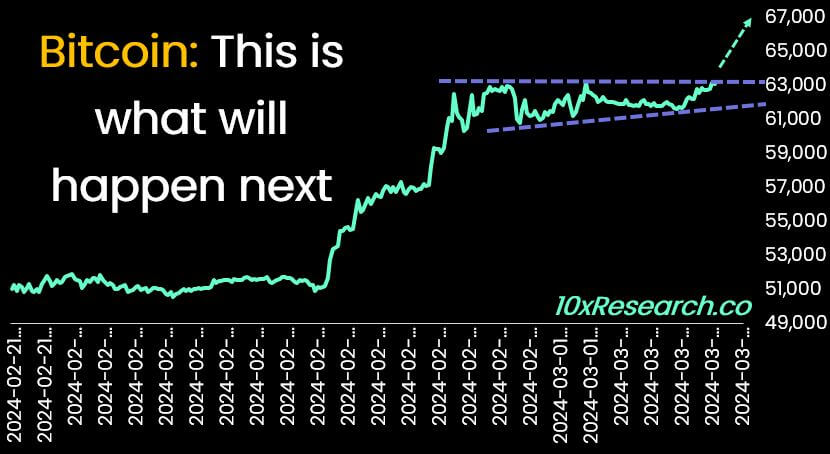

Bitcoin’s price is primed for a surge that could hit record-breaking highs this week, according to a 10X Research report shared with CryptoSlate.

Why BTC will print new ATH

The report outlines key factors driving this bullish momentum. It suggests that Bitcoin will experience a significant upswing if the outflows from Grayscale’s Bitcoin ETF drop below $100 million while substantial inflows continue to BlackRock.

These ETFs, launched in January, have notably influenced Bitcoin’s price, propelled by institutional demand. Markus Thielen, the founder of 10X Research, said this influence contributed to a notable 43% increase, amounting to $18,615, in Bitcoin’s price during February.

Beyond the US-based ETFs, Bitcoin’s demand is surging globally. Trading volume in Korea has skyrocketed from under $1 billion to nearly $8 billion. Furthermore, the pending ETF applications in Hong Kong are anticipated to attract Chinese investors upon approval.

Thielen further emphasized the shifting investment patterns, noting that a significant portion of Bitcoin ETF inflows is redirected from Gold ETFs, with Bitcoin increasingly viewed as a superior macro asset. This perception is bolstered by Bitcoin’s favorable response to changes in interest rate expectations and geopolitical events.

Moreover, heightened institutional demand has led to declining Bitcoin balances on Over-the-counter (OTC) desks and crypto exchanges. Thielen reported OTC balances have plummeted from around 10,000 BTC in the previous year’s second quarter to less than 2,000. Similarly, exchange balances have decreased by 63,000 Bitcoins over the past month.

Thielen concluded that the influx of new retail and institutional investors may not be price-sensitive, particularly with the prevailing perception that Bitcoin’s halving is bullish. So, he predicts that Bitcoin will likely reach a new all-time high this week, supported by the absence of sellers and ongoing attempts to boost leveraged long positions.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…