Asset management and risk management are critical components of any investment strategy, and the digital asset space is no exception. With the volatility and complexity of the crypto market, it is essential for investors to monitor their investments and assess their risk exposure carefully.

CryptoCompare, a leading digital asset data provider, has released its monthly Digital Asset Management Review, which provides an overview of the global digital asset investment product landscape.

Methodology

The report tracks the adoption of digital asset products by analyzing assets under management, trading volumes, and price performance. The review drew data from various sources, including Financial Times, 21Shares, Coinshares, XBT Provider, Grayscale, OTC Markets, HanETF, Yahoo Finance, 3iQ, Purpose, VanEck, ByteTree, Nordic Growth Market, Bloomberg, and CryptoCompare.

Key Findings

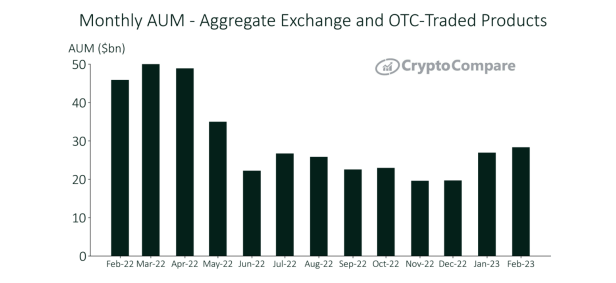

Digital asset investments continued their upward trend in February, with the total assets under management (AUM) for digital asset investment products reaching a new high of $28.3 billion.

This represents a 5.25% increase from January, the third consecutive monthly increase in AUM. The AUM surge signals investors’ bullish sentiment and a growing appetite for digital assets.

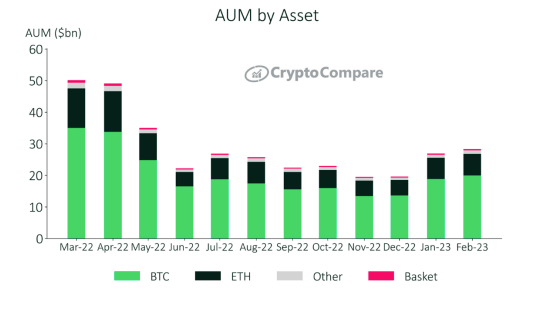

Bitcoin and Ethereum-based products experienced increased assets under management (AUM) in February. BTC-based products saw a rise of 6.06%, bringing the total AUM to $20.0 billion, while ETH-based products saw a 1.72% increase, bringing the total AUM to $6.80 billion. As a result, BTC and ETH products now account for 70.5% and 24.0% of the total AUM market share, respectively.

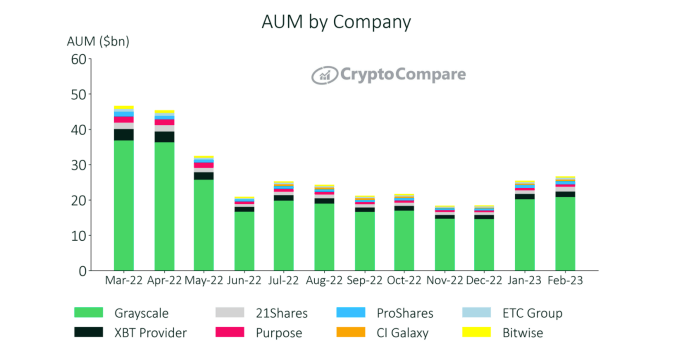

During February, CI Galaxy had the highest increase in assets under management (AUM), with a rise of 37.7% to $460 million. Following closely was 21Shares, which saw a 33.4% increase to $1.38 billion. Despite these gains, Grayscale continued to hold the dominant position, with products recording a total AUM of $20.8 billion, representing a 3.02% increase compared to the previous month. XBT Provider ($1.54 billion) and 21Shares ($1.38 billion) followed Grayscale as the market’s second and third-largest players.

According to the latest report for February 2023, the average daily aggregate product volumes across all digital asset investment products saw a slight decline of 9.39% to $73.3 million.

Compared to December 2022, volumes have increased by 21.5%. Despite this…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…