The rise of Ethereum staking since major network upgrades, Merge and Shanghai, has come at the cost of higher centralization and lower staking yields, a new report by JPMorgan said.

JPMorgan’s analysts led by senior managing director Nikolaos Panigirtzoglou issued a new investor note on Oct. 5, warning about the risks stemming from Ethereum’s growing centralization.

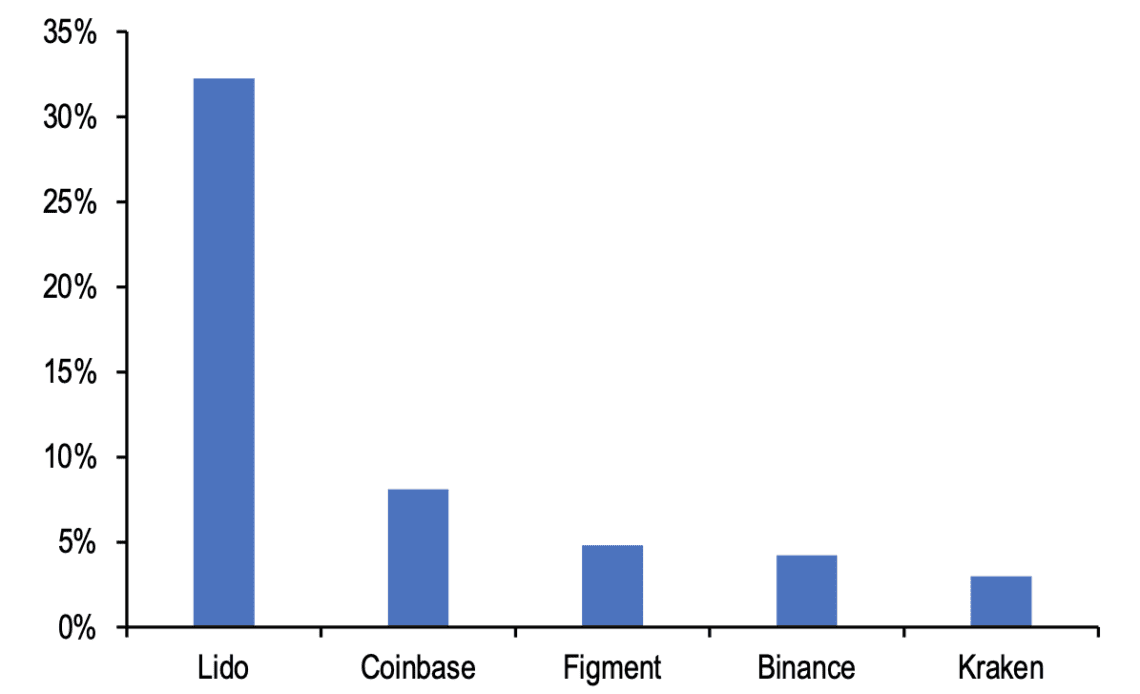

Top five liquid staking providers — including Lido, Coinbase, Figment, Binance and Kraken — control more than 50% of staking on the Ethereum network, JPMorgan analysts noted in the report, adding that Lido alone accounts for almost one-third.

The analysts mentioned that the crypto community has seen the decentralized liquid staking platform Lido as a better alternative to centralized staking platforms, associated with centralized exchanges like Coinbase or Binance. However, in practice “even decentralized liquid staking platforms involve a high degree of centralization,” JPMorgan’s report said, adding that a single Lido node operator accounts for more than 7,000 validator sets, or 230,000 ETH.

These node operators get selected by Lido’s decentralized autonomous organization (DAO), which is controlled by few wallets addresses, “making Lido’s platform rather centralized in its decision making,” the analysts wrote. The report mentioned a case when Lido’s DAO rejected a proposal to cap the staking share at 22% of Ethereum’s overall staking to avoid centralization.

“Lido didn’t participate in the initiatives as its DAO rejected the proposal by an overwhelming majority of 99%,” JPMorgan analysts wrote, adding:

“Needless to say that centralization by any entity or protocol creates risks to the Ethereum network as a concentrated number of liquidity providers or node operators could act as a single point of failure or become targets for attacks or collude to create an oligopoly […]”

Apart from higher centralization,…

Click Here to Read the Full Original Article at Cointelegraph.com News…