The cryptocurrency market has experienced a period of stagnation, with Bitcoin (BTC) trading within a narrow range for the past week.

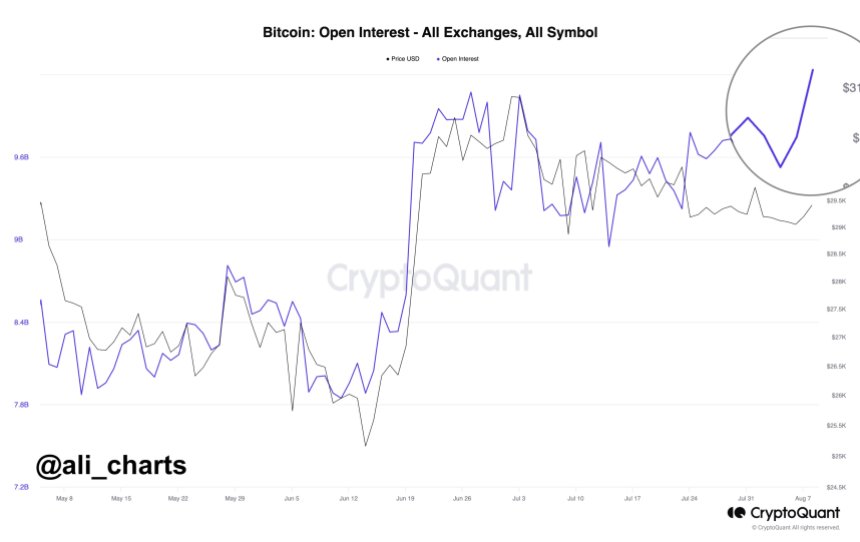

However, according to market analyst Ali Martinez, there is a glimmer of hope on the horizon as Open Interest, a key indicator of market sentiment, has skyrocketed to a year-to-date high.

Correlation Between Open Interest And Bitcoin

Notably, the correlation between Open Interest and Bitcoin’s price has historically been significant, suggesting that this surge may herald a potential reversal in the leading cryptocurrency’s fortunes.

Martinez believes the recent dip to $28,700 prompted crypto traders to take long positions, fueling optimism for a Bitcoin resurgence.

Over the past week, the overall crypto market has experienced a period of stagnation, with Bitcoin trading within a tight range of $28,900 to $29,200.

This consolidation follows a continuous decline from its yearly high of $31,800, which has also set the tone for other major cryptocurrencies. The lack of significant price movement has left investors and traders eager for a catalyst that could propel the market forward.

Nevertheless, the number of open long and short positions on crypto derivative exchanges has surged to a remarkable year-to-date high of $10.086 billion. This surge in Open Interest is significant, indicating heightened market activity and trader engagement.

One crucial aspect to consider is the historical correlation between Open Interest and the price of Bitcoin. This relationship has often been strong, with Open Interest as a leading indicator for potential price movements.

As Open Interest reaches new highs, it suggests that market participants are actively taking positions in anticipation of a significant market shift.

While the crypto market has been characterized by stagnation and decline in recent times, the surge in Open Interest to a yearly high provides hope for a bullish reversal.

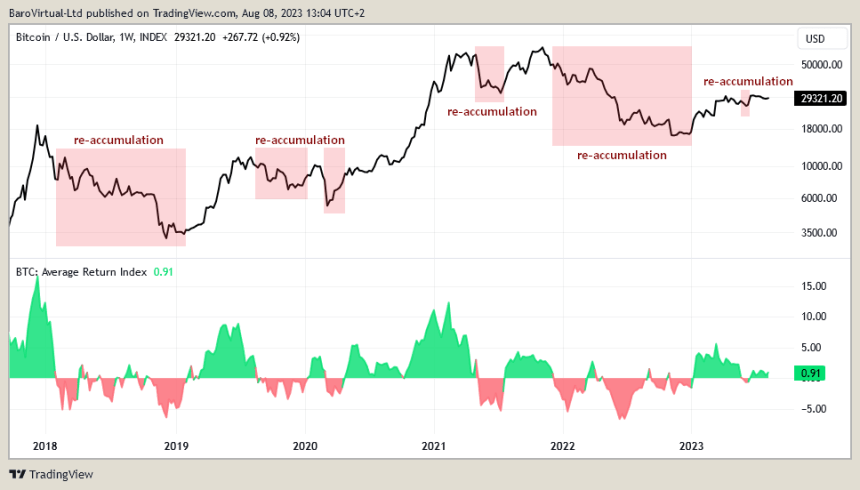

Bearish Divergence Signals Potential Pullback For BTC

Bitcoin has recently exhibited some intriguing patterns that warrant attention from both technical analysis and on-chain analysis perspectives.

According to Baro Virtual, CryptoQuant author and analyst, a bearish divergence on the BTC Average Return Index suggests a possible pullback to $26,000.

Simultaneously, on-chain…

Click Here to Read the Full Original Article at NewsBTC…