A closely followed crypto analyst says that Bitcoin (BTC) could be in the midst of repeating a pattern once displayed by Amazon’s stock (AMZN) over a decade ago.

Pseudonymous analyst TechDev shares with his 423,000 followers on the social media platform X a chart that compares BTC’s price action over the last 3 years to AMZN in 2010 and 2011.

According to TechDev, both charts show the respective assets forming double tops, then a drastic correction to previous all-time highs before a sudden parabolic move to all-time highs with little to no dips along the way.

“Here’s that time AMZN retested its prior all-time high with an expanded flat correction.

Just as BTC did.

Then here’s a dissection of the structural similarities of both flats.

Green line is where BTC has moved to since the chart.

A rapid move to new highs from

here would not be unusual for expanded flat retests of a prior ATH, if you can move past the herd narrative regarding the halving.

Not a guarantee. $32,000 retest scenario still on the table.

But if we are up only to new highs from here, I would not be surprised.

When structural analogs work, it’s because mass human speculative behavior doesn’t change, regardless of asset.”

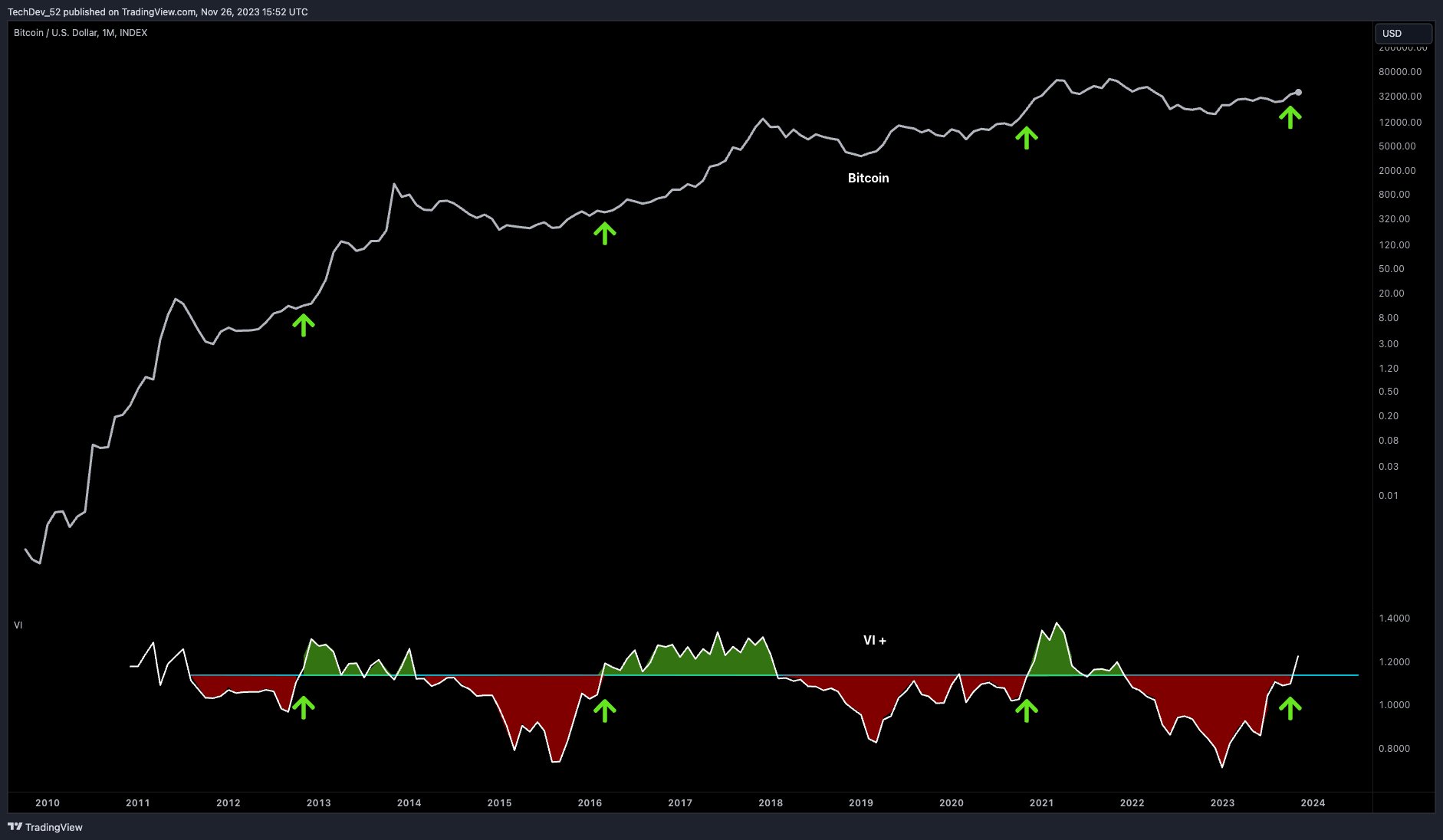

The analyst has previously taken note of Bitcoin’s Vortex Indicator (VI), which was designed to spot trend reversals and confirm current trends.

TechDev shares a monthly chart of BTC that appears to show that the VI has had a near-perfect track record in signaling bull markets. He calls the bullish flip of the VI the “parabolic signal” for Bitcoin.

“Bitcoin Parabolic Signal.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Click Here to Read the Full Original Article at The Daily Hodl…