin, its liquidity will increase, boosting prices.

With a Bitcoin ETF on the table, it would also mean the release of institutional-grade Bitcoin trading platforms. This will cement Bitcoin’s position in the industry and its potential role in reshaping finance.

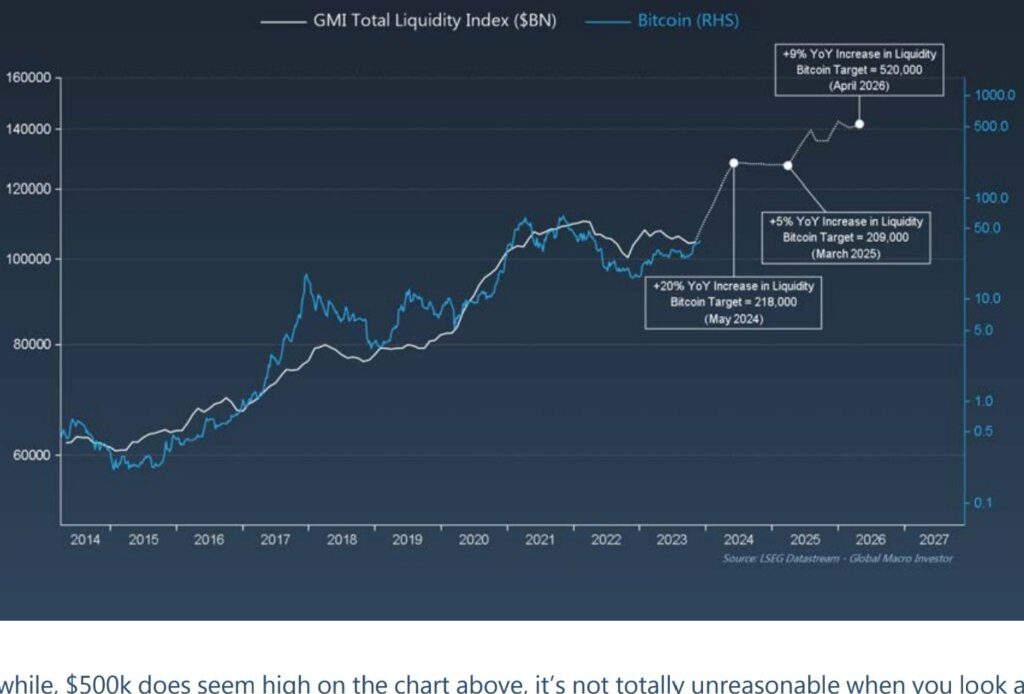

Paul’s monthly GMI data, which tracks the sentiment of institutional investors, as Tapiero mentions, further reinforces the general bullish sentiment across the board. Looking at the GMI total liquidity index, the trend has been rising, suggesting that institutional interest in Bitcoin has also increased.

This trend also indicates that more funds and asset managers are likely allocating more of their portfolios to Bitcoin, expecting to ride the leg up or be on the safe side.

Traditional Fund Managers Watching, BTC Up 64% From September Lows

Looking at Tapiero’s preview, the managing partner thinks rising prices will seriously affect traditional money managers. As such, if Bitcoin rallies to $200,000 on increasing liquidity, in the partner’s assessment, ignoring this asset class could pose a significant career risk.

Notably, Tapeiro opines that managers who fail to embrace the transformative power of Bitcoin may trail. This is because crypto will continue to evolve and find adoption.

As of December 18, Bitcoin is firmly in an uptrend…

Click Here to Read the Full Original Article at NewsBTC…