Solana has been on a downward trend over the past week, following a surge from multi-year low levels. The token suffered when its biggest promoter, crypto exchange FTX, fell, but the ecosystem continued to thrive, leading to the high timeframe recovery.

As of this writing, Solana’s native token SOL trades at $87 with a 2% profit over the past 24 hours. Over the previous seven days, the cryptocurrency records a 12% correction.

Rising Stars In The Solana Landscape

According to a report from Coingecko, the Solana network is witnessing a resurgence fueled by its recovery in the cryptocurrency market, notable reductions in network outages, and a series of positive developments.

This rejuvenation has drawn the attention of investors and developers and led to a surge in the adoption of existing projects within its ecosystem. Specific projects stand out among these, poised to shape the future of decentralized finance (DeFi) and non-fungible tokens (NFTs) on Solana, Coingecko claims.

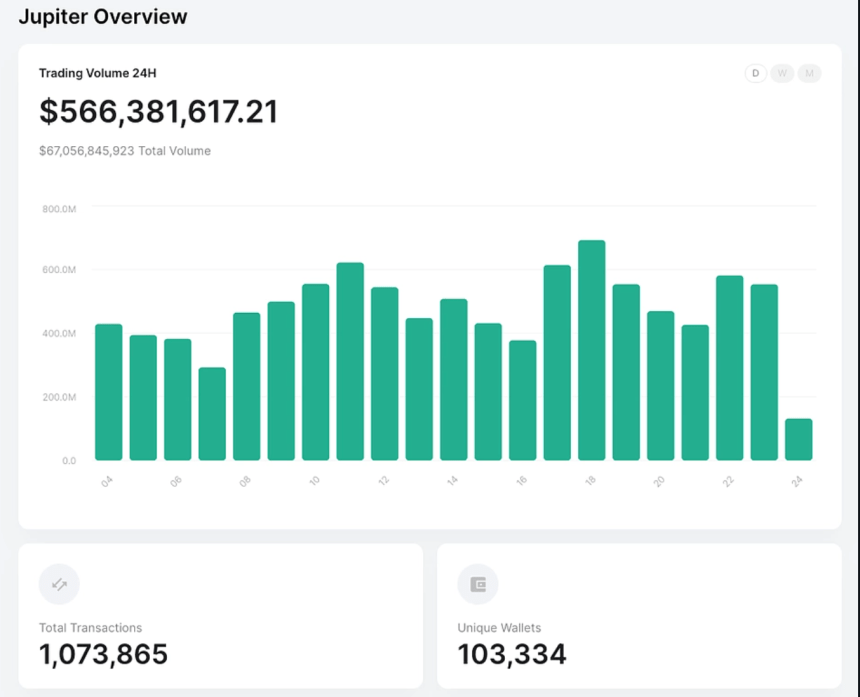

Decentralized exchanges (DEXs) such as Jupiter, Orca, and Drift are at the forefront of Solana’s innovation. Jupiter is “transforming” the landscape with its limit-order decentralized swap services, offering a DEX aggregator to ensure users get the optimal price offers.

The chart below shows that its daily trading volume, involving around 90,000 unique wallets, has reached an average of $400 million.

Orca, another DEX, has a concentrated liquidity feature, Whirlpools, which enhances returns for liquidity providers and reduces slippage for traders. With a total value of approximately $185 million, Orca’s community-driven governance model is another selling point to attract new users in the coming months.

Drift is a decentralized perpetual trading platform, allowing traders to engage with up to 20x leverage. It integrates a series of features, including a money market for decentralized lending, offering additional passive income opportunities through staking and market maker rewards.

Furthermore, Solend, Marginfi, and Kamino are making strides on the lending front. Solend, a prominent money market, enables users to lend and borrow crypto assets, with over $165 million locked in its smart contracts.

Marginfi, boasting over $345 million in tokens locked, enhances the lending experience with advanced risk management…

Click Here to Read the Full Original Article at NewsBTC…