Introduction

The realized price and the true market mean price are critical indicators in Bitcoin’s on-chain data analysis, each providing essential insights into the valuation and investor behavior within the cryptocurrency landscape.

Understanding the distinction between these two metrics is crucial for a comprehensive grasp of Bitcoin’s valuation, as they collectively shed light on both the broader holder base’s sentiment and the current market enthusiasm.

Realized price

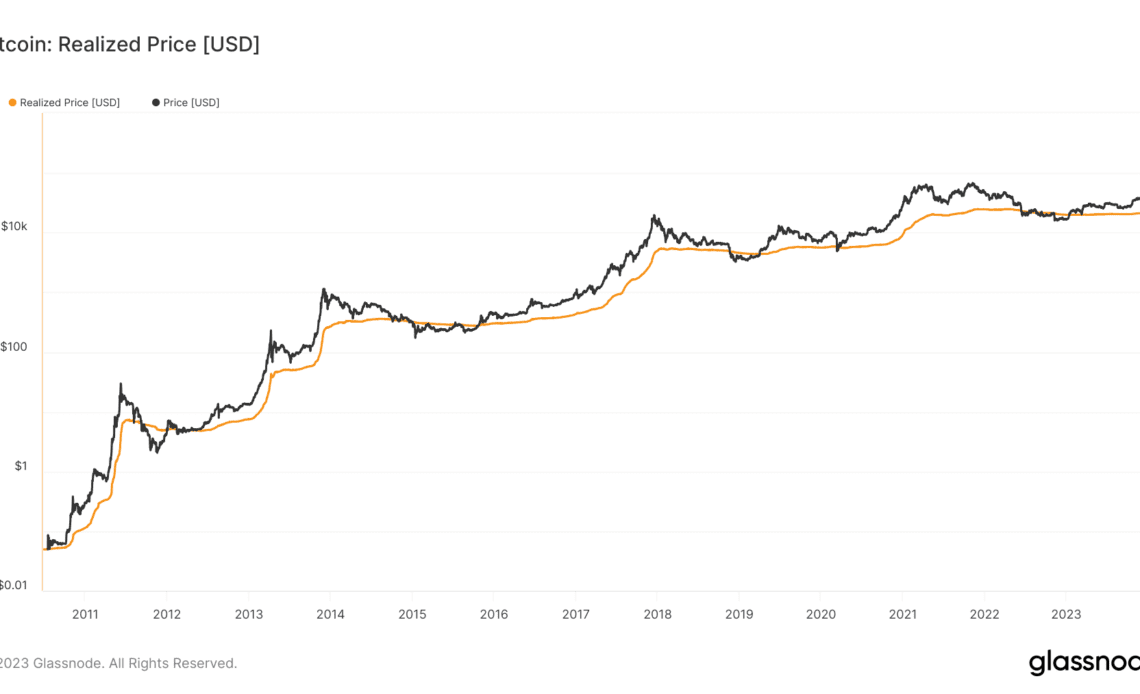

Realized price is a more complex metric compared to the market price, which is simply the current trading price on exchanges. It is calculated by dividing the realized capitalization by the current supply of Bitcoin. It encompasses all coins in circulation, regardless of origin (mining or secondary market transactions). This comprehensive approach ensures that the metric reflects the total economic weight of all bitcoins, giving a fuller picture of the network’s value. Realized capitalization is the sum of the value of all Bitcoins at the price they were last transacted on-chain. This calculation provides a weighted average price of all Bitcoins based on the last time each Bitcoin changed hands.

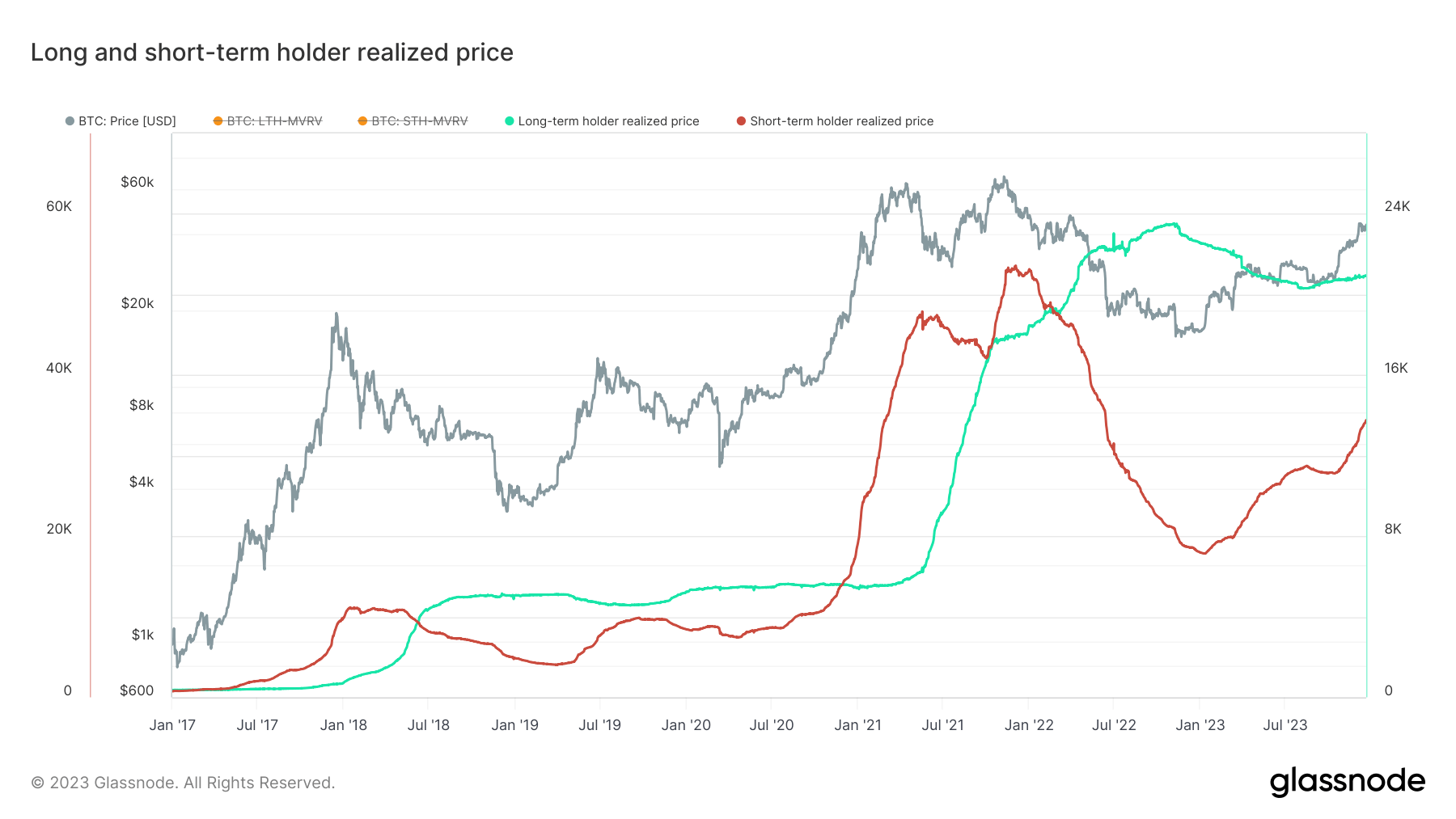

The realized price can be divided into two types: those held by long-term holders (LTH) and those held by short-term holders (STH). LTH realized price is calculated considering only those coins that haven’t moved in at least 155 days, whereas STH realized price accounts for coins moved within this period. This distinction allows analysts to understand the behavior and sentiment of different investor cohorts. The LTH realized price often reflects a price level that long-term investors entered at, serving as a support level during bear markets. In contrast, the STH realized price can indicate recent market sentiment and potential resistance levels in bull markets.

True market mean price

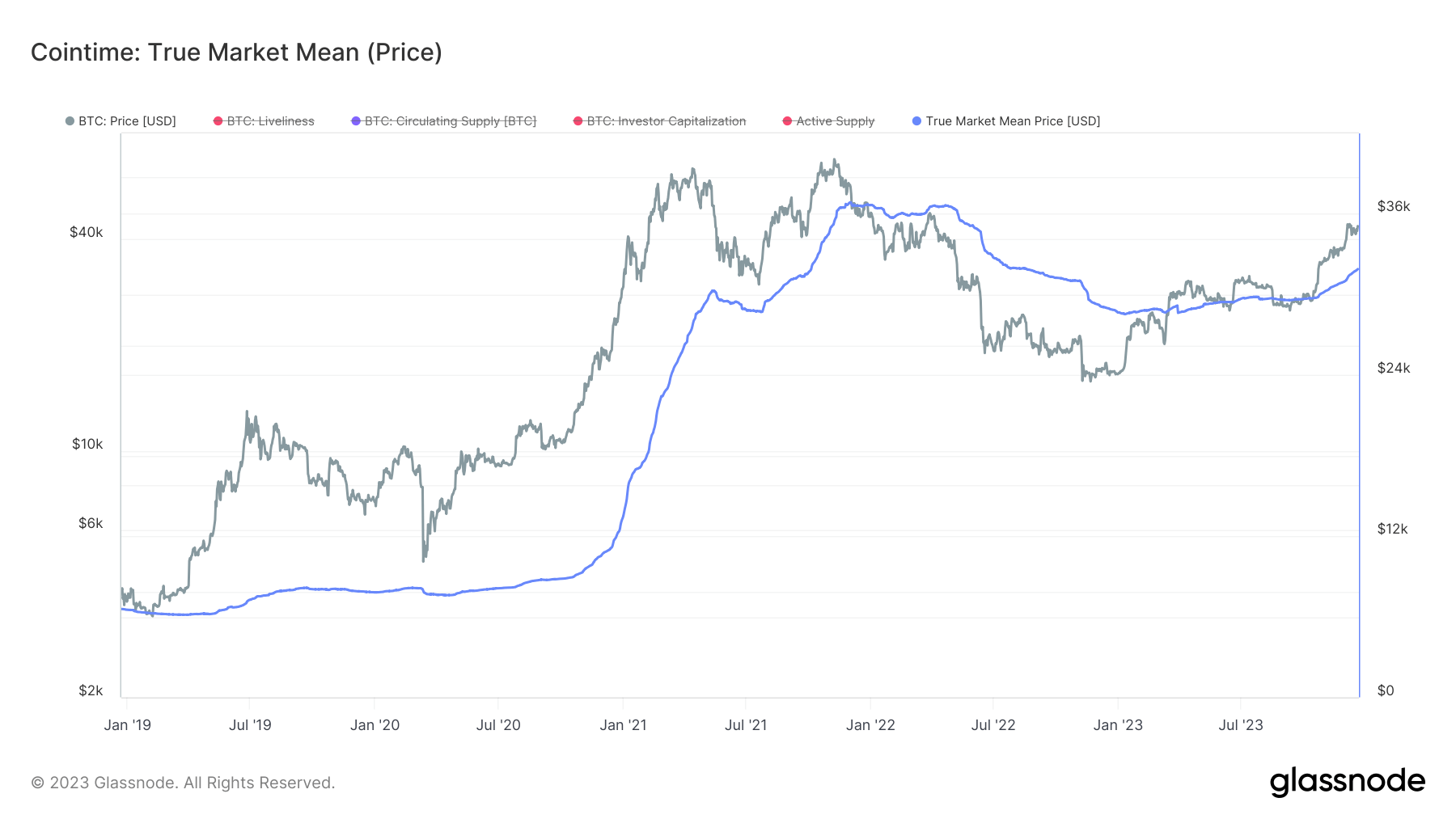

The true market mean price, a relatively new concept introduced in Glassnode’s Cointime Economics report earlier this year, offers a different lens for understanding Bitcoin. This metric focuses exclusively on coins that have been actively traded, excluding Bitcoin’s thermocap. Thremocap represents the total cumulative revenue miners have earned, including block rewards (newly minted coins) and transaction fees.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…