Recent on-chain data highlighted a significant trend: a wave of profit-taking by investors who have held Bitcoin (BTC) for less than five months.

As detailed by CryptoQuant’s latest data, this phenomenon is not just a random market movement but an echo of patterns observed at the zeniths of previous bull markets.

Profit-Taking Among Short-Term Bitcoin Holders Signals Market Shift

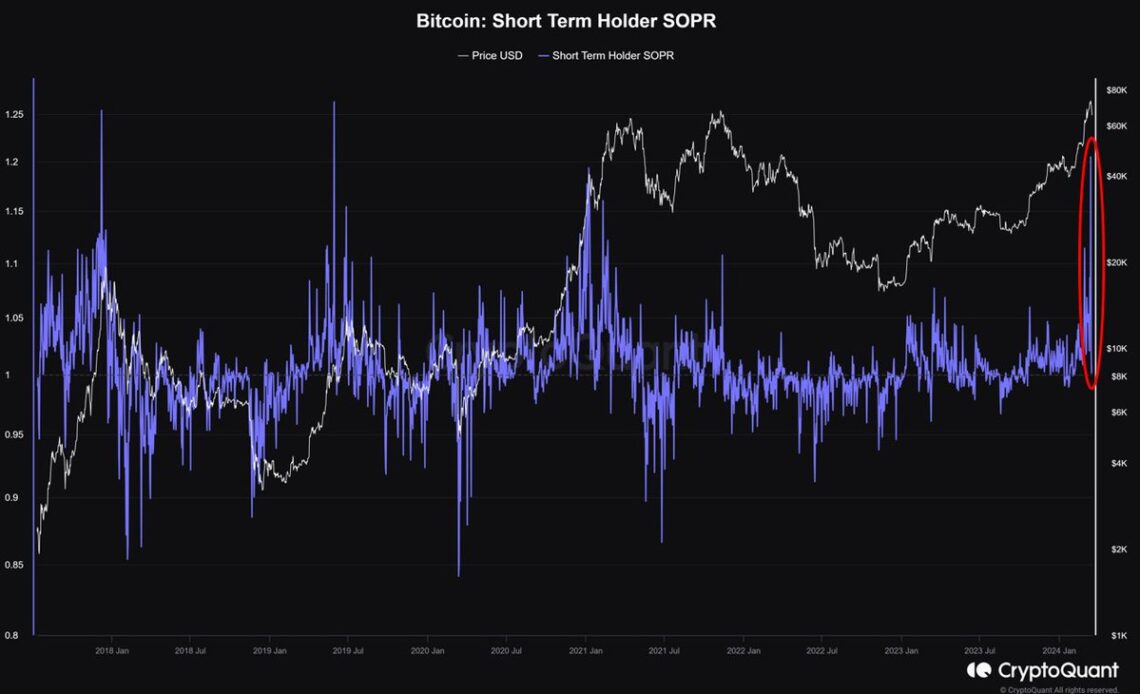

According to CryptoQuant, the Spent Output Profit Ratio (SOPR), a key metric in evaluating the profit and loss of Bitcoin transactions over a specific period, showcases a pronounced uptick indicative of widespread profit realization.

This tendency among short-term holders to liquidate their holdings for gains parallels historical market peaks and suggests a critical juncture for Bitcoin.

Crypto Dan, a seasoned market analyst, emphasized the significance of this trend, stating, “This movement is something that only happens once every few years,” highlighting the uniqueness and possible consequences of the present market trends.

$BTC short-term investors took large profits

“In relation to this adjustment, if we look at the SOPR, there was a big movement related to profit realization by short-term holders who held #BTC for less than 5 months.”

by @DanCoinInvestorLink 👇https://t.co/RqBtDm81hO

— CryptoQuant.com (@cryptoquant_com) March 18, 2024

New Market Forces At Play: ETFs Inflow Set To Rebalance The Equation

While the SOPR metric might signal alarm bells reminiscent of past bull market peaks, the crypto landscape is underpinned by factors that could mitigate the traditional outcomes of such profit-taking.

Among these is the recent introduction of a BTC spot Exchange-Traded Fund (ETF). This new avenue for Bitcoin investment introduces a complex layer to the market’s dynamics, potentially cushioning any adverse effects of short-term holders’ profit-taking activities.

Dan concluded by noting:

But considering the BTC spot ETF and potential additional inflows from institutions and individuals, it is difficult to judge it as simply a signal of the peak of a bull market. After a short-term correction period, it’s very likely that we will see a strong further bull in 2024.

CoinShares Head of Research, James Butterfill, provides a further layer of analysis, suggesting an imminent “positive demand shock” for Bitcoin. According to Butterfill, the delay in making spot Bitcoin…

Click Here to Read the Full Original Article at NewsBTC…