Determining the market bottom requires a lot of guesswork. Bitcoin’s recent volatility has resulted from various factors ranging from geopolitical uncertainty and local regulation to internal implosions of the crypto market.

Miners have historically been one of the most reliable omens of Bitcoin’s performance.

Bitcoin miners make up the foundation of the crypto market and create strong resistance levels that reduce volatility. As one of the largest holders of BTC, miners can swing the market by holding their coins and liquidating them.

Analyzing the state of the market requires analyzing the state of Bitcoin miners.

As previously covered by CryptoSlate, some of the most solid indicators of miner health have been hash ribbons.

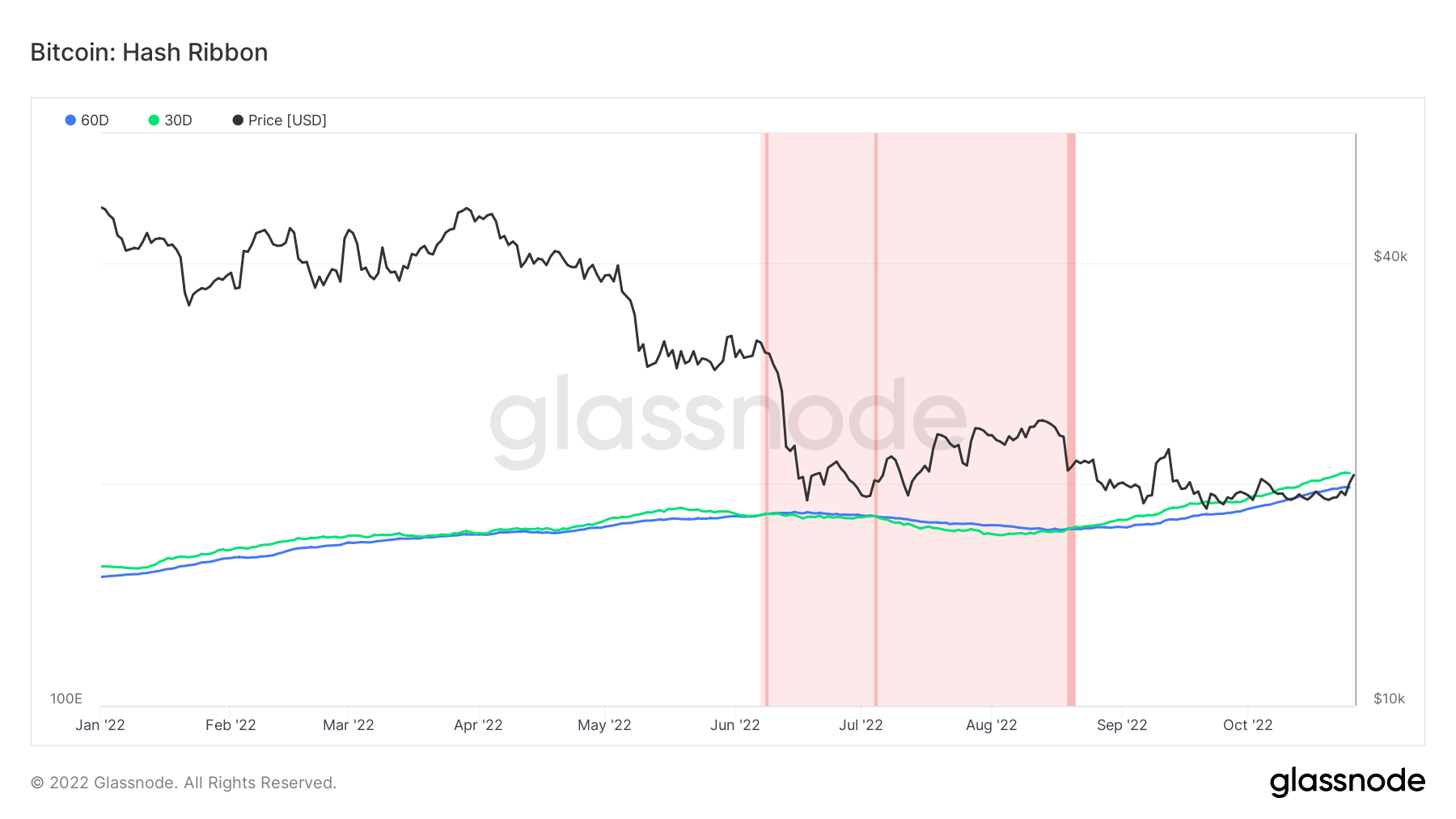

Hash ribbons indicate when miners capitulate, showing the divergence between the 30-day moving average and the 60-day moving average of the Bitcoin hash rate; having miners capitulate shows that Bitcoin has become too expensive to mine — i.e., Bitcoin’s market price is too low to cover the cost of electricity required to produce it.

According to hash ribbons, the worst of the miner capitulation is usually over when the 30-day MA of the Bitcoin hash rate crosses above the 60-day MA. Since the beginning of the year, we’ve seen three separate instances of this switch, shown in dark red on the graph below.

Data analyzed by CryptoSlate showed that severe miner capitulation began mid-June this year and lasted until mid-August. The data is supported by crossing the hash ribbons illustrated in the graph above.

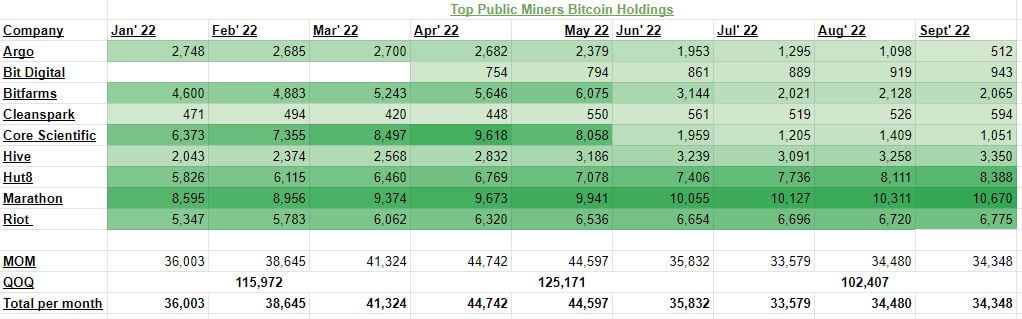

Looking at BTC holdings from the top 9 largest publicly listed Bitcoin mining companies further supports this trend. Several large miners created heavy selling pressure between May and June, liquidating around 8,765 BTC.

And while the selling pressure seems to have steadied on a month-to-month basis since June, quarterly data paints a much different picture.

The top 9 public Bitcoin miners saw their holdings decrease from 125,171 BTC in the second quarter to 102,407 in the third quarter.

The numbers shown in the table above decreased even further in October. Earlier this month, Core Scientific liquidated over 1,000 BTC it held in September and reported holding just 24 BTC on October 26.

With mining…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…