Ether’s (ETH) DeFi activity has declined in the bear market and the sector faces further competition from Ethereum’s annual staking reward of 4%, according to Glassnode analysts. However, a DeFi narrative is building around liquid staking derivative (LSD) tokens that could revive Ethereum’s network activity.

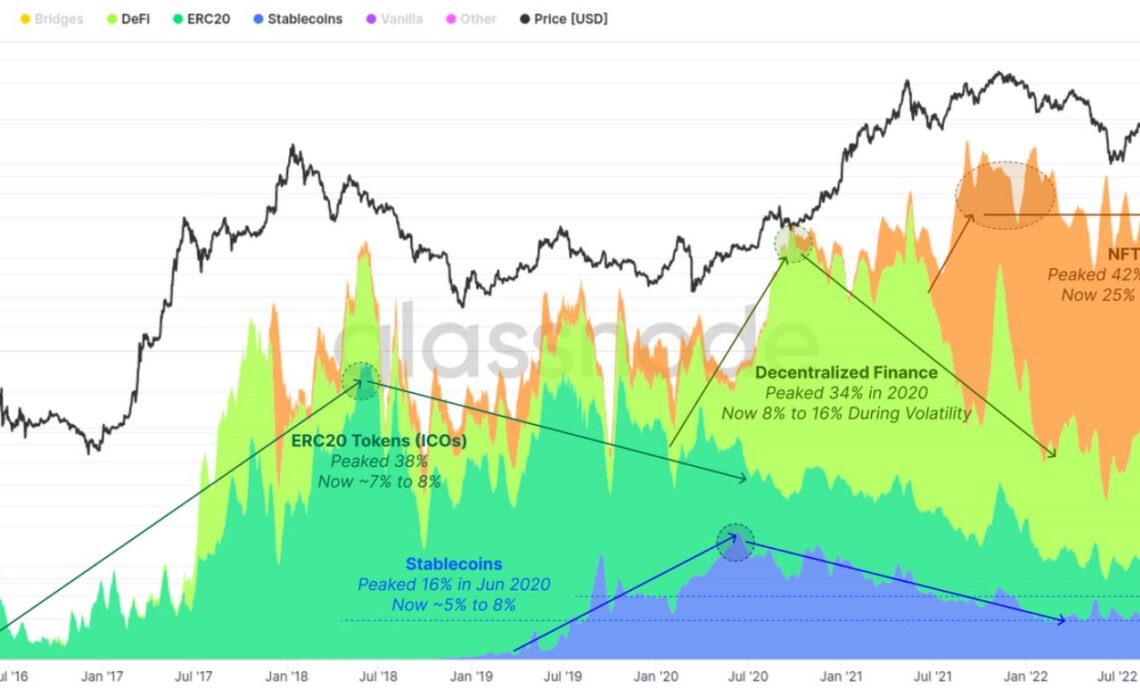

The percentage of gas consumed by DeFi protocols has dropped from 34% in 2020 to 8% to 16% presently, with NFTs commanding the maximum share of 25% to 30%, according to a recent report from Glassnode.

Glassnode’s supply-weighted price index for DeFi, priced in USD and ETH, recorded a 90% loss since early 2021.

The so-called DeFi “Blue-Chips,” which represents a basket of governance tokens from well known DeFi protocols like Uniswap (UNI), MakerDAO (MKR), Aave (AAVE), Compound (COMP), Balancer (BAL) and SushiSwap (SUSHI), have lost 88% of their market capitalization from the all-time highs of $45 billion in May 2021.

The DeFi blue chip tokens have underperformed ETH during bullish market rallies and experienced a more severe drop than ETH “on the downside during the bear.” The analysts predict that since staking of ETH now yields 4%, it will act as a “new hurdle rate over which token returns must jump.” This yield represents the benchmark rate for ether investors.

Currently, leading lending protocols like Aave and Compound offer between 2-3% yields on lending stablecoins and ether. Moreover, DeFi protocols like Aave and Compound also come with smart contract risk which is eliminated with proof-of-stake (PoS) validators.

Staking has become popular among Ethereum investors, especially after the Shapella upgrade in April 2023, which enabled redemptions from the staking contract.

By the end of May, Ethereum users staked 21.63 million ETH worth $40.021 billion, representing 18% of Ethereum’s total supply.

LSD platforms like Lido and…

Click Here to Read the Full Original Article at Cointelegraph.com News…