“Tokenization,” particularly of “real world assets,” or RWAs, has recently been touted as the next big thing in crypto. Most people do not make the connection that this trend is just another form of security tokens, a term you may not have heard since 2018 (for good reason).

Dave Hendricks is the co-founder and CEO of Vertalo.

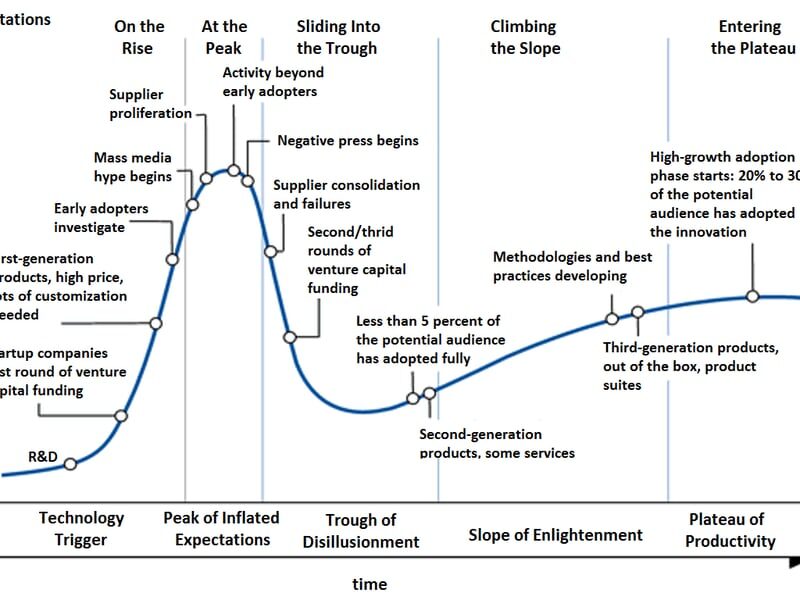

The people hyping tokenization are mostly wrong. But their heart is in the right place. It’s no one’s fault that something becomes trendy, but if “security tokens,” “tokenization” and RWAs are all part of the same technological continuum, and if the Gartner “Hype Cycle” is right, there will likely be another bust soon enough.

Many of the current promoters of tokenization are refugees from the former hype-cycle champion, decentralized finance, otherwise known as DeFi.

While influential TradFi influencers and CEOs see tokenization as a natural evolution in finance — (for instance, BlackRock CEO Larry Fink said the recent launch of bitcoin ETFs were the “first step” towards everything going on-chain) — the tokenization of “every financial asset” is much more complicated, and largely misunderstood by both proponents and detractors.

The Tokenization of the RWA assets industry is beginning its eigth year, having started in late 2017. My firm, Vertalo, launched one of the first fully compliant, Reg D/S equity tokenizations in March 2018. The challenges that we encountered — too many to recount here — led us to pivot from our original role as an issuer of tokenized equity to a “picks and shovels” enterprise software company with an aim to “connect and enable the digital asset ecosystem.”

See also: Andy Warhol Artworks to Be Offered as Tokenized Investments on Ethereum

Since that time, we saw the expansion, and subsequent massive contraction, of non-fungible tokens (NFT) and DeFi. NFTs and DeFi were easier and more end-user friendly applications of tokenization technology. In the case of NFTs, you could buy computer-generated art that would be represented by a tradeable token on easily-accessable marketplaces like OpenSea.

If you asked me to map the progress of NFTs to Gartner’s Hype Cycle, I would place them post-peak and sliding fast through the “trough of disillusionment.” For instance, OpenSea investor Coatue marked down of their $120 million investment…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…