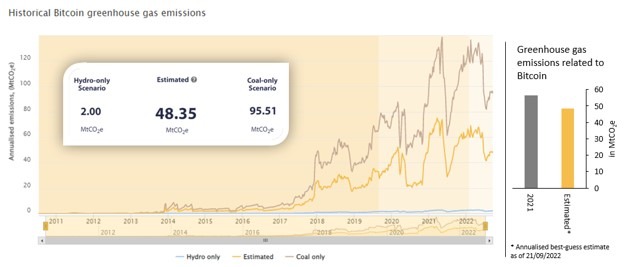

According to a recent report published by the Cambridge Centre for Alternative Finance (CCAF), bitcoin mining worldwide accounts for around 0.10% of global greenhouse gas (GHG) emissions or 48.35 million tons of carbon dioxide per annum. Moreover, CCAF’s report details that “Bitcoin’s environmental footprint is more nuanced and complex” and because of complexity issues it “underscores the need for independent data.”

Cambridge Centre for Alternative Finance Study: ‘Bitcoin Network Produces 48.35 Million Tons of CO2 per Annum’

On Tuesday, the Cambridge Centre for Alternative Finance (CCAF) published a new report called “A deep dive into Bitcoin’s environmental impact,” which was written by the CCAF project lead Alexander Neumueller. The report highlights how bitcoin’s increasing popularity has put a spotlight on “environmental issues associated with the production of Bitcoin.”

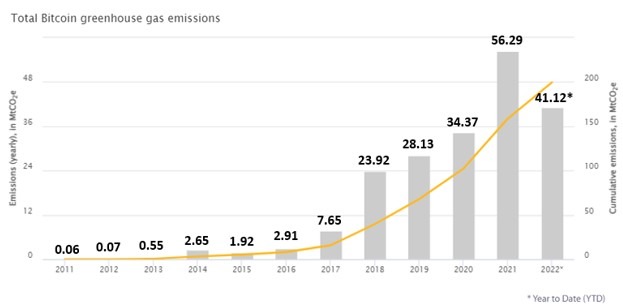

CCAF’s study claims that the Bitcoin network produces 48.35 million tons of carbon dioxide per annum. The metric equates to roughly 0.10% of global greenhouse gas emissions and Neumueller says it’s about “14.1% lower than the estimated GHG emissions in 2021.”

Neumueller’s research further details that 37.6% of the energy leveraged by bitcoin (BTC) miners derives from sustainable types of energy. CCAF’s “best-guess estimate” of 0.10% of global greenhouse gas emissions equates to the same amount of energy used by Nepal or the Central African Republic.

Bitcoin mining energy represents a touch less than half of the 100.4 million tons of carbon dioxide gold mining uses per year. Neumueller believes that the GHG emissions in 2022 were lower than in 2021 because of a “substantial decrease in mining profitability.”

CCAF notes that the decline may have been during a shift from less efficient mining rigs to more efficient next-generation machines. Neumueller says that CCAF’s assumption has been “confirmed by anecdotal evidence of Bitcoin miners.”

Miners face pressure from three angles: Falling BTC price, increasing hashrate & operating costs. Rev per hash is close to the ’20 lows, and energy costs are rising, ASICs more efficient though. This year might separate the wheat from the chaff, consolidation ahead?

Click Here to Read the Full Original Article at Bitcoin News…